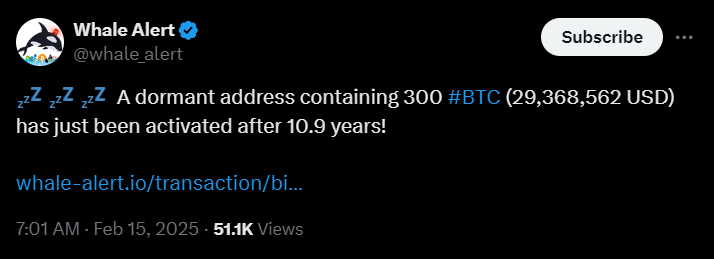

After nearly 11 years of silence, a Bitcoin whale has resurfaced, moving 300 BTC, worth $29.3 million, sparking speculation on lost keys, market timing, and hidden fortunes. The transaction, first reported by blockchain tracking service Whale Alert, has reignited discussions about long-term Bitcoin holders, lost private keys, and the motivations behind such reactivations.

Dormant Since 2014: A Bitcoin Time Capsule

According to Whale Alert, the wallet last transacted in 2014, a time when:

- Bitcoin was trading at around $500 per BTC.

- Ethereum’s Initial Coin Offering (ICO) was just being launched.

- Satoshi Nakamoto, Bitcoin’s mysterious creator, had already been absent from the crypto space for four years.

The fact that the wallet remained inactive for nearly 11 years suggests that it either belonged to an early adopter who deliberately held onto their BTC or was an address with lost private keys that were recently recovered.

Are Ancient Whales Returning for Profits?

This Bitcoin awakening is part of a broader trend. Over the past few months, multiple old wallets have been reactivated, with large sums of BTC being moved.

The timing aligns with Bitcoin’s price surge, which hit an all-time high of $109,114 on January 20, 2025 coinciding with the inauguration of the new U.S. president, a vocal supporter of crypto regulations and Bitcoin adoption.

Many speculate that these whales are cashing in on profits after holding BTC for over a decade. However, another theory suggests that some of these early holders had lost access to their wallets years ago and are only now recovering their private keys.

Why Do Bitcoin Whales Suddenly Move Their Holdings?

Bitcoin whales, large BTC holders tend to influence the market whenever they make major moves. Here are some possible reasons for such sudden activity:

- Profit-taking – With Bitcoin surpassing its previous all-time highs, early holders may be liquidating their holdings.

- Security concerns – Some long-time holders may be moving their BTC to more secure storage solutions due to evolving security risks.

- Institutional interest – The increasing adoption of Bitcoin ETFs and a potential U.S. Strategic Bitcoin Reserve may be attracting long-term holders back into the market.

- Recovered private keys – Many old wallets were believed to be lost forever, but new breakthroughs in data recovery and cryptography might be helping some owners regain access.

What This Means for the Market

While whale activity often raises concerns about increased selling pressure, the overall impact on Bitcoin’s price remains uncertain. Some investors worry that large liquidations could trigger short-term volatility, while others see these movements as a sign of renewed market confidence.

As Bitcoin continues to gain mainstream acceptance, long-dormant wallets waking up could become a regular occurrence. Whether these transactions represent profit-taking or strategic repositioning, they serve as a reminder of Bitcoin’s early days and its long-term store-of-value potential.

Final Thoughts

The reactivation of this 11-year-old Bitcoin wallet highlights the resilience of long-term holders and the fascinating history embedded in Bitcoin’s blockchain. As more ancient wallets come back to life, the market will be watching closely to see if these whales cash out or reinvest in the evolving crypto landscape.

With Bitcoin’s institutional adoption growing, these ancient wallets awakening could signal a new era, where early holders either cash out or reinvest in crypto’s next big chapter.