Ethena is a decentralized finance (DeFi) protocol operating on Ethereum, offering a synthetic dollar known as USDe. Launched on the Ethereum Virtual Machine (EVM) in 2024, Ethena aims to provide a crypto-native, scalable alternative to traditional stablecoins, independent of conventional banking systems.

Overview

Ethena is a synthetic dollar protocol built on the Ethereum blockchain, offering a decentralized, crypto-native alternative to traditional currencies. Its primary product, USDe, is designed to function as a stable digital currency within the cryptocurrency ecosystem. A Stable coin has its value pegged to the United States Dollar and can be used to swap assets in an exchange.

Unlike conventional stablecoins that rely on fiat reserves, USDe utilizes a delta-hedging strategy—a method that involves taking offsetting positions to mitigate the risk of depegging from the USD. Ethena’s USDe is available in the Ethereum Layer 1 mainnet and Layer 2 networks like Blast, Layer Zero, etc. Ethena also functions well with other EVM compatible Layer 1 networks like Aptos.

Key Features

- USDe Stability: Ethena employs a delta-hedging strategy to ensure that USDe maintains a stable value relative to the U.S. dollar. By balancing long positions in cryptocurrencies like Ethereum (ETH) with corresponding short-future positions, the protocol effectively neutralizes price volatility, thereby preserving the value of USDe.

- Internet Bond: Beyond USDe, Ethena introduces the concept of the Internet Bond, a globally accessible, dollar-denominated savings instrument. This bond generates returns from a combination of staked assets and market strategies, offering users a crypto-native yield-bearing asset that integrates aspects of traditional bonds with the decentralized nature of crypto finance.

- Decentralization: Operating independently of traditional financial institutions, Ethena enhances censorship resistance—the ability to operate without external control or suppression—and accessibility within the crypto ecosystem. By not relying on conventional banking infrastructure, Ethena provides a financial solution that is both resilient and inclusive.

Ecosystem Activity

- Total Value Locked (TVL): As of March 2025, Ethena’s synthetic dollar, USDe, holds over $6 billion in TVL, positioning it as the third-largest USD-denominated crypto asset in history.

- User Adoption: The platform has attracted over 500,000 users, reflecting a growing trust in Ethena’s decentralized financial solutions.

- Converge Network Launch: In collaboration with Securitize, a firm specializing in tokenizing real-world assets, Ethena announced the upcoming launch of Converge, an Ethereum-compatible blockchain designed to integrate traditional finance (TradFi) with decentralized finance (DeFi). Converge aims to serve as a settlement network for digital dollars and tokenized assets, enhancing interoperability between conventional financial systems and blockchain technology.

- Strategic Partnerships: Converge has secured initial partnerships with notable entities, including Pendle, Avara (the parent company of Aave Labs), Ethereal, Morpho, and Maple Finance, to foster a diverse and robust DeFi ecosystem.

Funding and Backers

In December 2024, Ethena successfully raised $100 million through a private sale of its governance token, ENA. This funding round attracted prominent investors, including Franklin Templeton and F-Prime Capital, the venture capital firm affiliated with Fidelity Investments. Other notable participants were Polychain Capital, Dragonfly Capital, and Pantera Capital.

This substantial investment aims to support Ethena’s development of a new cryptocurrency tailored for traditional financial institutions, bridging the gap between decentralized finance and the conventional banking sector.

Token Utility:

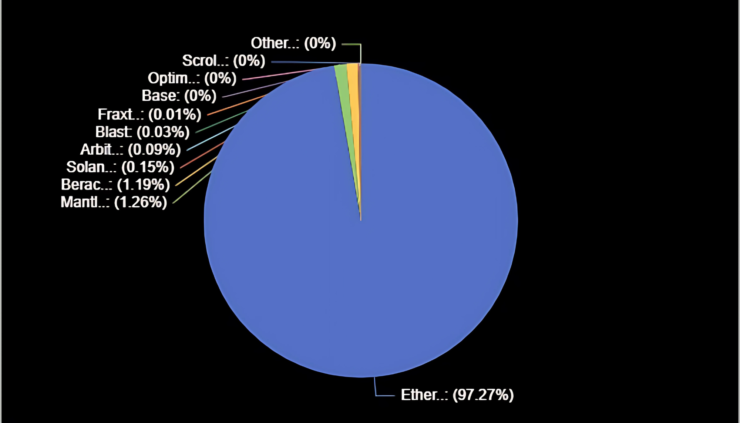

There are 15 billion ENA tokens, with 30% allocated to ecosystem development. Over 28,000 addresses hold ENA in different blockchain layers, although a good percentage of the circulating supply is found on the Ethereum Mainnet..

- Governance: Holders of Ethena’s governance token, ENA, have voting rights in key protocol decisions, including risk management, the composition of assets backing the synthetic dollar (USDe), and partnerships.

- Staking and Rewards: Users can stake their USDe tokens (synthetic dollars) to earn yields, typically higher than traditional banking products. Additionally, ENA token holders receive rewards for staking, promoting long-term engagement with the protocol.

- Delta Hedging and Stability: Ethena utilizes a delta hedging strategy—a risk management method that balances price fluctuations—to maintain the stable value of USDe against the US dollar, making it a reliable crypto-native currency solution.

Airdrop Participation

Ethena Labs operates a season-based rewards program, currently in Season 4, running until September 24, 2025. Participants automatically accrue points, and previous season participants receive boosted rewards. Season 3 results will be available in early April 2025, with detailed airdrop announcements forthcoming. Previously, in April 2024, Ethena distributed 750 million ENA tokens (5% of the total supply) to early users. A complete detail of the Airdrop guide is found here

Why It Matters

Ethena introduces an innovative approach to stablecoin design by leveraging delta-hedging strategies to create a synthetic dollar, USDe, that operates independently of traditional financial systems. This positions Ethena as a significant player in the DeFi space, offering a scalable and decentralized alternative to conventional stablecoins.

Follow details on the Ethena USDe project via the Website, Documentation or their X handle