CoinFund President Christopher Perkins has issued a scathing critique of the Bank for International Settlements’ (BIS) latest stance on cryptocurrency, warning that the organization’s attempt to isolate crypto from the traditional financial system could have destabilizing consequences. In a strongly worded post on X dated April 19, Perkins called the BIS’s recommendations “uninformed and, frankly,

Patrick Adeka

Patrick holds a graduate degree in Life Sciences and discovered Bitcoin and crypto in 2018. With a strong analytical background, he has worked with and advised multiple projects in DeFi and real-world NFT applications. Passionate about blockchain innovation, he provides valuable perspectives on decentralized finance and asset tokenization, shedding light on emerging opportunities in the space.

Robert Kiyosaki, author of the best-selling personal finance book Rich Dad, Poor Dad, has once again sounded the alarm on the U.S. dollar, predicting Bitcoin will soar to $1 million by 2035. In a recent post on X (formerly Twitter), the financial educator laid out his long-term outlook, also forecasting gold to hit $30,000 and

Robert Kiyosaki Projects $1M Bitcoin by 2035, Citing Fiat Collapse

Synthetix’s native stablecoin, sUSD, dropped to a low of $0.63 this week—marking a 37% depeg from its intended $1 target and extending a prolonged period of instability. The ongoing decline has raised fresh concerns over the protocol’s liquidity structure and risk management following major recent upgrades. While some observers have likened sUSD’s troubles to algorithmic

Synthetix’s sUSD Stablecoin Depegs Sharply Amid Renewed Stablecoin Crisis

Crypto exchange Kraken has begun a company-wide restructuring in preparation for its long-anticipated initial public offering (IPO), aiming to streamline operations and align teams with its long-term strategic goals. The move includes targeted role eliminations and departmental consolidation, which Kraken describes as a proactive, growth-focused realignment. In a statement, a Kraken spokesperson emphasized the company’s

Kraken Restructures Workforce Ahead of Anticipated IPO

Galaxy Research has unveiled a governance proposal aimed at resolving long-standing friction in Solana’s monetary policy decision-making. Titled Multiple Election Stake-Weight Aggregation (MESA), the new framework introduces a more flexible and representative voting mechanism to help reduce SOL’s inflation rate without the limitations of binary governance. Announced on April 17, the MESA proposal allows validators

Galaxy Proposes New Voting Model for Solana Inflation

From navigating the 2008 financial crisis to becoming one of Bitcoin’s most compelling macro advocates, Mark Connors has built a career at the intersection of institutional finance and systemic transformation. With over 35 years of experience in hedge funds, risk strategy, and global markets, Connors brings a voice of both caution and clarity to a

Mark Connors and the Macro Lens Crypto Can’t Ignore

Arizona’s bid to pioneer crypto integration at the state level is gaining traction. The Strategic Digital Assets Reserve Bill (SB 1373) passed a major legislative milestone on April 17, securing approval from the House Committee of the Whole—an internal review involving all 60 House members. The bill now advances to a final reading and floor

Arizona’s Digital Asset Reserve Bill Nears Final Approval

Responding to mounting user frustration over lagging transactions and network congestion, Coinbase has implemented a major infrastructure upgrade to enhance support for the Solana blockchain. The exchange now reports a five-fold improvement in transaction throughput—addressing long-standing concerns about speed and reliability. In a statement shared Thursday, Coinbase detailed several technical enhancements, including asynchronous transaction processing,

Coinbase Boosts Solana Support After User Complaints

A high-profile lawsuit filed by 18 U.S. states against the Securities and Exchange Commission (SEC) over its crypto authority has been paused for 60 days, following signs of a potential resolution under the agency’s new leadership. On Tuesday, U.S. District Judge Gregory Van Tatenhove approved a joint motion to stay the case, citing the SEC’s

Judge Pauses 18-State Lawsuit Against SEC for 60 Days

As macroeconomic tensions mount, traditional safe-haven assets are regaining favor—and Bitcoin appears to be missing the rally. In a research report published Wednesday, JPMorgan analysts said gold is attracting strong inflows from investors seeking protection, while Bitcoin is seeing waning demand and continued ETF outflows. Led by managing director Nikolaos Panigirtzoglou, the JPMorgan team highlighted

JPMorgan: Bitcoin’s Safe-Haven Appeal Losing Steam

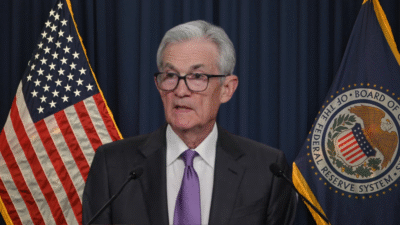

President Donald Trump reignited tensions with Federal Reserve Chair Jerome Powell on Thursday, blasting him for not cutting interest rates sooner and demanding his swift departure from office. The sharp comments come as global markets react to Trump’s escalating tariff measures and rising economic uncertainty. In a Truth Social post, Trump labeled Powell as “always

Trump Slams Fed Chair Powell Amid Tariff Fallout and Inflation Fears

Bitcoin clawed its way back above $85,000 mid-Wednesday following a tumultuous week driven by intensifying U.S.-China trade tensions. The bounce comes after a sharp drop to $77,000 last week, sparked by the White House’s latest round of tariff announcements targeting Chinese imports. While BTC’s daily performance flattened, the broader crypto market reflected residual anxiety—Ethereum, XRP,