In one of the strangest intersections of crypto hype and real-life events, a father-to-be turned his wife’s delivery room into a meme coin launch party. The man livestreamed his partner’s labor on Pump.fun, the Solana-based meme coin platform, while launching a token called PREGOWIFE in tandem with the birth of their daughter—whom they fittingly named

Patrick Adeka

Patrick holds a graduate degree in Life Sciences and discovered Bitcoin and crypto in 2018. With a strong analytical background, he has worked with and advised multiple projects in DeFi and real-world NFT applications. Passionate about blockchain innovation, he provides valuable perspectives on decentralized finance and asset tokenization, shedding light on emerging opportunities in the space.

In this week’s episode of The CoinRock Show, host Matthias Mazur sets the tone with a bullish market snapshot—Bitcoin hovering over $105,000, ETH at $2,600, and Solana staying active at $160. While the markets showed signs of green, Matthias reminded listeners not to confuse sentiment with signal. “we’re still in that choppy range. We haven’t

Jonny Caplan on Owning Your Narrative in the Media Age

Michelle Bowman has officially been confirmed as the Federal Reserve’s Vice Chair for Supervision, following a tight 48–46 Senate vote on June 4. Her confirmation is being hailed by pro-crypto lawmakers as a potential turning point in U.S. digital asset policy. Nominated by President Trump in March, Bowman has served on the Fed Board since

Michelle Bowman Confirmed by Senate as Fed’s Top Bank Regulator

The road to comprehensive crypto regulation hit another political snag this week, as the Digital Asset Market Structure Clarity Act — or CLARITY Act — faced turbulence during a House Financial Services Committee hearing. While the session was meant to dissect the bill’s 236 pages of proposals, it quickly veered into controversy as some lawmakers

Trump Dealings Overshadows CLARITY Act in Heated House Hearing

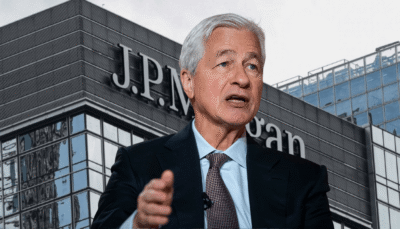

JPMorgan Chase is preparing to deepen its crypto integration, expanding services for select trading and wealth management clients. According to Bloomberg who cited sources familiar with the matter, the Wall Street giant is developing a new framework that would allow clients to use digital assets—such as Bitcoin—as collateral for loans tied to cryptocurrency exchange-traded funds

JPMorgan Expands Crypto Playbook with ETF Loans and Digital Collateral

A staggering $2.1 billion has been stolen from the crypto space in 2025, but not through breaking smart contracts—instead, through breaking human trust. According to cybersecurity firm CertiK, the dominant threat vector this year has been social engineering, not code vulnerabilities. Phishing schemes—where users are tricked into revealing private keys, seed phrases, or signing malicious

$2.1B Stolen in Crypto in 2025 as Hackers Change Target

A controversial Bitcoin donation linked to a convicted dark web operator has thrown the Czech government into political crisis, triggering the resignation of a senior cabinet official and prompting a no-confidence motion. Justice Minister Pavel Blažek resigned on Friday following mounting backlash over his ministry’s decision to accept and liquidate 468 Bitcoins—worth over $45 million—donated

Czech Government Faces No-Confidence Vote Over Bitcoin Scandal

U.S. Senator Cynthia Lummis has revealed growing military interest in creating a strategic Bitcoin reserve, citing feedback from senior generals stationed in Southeast Asia. In a June 3 interview with Bloomberg, Lummis described Bitcoin as a potential tool in the U.S. defense arsenal amid rising economic tensions with China. “These military leaders recognize that we’re

Bitcoin Reserve Gains U.S. Military Support as China Tensions Rise

BCP Technologies, a UK-based crypto firm, has officially launched Tokenised GBP (tGBP)—the first FCA-registered stablecoin backed by the British pound. The ERC-20 token went live on June 3 via the company’s in-house trading platform, BCP Markets, marking a milestone for pound-denominated digital assets in the UK. Users can now access tGBP by completing Know Your

UK’s First FCA-Registered Pound Stablecoin Launches Amid Regulatory Momentum

Texas Representative Brandon Gill is facing mounting criticism after failing to report two sizable Bitcoin purchases—each valued between $100,001 and $250,000—within the timeframe mandated by the STOCK Act. The trades, executed on January 29 and February 27, were disclosed well after the required 45-day reporting deadline, triggering concerns over transparency and potential conflicts of interest.

Texas Congressman Faces Scrutiny Over Late Bitcoin Disclosures

Circle, the issuer of the USDC stablecoin, has significantly raised its IPO fundraising goal to $896 million, reflecting increased investor confidence and improving regulatory sentiment in the U.S. According to a June 2 filing with the U.S. Securities and Exchange Commission (SEC), Circle now plans to offer 32 million shares at a price range of

Circle Targets $896M in IPO, Valuation Hits $7.2B

Robinhood has officially finalized its $200 million acquisition of Bitstamp, marking a significant step in its global expansion into institutional crypto markets. Initially announced in June 2024, the all-cash deal grants Robinhood access to more than 50 regulatory licenses and operational rights across Europe, the UK, and Asia—regions where Bitstamp has built a strong presence