Australia’s financial watchdog, the Australian Transaction Reports and Analysis Center (AUSTRAC) has escalated its crackdown on digital currency exchanges and remittance service providers. Recent actions have seen 13 providers penalized, with over 50 others under investigation for potential compliance violations.

AUSTRAC CEO Brendan Thomas announced on February 17 that six remittance providers had their registration renewals refused due to key personnel facing serious legal charges that “reflected adversely on their honesty or integrity.” The regulator also issued compliance alerts to over 50 digital currency exchanges and remittance providers, signaling further scrutiny ahead.

Targeting Compliance Failures

AUSTRAC’s latest measures are part of a broader effort to ensure strict adherence to Anti-Money Laundering and Counter-Terrorism Financing (AML/CTF) regulations. Thomas noted that systemic underreporting and non-reporting of suspicious transactions were key concerns driving the regulator’s increased oversight.

“The blitz follows AUSTRAC’s analysis that identified systemic non-reporting and under-reporting in the remittance and digital currency exchange sectors,” Thomas stated. “Early last year, we initiated an investigation to identify and eliminate non-compliant providers and improve the industry’s reporting on suspicious matters.”

Two providers that failed to meet AUSTRAC’s compliance deadlines were placed under strict conditions, with the threat of suspension or cancellation looming should they continue to violate regulations. Additionally, three other entities that were refused registration have ceased operations in Australia.

Crypto Failures and Market Impact

Australia’s digital asset sector has already felt the ripple effects of heightened regulatory scrutiny. FTX Express, a subsidiary of the collapsed exchange FTX, and Zipmex Australia were both removed from AUSTRAC’s Digital Currency Exchange Register following their insolvencies.

The crackdown comes at a time when Australia’s crypto industry is expanding rapidly. AUSTRAC currently oversees 417 registered digital currency exchanges and 5,112 remittance service providers, reflecting the growing role of crypto in the nation’s financial ecosystem.

Stricter AML Measures and Crypto Oversight

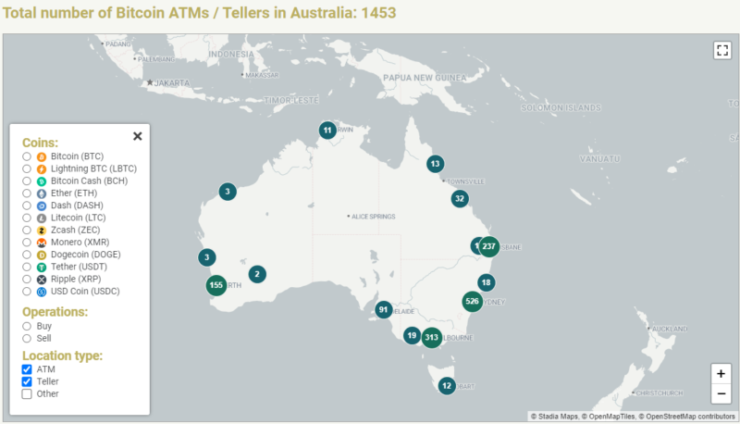

AUSTRAC’s actions align with the government’s broader agenda to tighten AML/CTF regulations in the crypto sector. In December 2024, Thomas announced that the agency would focus more on cryptocurrency compliance throughout 2025, with particular attention to crypto ATMs. Australia is the world’s third-largest hub for Bitcoin ATMs, boasting over 1,453 machines—an exponential rise from just 67 in August 2022, according to Coin ATM Radar.

That same month, AUSTRAC proposed stricter AML/CTF rules, aiming to increase transparency in digital asset transactions and prevent financial crime. Simultaneously, the Australian Securities and Investments Commission (ASIC) released a consultation paper outlining new guidelines that classify many digital assets as financial products, requiring firms dealing in crypto to obtain financial services licenses.

The Future of Crypto Regulation in Australia

AUSTRAC’s intensified scrutiny signals a pivotal moment for Australia’s digital currency industry. While regulatory oversight is intended to safeguard investors and enhance transparency, it also poses challenges for exchanges and crypto service providers navigating the evolving compliance landscape.

Industry participants will need to adapt swiftly to regulatory demands, ensuring they implement rigorous AML/CTF measures to remain operational. The coming months will be crucial in determining how these regulatory shifts shape Australia’s position as a key player in the global cryptocurrency market.

For crypto businesses, the message is clear—compliance is no longer optional, and failure to meet AUSTRAC’s standards could mean forced closures and legal repercussions. As regulations tighten, the future of Australia’s digital asset ecosystem hangs in the balance, awaiting the impact of continued government intervention and evolving industry practices.