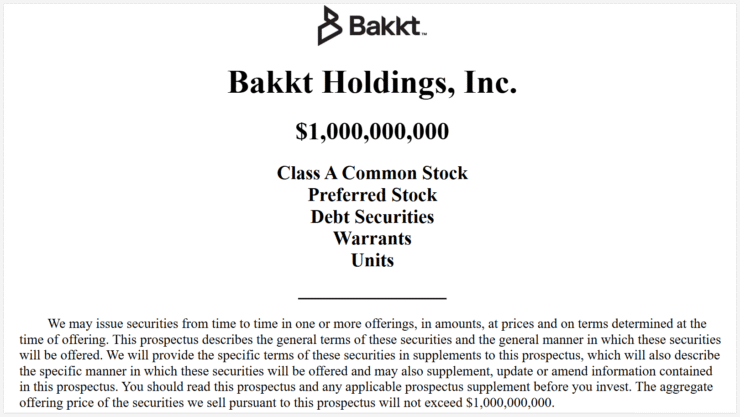

Bakkt Holdings has filed a $1 billion shelf registration with the U.S. Securities and Exchange Commission, signaling a potential pivot in strategy that could include direct purchases of Bitcoin and other cryptocurrencies. The move comes after Bakkt updated its investment policy earlier this month to permit the allocation of treasury capital into digital assets.

The filing outlines the company’s intention to offer a mix of securities—including common stock, preferred shares, debt instruments, and warrants—under a flexible issuance structure. This shelf offering enables Bakkt to raise funds in phases, depending on market conditions and strategic needs.

While no crypto purchases have been made yet, Bakkt emphasized that future acquisitions of Bitcoin or other assets could be financed through excess cash, debt, or new equity. The company, once touted as a major bridge between traditional finance and crypto, is now trying to reposition itself after years of financial challenges.

Financial Warning Casts Shadow Over Expansion Plans

Despite the bold fundraising target, Bakkt acknowledged significant financial hurdles in the same SEC filing. The company noted that its history of operating losses and limited revenue generation has created “substantial doubt” about its ability to continue as a going concern.

Founded in 2018 and backed by Intercontinental Exchange—the parent company of the New York Stock Exchange—Bakkt originally launched to offer institutional-grade crypto custody and trading. However, high-profile partnerships failed to deliver long-term traction, and recurring losses have undermined confidence.

The firm admitted that any move to purchase Bitcoin or expand services will depend heavily on market sentiment, capital availability, and broader business performance—each of which remains uncertain given Bakkt’s fragile operating condition.

Share Price Under Pressure Amid Client Departures

Bakkt’s share price rose 3% on Thursday to $13.33, but the broader picture remains bleak. Year-to-date, the stock has fallen nearly 46%, with a sharp 30% drop in March triggered by the non-renewal of major commercial agreements with Bank of America and Webull.

The company’s struggles haven’t stopped it from voicing optimism about the broader digital asset market. In a recent post on X, Bakkt pointed to IPO activity from firms like Circle, eToro, and Gemini as signs of returning investor interest in crypto infrastructure.

“These developments bring validation, visibility, and maturity to the market,” the company stated.

While Bakkt may not be leading the crypto race anymore, its attempt to reenter the game through a $1 billion capital plan and Bitcoin strategy could revive its relevance—if executed with precision and market support.

Quick Facts

- Bakkt filed a $1B shelf offering and may buy Bitcoin using future capital.

- The firm cited “substantial doubt” about its ability to continue operations.

- Shares are down 46% this year following major client exits.

- Bakkt remains bullish on crypto’s growth, citing recent IPO momentum.