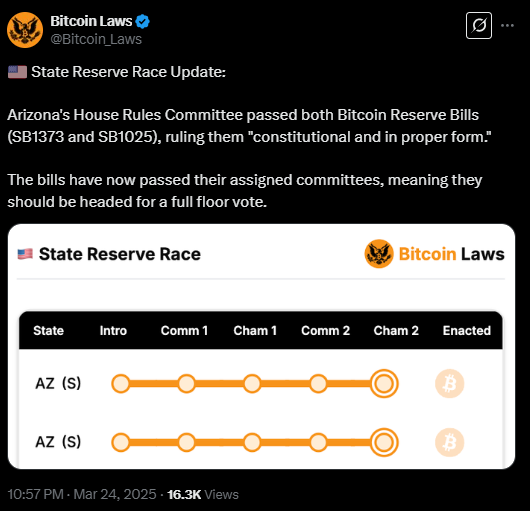

Two strategic digital asset bills, the Strategic Digital Assets Reserve Bill (SB 1373) and the Arizona Strategic Bitcoin Reserve Act (SB 1025) have cleared the House Rules Committee and are now headed for a full floor vote in the Arizona House of Representatives. If passed, the bills would mark a historic shift in state-level finance, allowing Arizona to diversify its reserves with Bitcoin and other digital assets.

At the core of this legislation is a new strategic reserve built from seized digital assets, plus a separate proposal to invest up to 10% of Arizona’s treasury and retirement system funds directly into Bitcoin.

SB 1373 focuses on digital assets already confiscated through criminal proceedings. Rather than liquidating these assets for cash, the state would manage and invest them to generate returns—with clear limits in place to avoid excessive risk.

Meanwhile, SB 1025 puts Bitcoin front and center, proposing that public funds could be allocated to Bitcoin as part of a long-term investment strategy. The bill even anticipates the future, allowing Arizona to hold BTC inside a secure, segregated federal Bitcoin reserve if one is ever created.

Risk or Strategic Hedge?

For supporters, this is about future-proofing Arizona’s economy. By holding digital assets, the state could hedge against inflation, diversify beyond traditional assets, and potentially benefit from Bitcoin’s long-term growth.

But critics warn of volatility risks especially when dealing with taxpayer funds and retirement systems. Bitcoin’s price swings could hurt public finances if not carefully managed. That’s why the proposed 10% cap is seen as a guardrail to prevent overexposure.

If passed, Arizona’s move could inspire other states to follow suit, turning Bitcoin into a mainstream reserve asset at the state level, something unthinkable just a few years ago.

Republicans currently hold a narrow 33-27 majority in Arizona’s House, giving both bills a realistic chance of passing. But the final challenge may lie with Democratic Governor Katie Hobbs, known for her aggressive use of the veto pen.

Hobbs has vetoed 22% of bills this year, the highest rate of any governor in the country. Her skepticism toward crypto-related legislation could derail the effort, despite growing national interest in digital asset reserves.

The Bigger Picture

Arizona isn’t alone. Texas, Oklahoma, and Utah are all exploring Bitcoin reserve bills—fueling a new wave of state-level crypto adoption across the U.S.

- Texas already passed its Senate bill and is now debating a cap on reserves.

- Oklahoma’s House approved its own Bitcoin reserve bill just days ago.

- Utah scaled back its legislation but remains in the race.

If Arizona succeeds, it could cement its position as a crypto policy leader, pushing the U.S. further toward integrating digital assets into public finance.

What’s Next?

Arizona’s full House vote will be a key test, not just for the state but for the future of crypto policy nationwide. A yes vote could send a powerful signal that Bitcoin is ready to play a role in state treasuries.

But the looming threat of a governor’s veto leaves the outcome uncertain. One thing is clear, the battle for Bitcoin’s place in U.S. finance has officially moved to the states. And Arizona is leading the charge.