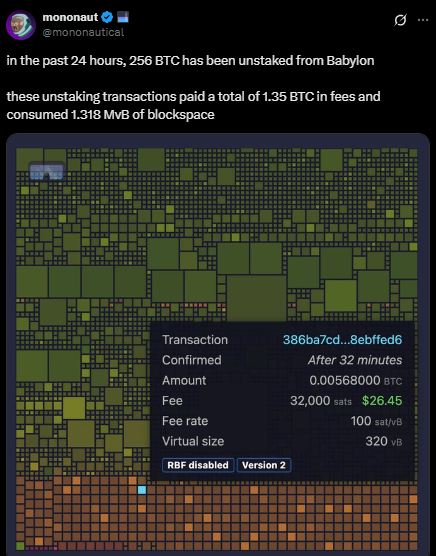

A major wave of Bitcoin unstaking has hit the Babylon protocol just one day after the platform launched its long-awaited BABY token airdrop. More than $21 million worth of Bitcoin, 256 BTC — was withdrawn from the network within 24 hours, according to blockchain data shared by developer Mononaut.

The unstaking activity consumed a significant amount of blockspace, totaling 1.318 Megavirtualbytes (MvB) and costing 1.35 BTC in fees. That’s nearly one-third of an entire Bitcoin block, making it one of the more impactful transactional bursts in recent staking protocol history.

The sudden outflow is likely tied to Babylon’s airdrop strategy, which rewarded early adopters and contributors with 600 million BABY tokens, equivalent to 6% of the total token supply.

The Babylon Foundation rolled out its airdrop program on April 3, distributing tokens to a wide range of participants, including stakers, developers, and NFT holders. The breakdown of the airdrop included:

- 335 million BABY for base staking rewards

- 200 million BABY as bonus rewards for users transitioning to Phase 2

- 30 million BABY for Pioneer Pass NFT holders

- 30 million BABY for general staking participation

- 5 million BABY for open-source contributors

In an earlier interview, Babylon co-founder Fisher Yu explained the unique nature of Bitcoin staking compared to networks like Ethereum and Solana. On Babylon, stakers don’t earn Bitcoin rewards — instead, they receive the native token of the blockchain or application they’re helping secure.

The platform emphasized that the airdrop didn’t include wallet farming campaigns or liquid staking incentives, focusing instead on genuine protocol contributors.

Exchanges Respond, TVL Remains High

The airdrop sparked a flurry of trading interest. Crypto exchange OKX quickly moved to list the BABY/USDT pair in its pre-market futures platform, allowing users to speculate on the token’s future price before it’s available on spot markets.

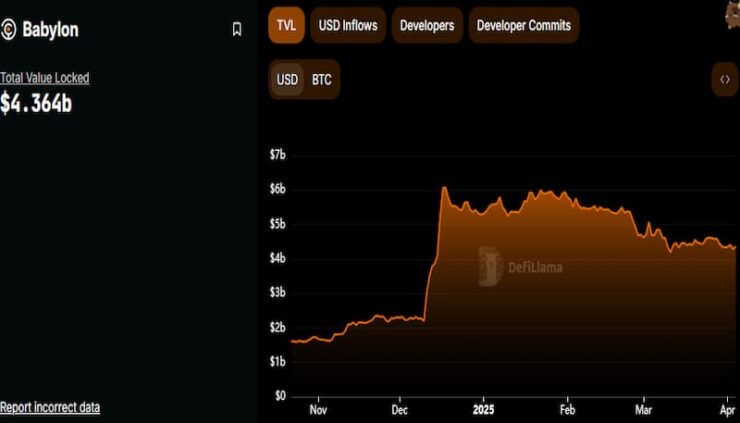

Despite the post-airdrop Bitcoin outflows, Babylon’s total value locked (TVL) remains strong. According to DeFiLlama, the protocol currently holds $4.36 billion in TVL, accounting for over 80% of the total TVL in the Bitcoin DeFi ecosystem, which stands at $5.34 billion.

Airdrop Aftermath: A Shift in Strategy?

The large volume of unstaking suggests that some users may have staked BTC primarily to qualify for the airdrop, and are now exiting the protocol to either realize gains or reallocate capital. This could indicate short-term volatility but doesn’t necessarily point to long-term weakness in the protocol.

Whether this pattern continues in future reward cycles will depend on how Babylon evolves its staking incentives and whether users see long-term utility in the BABY token beyond the airdrop event.

As Babylon transitions into its next development phase, the crypto community will be watching closely to see how it sustains momentum and whether the BABY token can hold its value amid speculative activity and shifting market dynamics.