Taiwan may be the next country to flirt with Bitcoin at the state level. Legislator Ko Ju-Chun has formally proposed that the Taiwanese government allocate a portion of its national reserves to Bitcoin, citing the cryptocurrency’s potential as a strategic hedge against global financial volatility. Speaking at the National Conference on May 9, Ko emphasized

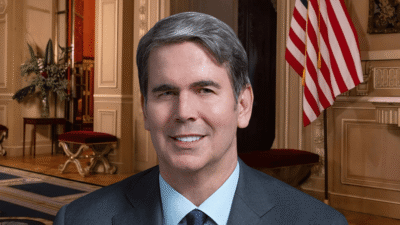

Patrick Adeka

Patrick holds a graduate degree in Life Sciences and discovered Bitcoin and crypto in 2018. With a strong analytical background, he has worked with and advised multiple projects in DeFi and real-world NFT applications. Passionate about blockchain innovation, he provides valuable perspectives on decentralized finance and asset tokenization, shedding light on emerging opportunities in the space.

Efforts to pass the GENIUS Act—a high-profile bill aimed at regulating stablecoins in the U.S.—suffered a major blow on Thursday after the legislation failed to clear a critical procedural hurdle in the Senate. The setback not only jeopardizes the bill’s future but also dims the broader outlook for crypto regulation on Capitol Hill. The bill

GENIUS Act Stalls in Senate Amid Crypto, Political Blowback

The Doodles NFT ecosystem is heating up as anticipation builds for the launch of its native token, DOOD. Over the past 24 hours, Doodles recorded a 97% surge in sales volume, topping $1.1 million, according to CryptoSlam data—nearly double the previous day’s total. The spike catapulted the project to third place in daily NFT sales

Doodles NFT Sales Soar 97% Ahead of DOOD Token Airdrop

After a week of high-stakes political maneuvering, a fractured U.S. Senate may be edging closer to consensus on the long-awaited stablecoin regulation bill known as the GENIUS Act. A small group of Senate Democrats—who abruptly withdrew support over the weekend—has reportedly reopened negotiations with Republicans in a bid to salvage the legislation, according to sources

Senate Inches Toward Deal on Stablecoin Bill as Democrats Re-Enter Talks

In a notable shift in federal banking policy, the U.S. Office of the Comptroller of the Currency (OCC) has reaffirmed that national banks may directly engage in cryptocurrency services on behalf of their clients—including buying, selling, and managing digital assets. The updated guidance also confirms that banks can outsource these operations to qualified third-party providers,

OCC Clears Banks to Handle and Outsource Crypto Services

A groundbreaking proposal to establish a state-managed Bitcoin reserve has taken a major step forward in Texas, as Senate Bill 21 cleared the House Committee on Government Efficiency this week. The legislation, which has already passed the state Senate, now heads to the House floor for a final vote before potentially landing on Governor Greg

Texas State Bitcoin Reserve Bill Clears Key Committee

World Liberty Financial (WLFI), the high-profile crypto venture associated with U.S. President Donald Trump, has opened community voting on a proposal to airdrop its USD1 stablecoin to existing WLFI token holders. The vote, hosted on Snapshot, serves as a live test of the project’s onchain distribution infrastructure and as a symbolic gesture of appreciation to

Trump-Backed WLFI Pushes USD1 Airdrop Plan with Near-Unanimous Support

U.S. Treasury Secretary Scott Bessent firmly rejected the idea of a central bank digital currency (CBDC) during testimony on Capitol Hill Tuesday, asserting that such a move would signal economic fragility—not financial leadership. Speaking before the House Appropriations Subcommittee on Financial Services and General Government, Bessent said digital assets should remain the domain of the

U.S. Treasury Secretary Bessent Labels CBDCs as ‘Sign of Weakness’

The Commodity Futures Trading Commission (CFTC) has officially withdrawn its appeal in the high-profile case against Kalshi, marking the end of a protracted legal battle over the startup’s right to offer election-based event contracts in the United States. On Monday, the CFTC filed a motion to voluntarily dismiss its appeal with the U.S. Court of

Kalshi Clinches Legal Victory as CFTC Drops Appeal Over Election Betting

Binance founder and former CEO Changpeng “CZ” Zhao is once again stirring conversation with bold predictions for Bitcoin and the broader crypto market. Speaking on a new episode of Farokh Radio, CZ said he believes Bitcoin could surge to between $500,000 and $1 million during the current cycle, while projecting the total crypto market cap

CZ Reignites $1M Bitcoin Forecast, Sees Crypto Market Doubling to $5 Trillion

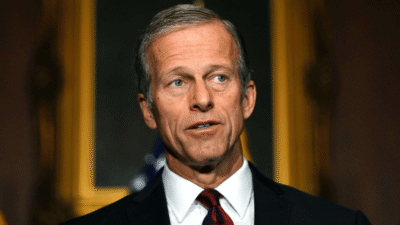

As the U.S. Senate prepares for a pivotal vote on the GENIUS Act, a landmark bill to regulate stablecoins, Republican leadership is signaling a strategic shift. Senate Majority Leader John Thune (R-SD), who previously backed fast-tracking the legislation, now says the GOP is open to bipartisan amendments aimed at addressing Democratic concerns. “Changes can be

Thune Softens GOP Stance on Stablecoin Bill as Senate Showdown Looms

VanEck has become the first asset manager to submit a filing for a spot Binance Coin (BNB) exchange-traded fund in the United States, marking a potential milestone in the evolution of regulated altcoin-based investment products. The S-1 registration, filed Monday with the U.S. Securities and Exchange Commission (SEC), outlines a fund designed to offer investors