Cathie Wood’s Ark Invest is doubling down on Bitcoin, acquiring 997 BTC worth $80 million in a bold move that underscores its unwavering confidence in digital assets. The purchases, executed through Coinbase on March 13, 2025, come as Ark continues to position itself as a leading institutional Bitcoin holder despite market volatility.

However, Ark has also trimmed $9 million alongside this investment from its Bitcoin ETF holdings, signaling a strategic portfolio rebalancing rather than an outright accumulation spree.

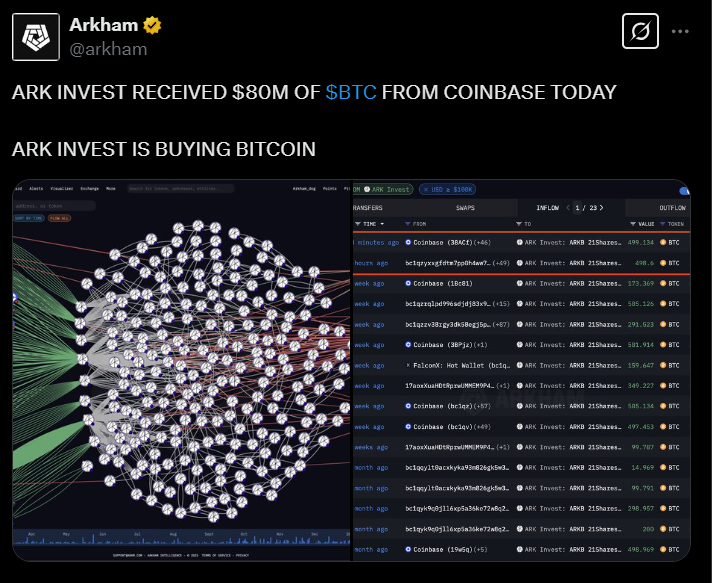

According to Arkham Intelligence, Ark Invest’s purchase of 997 BTC was split into two transactions:

- 498 BTC in the first transaction

- 499 BTC four hours later

The acquisition aligns with Ark’s broader strategy of maintaining a strong digital asset portfolio, especially as institutional investors ramp up their exposure to Bitcoin ETFs.

However, the timing is notable; this comes amid a $1.1 billion outflow from Bitcoin ETFs as institutional investors react to macroeconomic concerns like inflation and shifting trade policies.

Bitcoin & Coinbase Stocks

While Ark is adding physical Bitcoin, it has also increased its stake in Coinbase (COIN) stock, acquiring 64,358 shares worth approximately $11.53 million. This marks Ark’s largest investment in Coinbase stock since August 2024.

Notably, Ark did not sell its spot Bitcoin ETF holdings entirely, signaling a strategic shift rather than an exit from the ETF market. Analysts view this as a long-term commitment to crypto infrastructure, with Ark reinforcing both direct Bitcoin exposure and investments in crypto-native companies.

Cathie Wood has long been one of Bitcoin’s biggest institutional advocates, previously predicting that BTC could hit $1 million by 2030.

Despite Bitcoin’s recent price struggles, Ark’s latest move suggests confidence that the current cycle remains bullish in the long run.

- BTC recently ranged between $79,000 and $81,000, facing resistance at $83,700.

- If selling pressure persists, analysts warn of a potential retest of the $75,000 support level.

- The ongoing trade war and economic uncertainty remain key risks impacting Bitcoin’s short-term trajectory.

What’s Next for Ark Invest and Bitcoin?

With institutions actively rebalancing their portfolios, Ark’s approach highlights the growing shift toward direct Bitcoin exposure over ETFs.

While Ark’s Bitcoin accumulation signals long-term optimism, its decision to trim Bitcoin ETF holdings amid macroeconomic uncertainty reflects a measured approach to market risks.

As institutional flows continue to shape Bitcoin’s price action, Ark’s moves will be closely watched as a barometer for Wall Street’s evolving crypto appetite.

Will Ark Invest’s latest Bitcoin purchase spark renewed institutional interest, or is the market bracing for further correction? The next few weeks could provide critical answers.