Arthur Hayes, co-founder of BitMEX, has boldly predicted that the world’s largest cryptocurrency will more likely surge to $110,000 than drop to $76,500 in the short term. His forecast adds fuel to growing market optimism driven by easing inflation and shifting monetary policies.

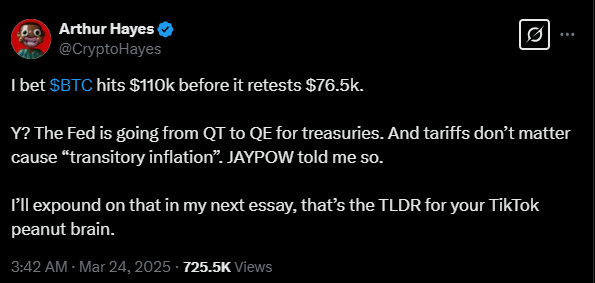

In a recent post on X, Hayes argued that the Federal Reserve’s pivot from quantitative tightening (QT) toward quantitative easing (QE) could serve as a significant tailwind for Bitcoin. He pointed to the central bank’s growing bond purchases as a sign of changing economic conditions that typically favor risk assets like crypto.

“I bet $BTC hits $110k before it retests $76.5k. Y? The Fed is going from QT to QE for treasuries. And tariffs don’t matter cause of “transitory inflation.” JAYPOW told me so.”

Analysts Caution the Fed Hasn’t Fully Pivoted Yet

While Hayes is bullish, not everyone agrees the Fed has fully reversed course. Benjamin Cowen of IntoTheCryptoVerse noted that while the Fed is slowing QT, it still plans to reduce $35 billion per month in mortgage-backed securities — signaling that liquidity conditions remain tight.

Still, history favors Hayes’ thesis. The last major QE round in 2020 triggered a 1,000% surge in Bitcoin’s price, setting a new record high at the time. Analysts now wonder if a similar scenario is brewing.

Beyond U.S. monetary policy, macro factors are aligning for Bitcoin’s climb. Enmanuel Cardozo from Brikken in an interview with Cointelegraph, pointed to rising global liquidity, growing conversations around a potential U.S. Bitcoin strategic reserve, and a sharp drop in Bitcoin’s exchange supply all of which could trigger a supply squeeze.

“These conditions support a run to $110,000, though a correction to $76,500 remains possible given Bitcoin’s historical volatility,” Cardozo added.

Meanwhile, Ryan Lee of Bitget Research flagged Bitcoin’s strong technical positioning, having closed above both its 21-day and 200-day moving averages — a bullish signal. However, Lee cautioned that the $88,000 resistance remains a critical hurdle for the next leg up.

The Takeaway

With macro conditions improving and market sentiment heating up, Bitcoin’s next all-time high may be closer than most think. Hayes’ call for $110K before any major pullback reflects growing confidence that Bitcoin is gearing up for another parabolic move — one fueled by liquidity, institutional demand, and shifting global monetary policies.

Whether Bitcoin clears $88K resistance or sees another dip first, the path toward six-figure territory looks increasingly likely in 2025.