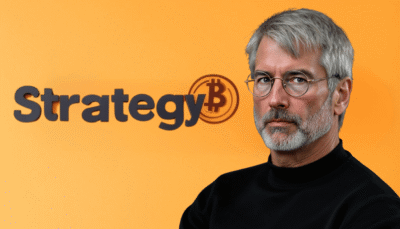

Michael Saylor’s Strategy is back in the headlines after scooping up nearly $531 million worth of Bitcoin last week, reinforcing its status as the world’s largest corporate holder of the asset. According to a Monday filing with the U.S. Securities and Exchange Commission, Strategy acquired 4,980 BTC at an average price of $106,801 per coin.

Tommy Argo

South Korea’s central bank has suspended its pilot program for a central bank digital currency (CBDC) as policymakers and financial institutions increasingly turn their focus to stablecoins. According to local reports from Yonhap News Agency and The Chosun Daily, the Bank of Korea notified seven major banks on Sunday that it was postponing the second

South Korea Halts CBDC Tests as Banks Pivot to Stablecoins

Vanadi Coffee, a modest café chain based in Alicante, Spain, has secured shareholder approval for one of the most ambitious Bitcoin treasury plans ever announced by a European small-cap company. On June 29, Vanadi’s investors voted in favor of authorizing up to €1 billion (roughly $1.17 billion USD) for Bitcoin purchases, positioning the six-location chain

Shareholders of Spanish Coffee Chain Approves €1 Billion Bitcoin Strategy

Crypto doesn’t live in isolation anymore. With platforms like Kraken eyeing competition with fintech giants like Revolut and Wise, the writing on the wall is clear: we’re not just building financial infrastructure. We’re building experiences. And in this next cycle, the battleground won’t just be yield or decentralization—it will be usability, tokenized rails, and narrative

Betting on What Comes Next in this Crypto Cycle

As crypto matures, the next generation of leadership is being shaped not just by coders or traders, but by growth architects who understand the intersection of technology, regulation, and user behavior. One such figure is Matthew Howells-Barby, the VP of Growth at Kraken. With a background in marketing, product strategy, and startup advisory, Matthew brings

Matthew Howells-Barby: Betting Big on the Future of On-Chain Finance

Ethereum co-founder Vitalik Buterin has laid out a detailed critique of emerging digital identity systems, cautioning that even zero-knowledge (ZK) proof-based credentials may fail to protect core privacy principles if implemented too narrowly. In a blog post published Sunday, Buterin introduced the idea of pluralistic identity—a framework designed to prevent any one institution or technology

Zero-Knowledge IDs Are Not Enough, Buterin Says

This week’s CoinRock Show opened with Matthias in a light, improvisational mood as he reflected on what he called a “dead day” in crypto markets, underscoring how stagnant sentiment often hides the biggest opportunities. “Crypto is dead today,” he quipped, before digging into the real reason: mounting geopolitical instability, particularly in the Middle East. With

Matthew Howells-Barby, VP of Growth at Kraken, on What’s Next for Crypto

Crypto exchange Bitvavo has secured regulatory approval to operate across the European Union under the bloc’s new Markets in Crypto-Assets (MiCA) framework. The license was issued by the Dutch Authority for Financial Markets (AFM), marking a milestone for one of Europe’s largest digital asset platforms. In a statement on Friday, Bitvavo CEO Mark Nuvelstijn praised

Dutch Exchange Bitvavo Secures MiCA License to Operate Across Europe

U.S. President Donald Trump sidestepped questions Friday about whether he would divest from his family’s cryptocurrency ventures to ease tensions surrounding major crypto legislation pending in Congress. During a White House press briefing, a reporter pressed Trump about growing Democratic opposition to advancing bills that could expand the industry’s regulatory clarity, citing concerns over the

Trump Dodges Divestment Question as Crypto Conflict Clouds Key Legislation

Crypto exchange Gemini has launched a tokenized version of Michael Saylor’s MicroStrategy (MSTR) stock exclusively for investors in the European Union, marking a significant expansion into the onchain equities space. In a statement on Friday, Gemini said the new tokenized asset aims to simplify access to U.S.-listed stocks for international investors while modernizing outdated financial

Gemini Brings Tokenized MicroStrategy Stock to European Investors

Singapore-based Genius Group is laying out an ambitious roadmap to turn courtroom victories into Bitcoin reserves and shareholder dividends. In a Thursday statement, the AI-powered education technology firm said its board has signed off on a framework to distribute any future proceeds from two major lawsuits that together seek over $1 billion in damages. One

Genius Group Targets Lawsuit Wins to Fuel Bitcoin Buying Spree

In a bold move that’s grabbing attention across both political and crypto circles, United Arab Emirates-based Aqua1 Foundation has invested $100 million into World Liberty Financial (WLFI), the crypto venture closely linked to U.S. President Donald Trump and his family. According to Thursday’s joint announcement, Aqua1’s investment makes it one of the largest holders of