In a space where token launches drive speculation, Aave DAO is breaking the mold. The decentralized finance (DeFi) heavyweight has reached a consensus—no new tokens. Instead, the DAO is sharpening its focus on Real-World Assets (RWAs), a strategic move that signals where DeFi’s next evolution might be heading.

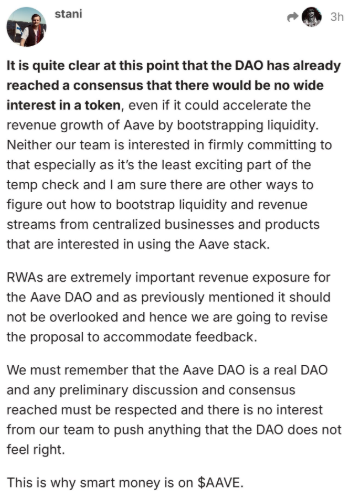

Aave Labs CEO Stani Kulechov confirmed the decision, emphasizing that Aave operates as a true DAO, not just in name. The message was clear:

“There is only $AAVE.”

But why is Aave rejecting token diversification at a time when new launches often spark hype and liquidity? And how does this shift align with the growing RWA sector, where giants like BlackRock and JPMorgan are making bold moves?

Why Aave Is Betting Big on RWAs

Aave’s pivot toward Real-World Assets isn’t an impulsive shift—it’s a calculated strategy aimed at positioning DeFi as a bridge between traditional finance and blockchain.

Instead of adding new speculative tokens, Aave focuses on integrating regulated, real-world assets into its lending ecosystem. This aligns with the broader industry trend, where institutions increasingly turn to on-chain treasuries, tokenized bonds, and money market funds (MMFs) as viable financial instruments.

According to RWA.xyz, the total value of tokenized assets on-chain has surged 17% in just one month, surpassing $18.1 billion. The number of unique asset holders has also jumped by 5%, crossing 89,818 participants.

With such rapid growth, Aave sees RWAs as the future of institutional DeFi adoption.

Mixed Reactions from the Community

While many in the Aave ecosystem supported the DAO’s decision to focus on AAVE and RWAs, some community members were more skeptical.

One user questioned why RWA exploration was slowed down, arguing that AAVE’s value should have been the focus from the start. Another commenter suggested that launching new tokens was unnecessary and that Aave’s priority should be maximizing value extraction from its existing ecosystem.

Despite the debates, the DAO’s consensus remains firm: RWAs are the future, but Aave won’t rush into expansion without a solid framework.

Aave’s stance on RWAs isn’t just theoretical, it’s already taking shape through Project Horizon, launched on March 13.

This initiative aims to seamlessly integrate institutional RWAs into DeFi, creating a structured pathway for asset issuers to leverage on-chain finance without sacrificing compliance.

Key features of Horizon include

- Tokenized MMFs as collateral for borrowing stablecoins.

- An Aave Protocol licensed instance governed by the Aave DAO.

- A transition to Aave V4 deployment for long-term RWA integration.

- Profit-sharing model allocating 50% of the first-year revenue to the Aave DAO.

This approach mirrors the strategies of major financial institutions like JPMorgan, Citigroup, UBS, and Franklin Templeton, all actively investing in the RWA revolution.

JPMorgan alone has processed over $900 billion in tokenized assets through its Onyx platform, while BlackRock’s BUIDL product has already issued significant tokenized assets.

The message is clear: DeFi isn’t just competing with TradFi anymore—it’s merging with it.

The Bigger Picture

Aave’s no-new-token stance signals a growing maturity in DeFi governance. Instead of chasing short-term speculative gains, the DAO is positioning itself for long-term institutional adoption.

Experts predict that RWAs could scale to a $16 trillion industry within the next decade, and this may prove to be Aave’s most strategic pivot yet.

The days of meme tokens and speculative DeFi experiments are slowly giving way to regulated, structured financial products. The question is—will Aave’s bet on RWAs pay off before others catch up?

The race for DeFi’s next evolution has officially begun.