Despite a brutal sell-off in crypto markets, Cathie Wood’s Ark Invest is going all in on Coinbase (COIN). On March 11, Ark purchased 64,358 Coinbase shares worth $11.5 million across two major exchange-traded funds (ETFs), even as COIN plunged 17.6% in a single trading session.

This move extends Ark’s aggressive buying streak, signaling continued confidence in Coinbase and the broader crypto sector—even in the face of extreme volatility.

Ark Invest split its latest purchase between two of its funds:

- 52,753 shares ($9.4 million) for the Ark Innovation ETF (ARKK)

- 11,605 shares ($2.1 million) for the Ark Fintech Innovation ETF (ARKF)

This follows Ark’s $8 million purchase of Coinbase shares last week for its Next Generation Internet ETF (ARKW) and $8.7 million the week before. With this latest acquisition, Ark’s three-week buying spree now totals $28.2 million in Coinbase stock.

Why Ark Keeps Buying COIN

Ark Invest follows a strict portfolio rebalancing strategy, ensuring that no holding exceeds 10% of any fund. As Coinbase’s price fluctuates, Ark is adjusting its weighting to maintain balance, suggesting more purchases or sell-offs depending on price movement.

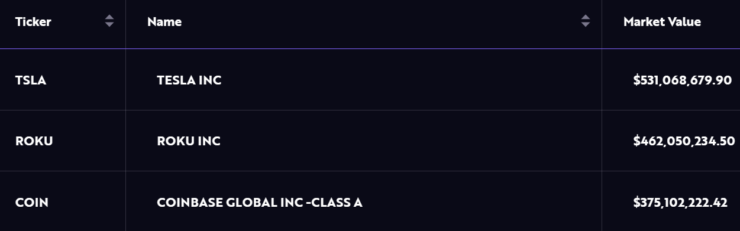

COIN is Ark’s third-largest holding in the ARKK fund, with a 7.1% weighting worth $375.1 million, trailing only Tesla and Roku. In the ARKF fund, Coinbase is the second-largest position, with a 7.7% weighting worth $65.7 million, just behind Shopify.

Ark’s continued accumulation of Coinbase stock suggests Wood sees long-term potential despite short-term market turbulence.

Crypto Stocks Take a Hit

Coinbase wasn’t the only stock hit hard in Monday’s trading session. The entire crypto sector suffered heavy losses amid a broader market downturn.

- According to The Block, COIN closed 17.6% at $179.23, extending its one-month decline to 34.6%.

- However, in pre-market trading on Tuesday, Coinbase rebounded 4.3%, per TradingView.

- According to the Block’s data dashboard, the company’s current market valuation stands at $33.3 billion.

Despite these losses, Ark remains bullish on Coinbase, suggesting it sees the current dip as a buying opportunity rather than a long-term risk.

The Bigger Picture

Cathie Wood has long been one of Wall Street’s biggest crypto bulls, with Ark positioning itself as a major institutional player in digital assets.

- Ark was one of the earliest institutional buyers of Coinbase stock, accumulating shares since its 2021 IPO.

- The firm is heavily invested in Bitcoin ETFs, reinforcing its long-term belief in digital asset adoption.

- Despite ongoing regulatory challenges, Wood has repeatedly stated that Coinbase is well-positioned as the go-to U.S. crypto exchange.

While Ark’s aggressive buying doesn’t guarantee a short-term turnaround, it highlights institutional confidence in the long-term viability of crypto stocks—even as the market faces turbulence.

What’s Next?

Coinbase’s price action in the coming weeks will likely dictate Ark’s next move.

- If COIN continues declining, expect Ark to increase its position further.

- If Coinbase rebounds, Ark may trim holdings to maintain its portfolio balance.

- With crypto regulation, Bitcoin ETF flows, and macroeconomic factors shaping the market, Coinbase remains one of the most closely watched stocks in the sector.

For now, Ark’s latest purchase signals a clear message—despite the downturn, it’s not backing down on its Coinbase bet.