Before welcoming this week’s guest, host Matthias kicked things off with a rundown of major crypto headlines that are shaping the broader market. In typical fashion, he touched on regulation, market structure, and the ever-persistent evolution of Bitcoin and its surrounding ecosystems. The highlight? The U.S. Senate’s advancement of the Genius Act, a landmark bill

Patrick Adeka

Patrick holds a graduate degree in Life Sciences and discovered Bitcoin and crypto in 2018. With a strong analytical background, he has worked with and advised multiple projects in DeFi and real-world NFT applications. Passionate about blockchain innovation, he provides valuable perspectives on decentralized finance and asset tokenization, shedding light on emerging opportunities in the space.

Digital asset investment products drew a record $3.3 billion in inflows last week, according to CoinShares’ latest report, marking the sixth consecutive week of major institutional activity. The surge has propelled the sector into uncharted territory, led by products managed by giants like BlackRock, Fidelity, and Grayscale. Assets under management briefly hit a new all-time

Crypto Investment Funds Hit $3.3B in Weekly Inflows

A wealthy cryptocurrency investor has been arrested in New York and charged with masterminding a disturbing kidnapping scheme targeting an Italian tourist. Authorities allege 37-year-old John Woeltz, along with a 24-year-old female accomplice, held the victim captive in a luxury SoHo apartment where he was beaten and tortured in a bid to access his multimillion-dollar

Crypto Investor Accused of Kidnapping and Torturing Italian Tourist in NYC

U.S.-listed spot Bitcoin ETFs have just wrapped their most active trading week of 2025, with a staggering $25 billion in weekly volume, according to SoSoValue data. This marks the highest activity level since the December 2024 rally, driven by Bitcoin’s push toward new all-time highs and a surge in demand for regulated crypto exposure. Weekly

Bitcoin ETFs Hit Record $25B Weekly Volume Lead by BlackRock’s IBIT

Nasdaq-listed medical tech firm Semler Scientific is pressing forward with its aggressive Bitcoin strategy, even as it faces increasing legal scrutiny from federal authorities and shareholder advocates. On Thursday, Bragar Eagel & Squire, P.C., a law firm specializing in securities litigation, announced an investigation into potential securities violations and unlawful conduct at Semler. The firm

Semler Scientific Faces Legal Probe as It Deepens $466M Bitcoin Bet

Investor appetite for crypto-backed ETFs has surged to its highest point in months, with Bitcoin and Ethereum funds collectively drawing over $1 billion in inflows on Thursday. The figure marks the largest single-day combined ETF inflow in five months, signaling renewed institutional confidence amid a broader crypto market rally. BlackRock’s iShares Bitcoin Trust (IBIT) led

Bitcoin and Ethereum ETFs See $1B+ Daily Inflow Surge

Swedish health tech company H100 Group AB saw its shares jump by 37% after announcing its first-ever Bitcoin treasury allocation, joining a growing list of public firms turning to digital assets as part of their financial strategy. In a May 22 press release, H100 revealed it had purchased 4.39 BTC for approximately 5 million Norwegian

Swedish Health Firm’s Stock Soars 37% Following Bitcoin Investment

Despite hitting new all-time highs above $111,000, Bitcoin’s rally shows no sign of slowing. On-chain analytics from CryptoQuant reveal a strong dominance of buy orders over sell orders, suggesting that bullish momentum may still have room to run. Ibrahim Cosar, a CryptoQuant researcher, pointed to the 90-day cumulative volume delta (CVD)—a key indicator tracking the

Bitcoin’s $111K Rally Fueled by Buyer Dominance, Signaling More Gains Ahead

Bitcoin traded at $110,500 on Friday morning, after marking a new all-time high of $111,800 on Thursday and igniting a broader rally across the crypto market. The breakout builds on momentum from earlier this week, with altcoins now outpacing Bitcoin in daily gains. According to CoinGecko, Bitcoin is up 6.4% over the past 7 days

Altcoins Surge as Bitcoin Hits Another Record High

BlackRock’s iShares Bitcoin Trust (IBIT) recorded a major single-day inflow of $530.6 million on May 21—its largest since early May—underscoring growing institutional interest in Bitcoin as the asset edges closer to a new all-time high. According to data from SosoValue Data, the fund’s inflow was just below its May 5 record of $531.2 million. Trading

BlackRock Bitcoin ETF Sees $530M Inflow as BTC Surges

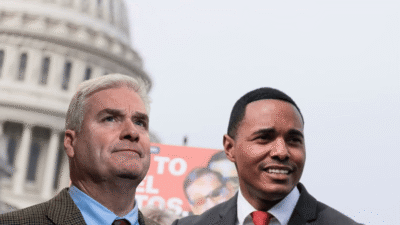

U.S. Representatives Tom Emmer (R-MN) and Ritchie Torres (D-NY) have reintroduced the Blockchain Regulatory Certainty Act—a bipartisan bill aimed at shielding non-custodial crypto developers from being misclassified under outdated financial regulations. The bill would establish that developers and operators of non-custodial platforms—such as miners, validators, and wallet developers—should not be treated as “money transmitters” or

Reps Emmer, Torres Reintroduce Bill to Protect Non-Custodial Builders

Why the Crypto World Still Celebrates Bitcoin Pizza Day What if your lunch one day ended up costing you over $1 Billion? For one Florida-based developer, that question isn’t hypothetical—it’s history. Every year on May 22, the global crypto community gathers around its digital campfire to honor the day that marked Bitcoin’s first real-world use