Elon Musk’s weekend announcement of XChat—a new messaging platform set to launch on X (formerly Twitter)—has sparked both excitement and skepticism across the tech world. Musk claimed that the new feature would be built using Rust and secured by what he described as “Bitcoin-style” encryption—a phrase that quickly drew scrutiny from cryptographers and Bitcoin developers.

Patrick Adeka

Patrick holds a graduate degree in Life Sciences and discovered Bitcoin and crypto in 2018. With a strong analytical background, he has worked with and advised multiple projects in DeFi and real-world NFT applications. Passionate about blockchain innovation, he provides valuable perspectives on decentralized finance and asset tokenization, shedding light on emerging opportunities in the space.

The Open Network (TON), the blockchain protocol closely linked to Telegram, experienced a brief but notable disruption on June 1 that halted block production. The issue was traced to a malfunction in the masterchain dispatch queue—a critical component responsible for coordinating validator activity. TON’s development team reported the disruption at precisely 12:51 UTC and swiftly

TON Blockchain Restores Service After Network Experiences Block Production Halt

Ross Ulbricht—the convicted founder of Silk Road—has raised more than $1.8 million in Bitcoin through the auction of his personal belongings. Hosted on the Bitcoin-only platform Scarce City, the event drew intense interest from collectors eager to own a piece of crypto history. The items reflected Ulbricht’s life both before and during his incarceration. From

Ross Ulbricht’s Personal Items Fetch $1.8M in Bitcoin Auction

A surge in violent crimes targeting cryptocurrency holders is pushing insurers to launch specialized kidnap and ransom (K&R) policies designed for the digital asset space. With crypto-related abductions rising globally, insurance providers and high-net-worth investors are responding to a new and dangerous form of personal risk. At least three companies—AnchorWatch, Relm Insurance, and Hylant Capital—are

Insurers Rush to Offer Crypto Related Kidnap and Ransom Coverage

BlackRock’s iShares Bitcoin Trust (IBIT) experienced its largest-ever daily outflow on May 30, with $430.8 million in net withdrawals—bringing an end to its impressive 31-day inflow streak, according to data from SosoValue. The move signals a potential shift in institutional behavior as the broader crypto market faces fresh volatility. This marks IBIT’s most substantial outflow

BlackRock’s IBIT Suffers Record $430M Outflow, Breaking Historic Inflow Streak

Crypto traders betting on a continued rally were blindsided over the past 24 hours, as a steep market downturn erased more than $827 million in open positions, the majority of them long bets. The selloff, which swept across top cryptocurrencies, highlights the unrelenting volatility that continues to define the digital asset landscape. According to CoinGlass,

Over $800M in Longs Liquidated in Market Slump

At the Bitcoin 2025 conference in Las Vegas, Panama City Mayor Mayer Mizrachi proposed a radical new idea: allowing ships to skip the queue at the Panama Canal if they pay in Bitcoin. Speaking alongside El Salvador’s Bitcoin advocates Max Keiser and Stacy Herbert, Mizrachi positioned the proposal as part of a wider effort to

Panama Mayor Proposes Bitcoin Priority for Passage Through Canal

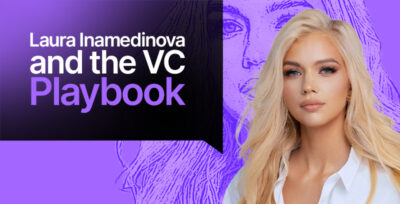

There’s a chasm running through crypto—one that no blockchain can bridge on its own. On one side is the retail crowd: fast, reactive, emotionally driven. On the other, venture capital: calculated, long-term, and often years ahead in narrative positioning. If Web3 is truly about leveling the playing field, then retail must do more than participate.

The Hard Truth: Why Retail Must Think Like VCs

Laura K. Inamedinova didn’t start out in crypto — but she arrived early and never looked back. With a background in physics and an early fascination with science and systems thinking, Laura found herself questioning whether to pursue a conventional career in traditional finance or to bet on the chaos and promise of crypto. She

Laura Inamedinova and the Venture Capital Ecosystem Playbook

James Wynn, the high-profile trader who recently went viral for placing a $1 billion Bitcoin long on decentralized exchange Hyperliquid, has suffered a catastrophic $99.3 million loss after Bitcoin’s price unexpectedly dipped below $105,000. The liquidation is one of the largest ever recorded on the platform and underscores the harsh risks of leveraged trading in

James Wynn, Popular Hyperliquid Trader Faces $100M Loss Amid Bitcoin’s Dip

In this week’s episode of The CoinRock Show, host Matthias Mazur opens with a market rally update that has everyone watching Bitcoin’s trajectory. With BTC reclaiming bullish momentum and altcoins perking up, excitement is building—but Matthias cautions that institutional behavior remains the real signal beneath the retail noise. “What’s interesting about this year, I’d say

Retail vs. Venture Capital: Laura Inamedinova on Lessons From the Investment Frontlines

In a long-anticipated move, U.S. lawmakers have introduced a bipartisan bill aimed at finally resolving one of the most contentious issues in crypto regulation: which federal agency governs what. The Digital Asset Market Clarity Act of 2025, or CLARITY Act, proposes a formal split in oversight duties between the Securities and Exchange Commission (SEC) and