Bitcoin ETFs have extended their bullish streak with another week of impressive inflows, pulling in over $1.8 billion between April 28 and May 4, according to data from CoinGlass. The momentum underscores a growing investor preference for Bitcoin over traditional safe havens like gold. Thursday and Friday were particularly strong, with inflows of $423 million

Patrick Adeka

Patrick holds a graduate degree in Life Sciences and discovered Bitcoin and crypto in 2018. With a strong analytical background, he has worked with and advised multiple projects in DeFi and real-world NFT applications. Passionate about blockchain innovation, he provides valuable perspectives on decentralized finance and asset tokenization, shedding light on emerging opportunities in the space.

Indonesia’s tech regulators have intensified scrutiny on OpenAI CEO Sam Altman’s biometric crypto project, Worldcoin (now known as “World”), suspending its operations over allegations of regulatory misconduct. On May 4, the Ministry of Communications and Digital (Kominfo) announced it had revoked the Electronic System Operator Certificate (TDPSE) registrations for both World and its companion service,

Indonesia Suspends Worldcoin Over Regulatory and Licensing Breaches

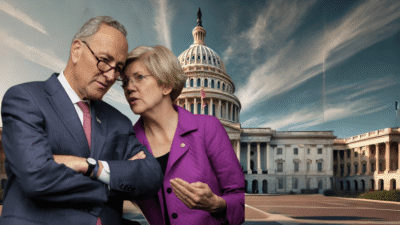

Senate Democrats are walking back support for a long-negotiated stablecoin bill following late-stage concerns about foreign regulatory gaps and alleged links to former President Donald Trump’s crypto ventures. According to a new Politico report, Senate Majority Leader Chuck Schumer and Senator Elizabeth Warren led the charge against the bipartisan proposal during a private meeting on

Democrats Rethink Stablecoin Bill Over Foreign and Trump Concerns

Originally launched as a joke, Dogecoin has become one of the most recognizable names in crypto. What began in 2013 as a lighthearted take on digital currencies has evolved into a widely traded asset, a payment token accepted by major merchants, and the original blueprint for meme coin culture in Web3. Today, Dogecoin remains an

Dogecoin – The Meme Coin That Sparked a Movement

Brown University has taken a major step into the digital asset world by revealing a multimillion-dollar position in BlackRock’s iShares Bitcoin Trust (IBIT), according to a newly released SEC filing. The 13F report filed with the U.S. Securities and Exchange Commission on Friday shows that the Ivy League institution purchased 105,000 shares of the Bitcoin

Brown University Allocates $4.9M to BlackRock’s Bitcoin ETF

The UK’s Financial Conduct Authority (FCA) has launched a public consultation as part of its push to introduce formal legislation for the cryptocurrency sector. The move marks a key step in transitioning the UK from a largely unregulated environment to a more structured crypto oversight regime. In a newly released discussion paper, the FCA is

UK Regulator Launches Public Consultation on Crypto Rules

Movement Labs has officially suspended its co-founder, Rushi Manche, amid growing fallout from a controversial market maker arrangement that triggered a $38 million sell-off of the MOVE token. The decision, confirmed in a May 2 announcement on X, follows mounting scrutiny over a deal that has rattled the project’s community and drawn regulatory attention. The

Movement Labs Co-Founder Suspended Over $38M Token Fallout

What began as a standard remote job application at crypto exchange Kraken quickly evolved into a high-stakes security operation. On Thursday, the company revealed it had flagged an applicant for a remote engineering role as a suspected North Korean operative, triggering an internal intelligence-gathering mission. Instead of ending the process early, Kraken’s security team continued

Kraken Blocks Suspected North Korean Infiltration Attempt

In a market driven by adrenaline, headlines, and high-yield promises, it’s easy to forget a basic truth: speculating is not the same as investing. And in this latest episode of The CoinRock Show, guest Chris J. Snook made it painfully clear — if you’re not anchoring your crypto thesis in reality, you’re just gambling in

Speculation Is Not Strategy: A Blueprint for Sustainable Crypto Investing

On this episode of The CoinRock Show, host Matthias Mazur is joined once again by venture strategist and media entrepreneur Chris J. Snook, who delivers a sobering but strategic take on what he calls the “Guns of April” moment. Drawing parallels between today’s escalating geopolitical landscape and historical flashpoints like World War I and the

Tariffs, Tensions, and Tactical Thinking: Chris J. Snook on Why the Guns of April Are Already Firing

Shares of Strategy Inc. (NASDAQ: MSTR)—formerly MicroStrategy—rallied Thursday, surging past $400 as Bitcoin approached the $100,000 mark ahead of the firm’s Q1 earnings report. The stock reached an intraday high of $403.90, just shy of its 2025 peak of $404.42, set in January following President Donald Trump’s second inauguration. The 4% daily gain reflects growing

Strategy Stock Hits High as Bitcoin Nears $100K

A coalition of nearly 30 crypto advocacy organizations is urging the U.S. Securities and Exchange Commission (SEC) to issue clear guidelines on how cryptocurrency staking should be regulated—arguing it is a technical function, not an investment contract under federal securities law. Led by the Crypto Council for Innovation (CCI) and the Proof of Stake Alliance