Argentine President Javier Milei is facing a legal storm after lawyers accused him of fraud over his promotion of a controversial cryptocurrency project. The case, filed in a criminal court, raises serious questions about the role of political figures in endorsing digital assets and the broader implications for Argentina’s crypto policies.

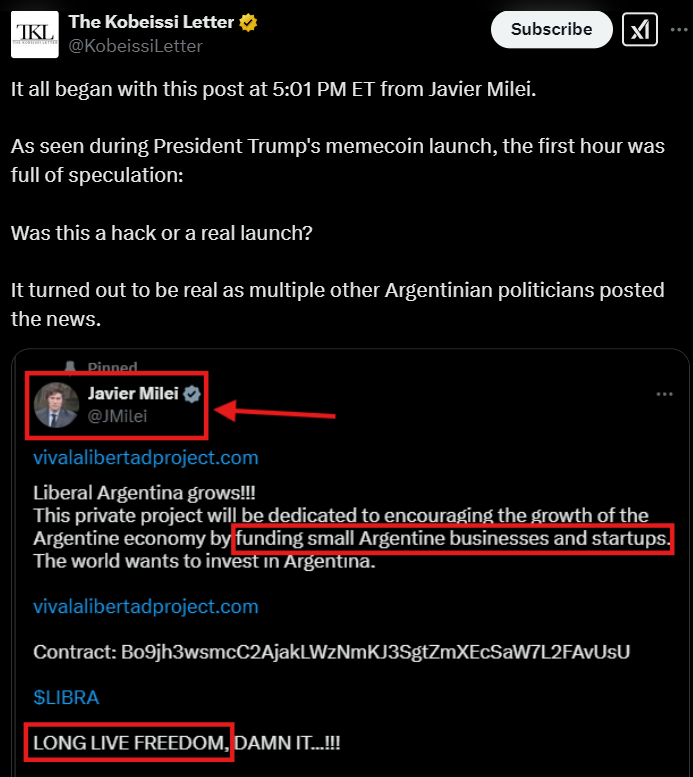

The controversy centers around the Libertad project’s native Solana-based token, Libra (LIBRA), which saw a meteoric rise before a sudden collapse. On February 14, Milei posted about the token on X (formerly Twitter), propelling its market capitalization to $4.56 billion. However, the euphoria was short-lived, as the token plummeted by over 94% after the president deleted his post. This drastic price movement led to allegations of a pump-and-dump scheme, with critics arguing that Milei’s endorsement manipulated market sentiment.

Legal Charges and Accusations

A group of professionals, including lawyers Marcos Zelaya and Jonatan Baldiviezo, engineer María Eva Koutsovitis, and economist Claudio Lozano, have filed a criminal complaint, accusing Milei of complicity in fraud. According to an Associated Press report on February 17, Baldiviezo also claimed that Milei violated Argentina’s Public Ethics Law. This law mandates transparency from public officials regarding asset declarations and potential conflicts of interest.

“In this illicit association, the crime of fraud was committed, in which the president’s actions were essential,”

Baldiviezo stated, reinforcing claims that Milei’s post directly influenced the market’s speculative rise and fall. A judge is expected to be assigned to the case, or it may be forwarded to a prosecutor for further investigation.

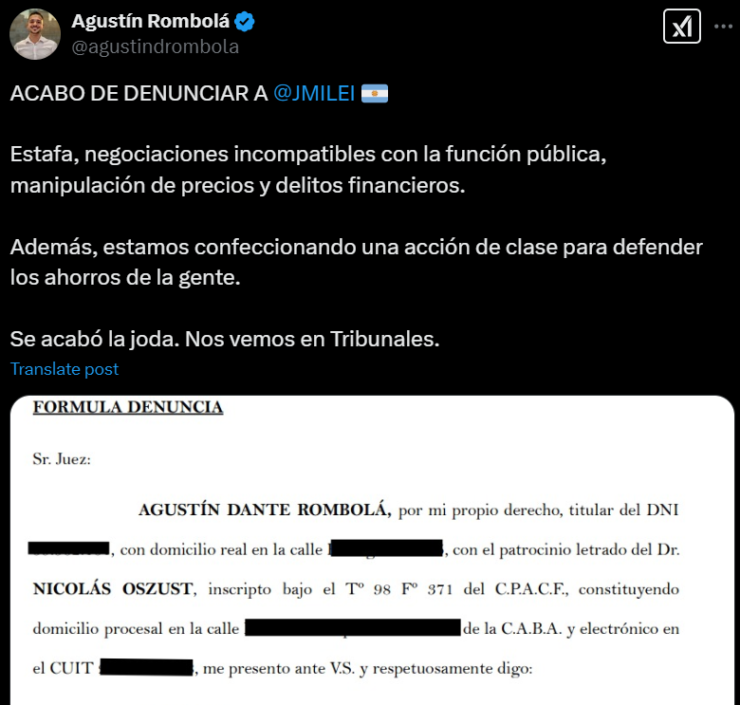

Separately, Argentine lawyer Agustín Rombolá, founder of the Rombola Mangione law firm, has filed another legal complaint, alleging that Milei engaged in fraud, price manipulation, and financial crimes. Rombolá, also a member of the Unión Cívica Radical political party, announced via X on February 16 that his firm is preparing a class-action lawsuit on behalf of investors who suffered losses due to the token’s collapse.

Milei’s Response and Government Investigation

In response to the growing scrutiny, the Argentine presidential office stated that Milei had no prior knowledge of the details surrounding the Libertad project when he endorsed it. To address concerns, Milei has requested the Anti-Corruption Office to investigate all government members, including himself, and share the findings with the courts.

The presidential office maintains that Milei has no ties to the company behind the token. However, Milei did meet with representatives from KIP Protocol, a Web3 company specializing in AI payment infrastructure, on October 19 in Argentina. KIP Protocol claims that while it was hired to facilitate fund distribution to local businesses, it did not create or act as a market maker for the Libra token.

Skepticism and Market Concerns

Analysts investigating the project have flagged multiple red flags. Notably, the domain for Libra’s website was reportedly created just hours before its launch, and there is no publicly available ownership information. This lack of transparency has fueled suspicions that the project may have been designed for quick speculation rather than long-term utility.

The case has also sparked political ramifications. Opposition lawmaker Leandro Santoro has announced his intention to file an impeachment request against Milei, adding another layer of complexity to an already turbulent political climate in Argentina.

Broader Implications for Crypto Regulation

Milei, a vocal advocate of free-market economics and cryptocurrency adoption, has previously positioned himself to support decentralized financial solutions. However, this incident may prompt increased scrutiny and regulatory oversight of crypto projects in Argentina. The controversy underscores the risks associated with public figures endorsing financial instruments without thorough due diligence.

The legal battle against Milei is still unfolding, but its outcome could set a precedent for regulating political endorsements of digital assets. As the case progresses, it will be closely watched by the crypto industry and policymakers seeking to balance innovation with investor protection.