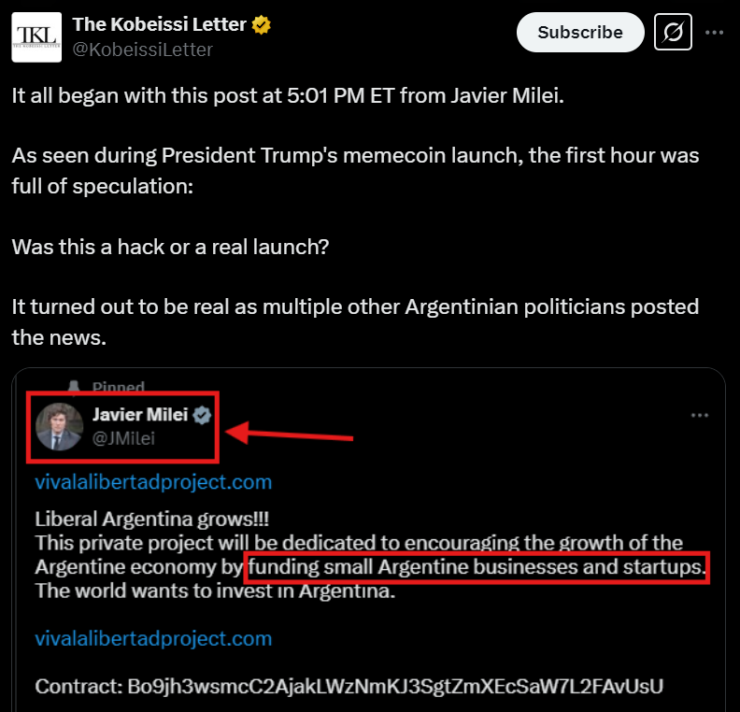

The LIBRA memecoin scandal has taken a dramatic turn as Argentine federal prosecutor Eduardo Taiano moves to freeze $110 million in assets linked to the alleged financial misconduct surrounding the cryptocurrency. The case, which has cast a shadow over Argentine President Javier Milei, is now the subject of an intensified federal investigation, signaling a broader crackdown on crypto-related fraud in Argentina.

Taiano’s request includes the recovery of deleted social media posts, particularly those in which Milei reportedly promoted the Solana-based LIBRA memecoin. Investigators aim to reconstruct the token’s financial operations, particularly around February 14–15, when LIBRA’s trading volume reached its peak before its sudden collapse.

According to reports, at least eight insider wallets connected to the LIBRA team managed to cash out approximately $107 million before the token crashed by over 90%, triggering accusations of an insider rug pull. The timing of these transactions has raised serious red flags, with authorities now tracing recent fund movements in an effort to halt further dispersal of stolen assets.

Asset Freezes and Exchange Scrutiny

In response to the unfolding scandal, Argentine authorities have requested the freezing of identified digital wallets to prevent further laundering of illicit funds. The prosecutor has also drafted international requests to gain access to records from foreign cryptocurrency exchanges, a move that underscores the global nature of the investigation.

Investigators have already tracked a recent movement of $4.5 million from a wallet linked to the LIBRA team. Some of these funds were reportedly used to purchase another memecoin called POPE, raising suspicions that insiders may be attempting to launder the money through fresh digital asset investments.

The LIBRA scandal, now widely referred to as “Libragate,” has placed President Javier Milei in the crosshairs of political opposition and federal investigators. Milei, a self-proclaimed libertarian and crypto supporter, has faced calls for impeachment after endorsing LIBRA, a token that was allegedly created to fund Argentine small businesses and startups.

While the president has denied direct involvement, stating in February that he merely “spread the word” rather than formally promoting the project, the scandal has already eroded his political standing. Critics argue that Milei’s association with LIBRA has damaged his credibility and weakened his ability to form political alliances ahead of Argentina’s upcoming congressional midterm elections.

What Comes Next?

As Argentina grapples with one of its largest crypto fraud cases, this scandal may prompt a regulatory reckoning for the country’s digital asset sector. The LIBRA collapse has amplified concerns about the risks of unregulated crypto ventures, especially those linked to high-profile public figures.

With federal authorities ramping up their investigation, the outcome of Libragate could set a precedent for future crypto-related prosecutions. Will Argentina implement stricter oversight on digital assets, or will the case fade into political controversy?

For now, the world is watching as Argentina’s legal system navigates the intersection of crypto, politics, and financial crime a case that could reshape how nations handle digital asset fraud on a global scale.