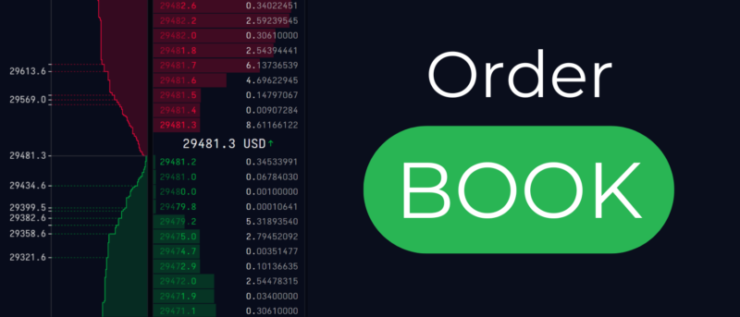

In financial markets, whether it’s stocks, forex, or cryptocurrency, the order book is an essential tool for understanding market activity. It provides traders with real-time data on buy and sell orders, helping them make informed decisions.

But how does it work? Let’s break it down and explore the ins and outs of the order book in easy-to-understand terms.

What is an Order Book?

At its core, an order book is a digital ledger of all the buy and sell orders for a specific asset at a given point in time. It displays the price and quantity of orders that are waiting to be executed.

Market participants can view the order book to assess supply and demand levels, giving them insight into potential price movements.

The order book typically shows limit orders (orders set at a specific price) and market orders (orders placed at the current market price).

Key Components of an Order Book

Understanding the order book is easier when you break it down into its key components:

- Bids: These are the buy orders.To buy an asset at a certain price, traders specific offers. The highest bid is the price that a buyer is willing to pay at that moment.

- Asks (or Offers): These are the sell orders. Sellers list their ask prices, representing the price at which they’re willing to sell.

- Bid-Ask Spread:what separates the lowest ask from the highest bid. A narrow spread indicates a more liquid market, while a wider spread suggests less liquidity.

- Order Size: The quantity of assets that a trader is looking to buy or sell at a given price.

How Does the Order Book Affect Market Prices?

The order book plays a crucial role in determining the market price of an asset. When a buy order matches a sell order, a trade is executed, and the price at which this trade occurs becomes the last price. The order book helps to create a market equilibrium between supply and demand, influencing short-term price movements.

- High demand, low supply: When there are more buyers than sellers at a particular price, the price tends to go up.

- Low demand, high supply: When there are more sellers than buyers, the price typically goes down.

How to Read an Order Book

Reading an order book might seem intimidating at first, but it’s relatively straightforward. Usually, there are two portions in a book:

- The Bid Side: On the left side, you’ll find the bids with their prices and quantities.

- The Ask Side: On the right side, you’ll find the asks with their prices and quantities.

Each row in the book represents an order. The most important part to look at is the highest bid and the lowest ask because these are where the market is currently “active.” When these two prices come close enough to match, a trade will be executed.

The Role of Liquidity in the Order Book

The ease of buying or selling an asset without changing its price is known as liquidity. The more orders present in the order book, especially at narrow price levels, the more liquid the market is.

This makes it easier for traders to execute large orders without causing significant price fluctuations. A highly liquid order book will typically have many orders near the current market price, resulting in smoother price movements.

Conversely, a thin order book (with fewer orders) might result in higher volatility, as large orders can move the price more drastically.t result in higher volatility, as large orders can move the price more drastically.

Limit Orders vs Market Orders

When using an order book, you’ll come across two main types of orders:

- Limit Orders: These are placed at a specific price, and they remain in the order book until they are either matched or canceled. Traders use limit orders when they want to buy or sell an asset at a particular price, but not higher or lower.

- Market Orders:These orders are fulfilled right away at the order book’s best price. Market orders prioritize speed over price, meaning they will be filled quickly but at the current market rate.

Why Do Traders Use the Order Book?

Traders use the order book to gain insights into market sentiment and to help inform their trading strategies. By observing the order book, they can:

- Identify Support and Resistance Levels: A large number of buy orders can act as support (a price level where demand is strong enough to prevent further price drops), while a large number of sell orders can serve as resistance (a level where price struggles to rise beyond).

- Predict Market Moves: By monitoring changes in the order book, traders can anticipate where the price is likely to move. For instance, if the number of buy orders at a specific price increases, the market price might soon rise.

Advanced Techniques:

Experienced traders often analyze the order book depth to predict potential market trends. They look at:

- Order Book Imbalance: This occurs when the number of buy orders significantly outweighs the sell orders (or vice versa), which can signal a potential breakout or breakdown in price.

- Time and Sales Data: This provides a real-time list of executed trades, showing price, size, and time. By comparing this data with the order book, traders can assess whether the market is active or just fluctuating within a range.

Conclusion:

The order book is a powerful tool that provides deep insights into the dynamics of a financial market. By understanding how the order book works, you can make more informed decisions, spot trends early, and better manage your trades.

Remember, the order book offers a snapshot of the current market, but it’s just one piece of the puzzle. By combining order book analysis with other tools and strategies, traders can increase their chances of success in the fast-paced world of trading.