Harpie, the blockchain security firm once backed by Coinbase Ventures and Dragonfly Capital, has shut down its on-chain firewall business. The company cited financial difficulties as the reason for the abrupt closure. “We attempted to create a theft-free crypto ecosystem, but unfortunately could not create a sustainable business model around it,” Harpie wrote in a

Kelvin Maina

Kelvin Maina is a professional crypto and Forex technical analyst with a Bachelor’s degree in Computer Science and experience in the industry since 2017. He has authored several crypto white papers and supported multiple cryptocurrency launches through marketing and technical writing expertise.

Interactive Brokers has expanded its cryptocurrency offering by adding Solana (SOL), Ripple (XRP), Cardano (ADA), and Dogecoin (DOGE) to its trading platform. The additions come more than three years after the firm first launched crypto trading services with Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH). Eligible clients in the U.S. and U.K.

Interactive Brokers adds SOL, XRP, ADA, and DOGE to the Platform

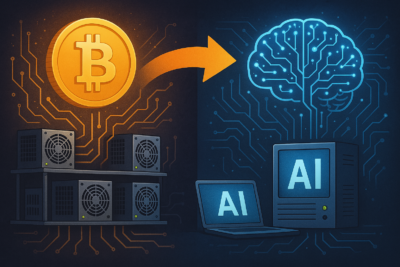

Crusoe Energy is exiting the Bitcoin mining business to double down on artificial intelligence infrastructure. On March 25, the Denver-based company announced it would sell its bitcoin mining operation—including 425 modular data centers and its Digital Flare Mitigation (DFM) technology—to New York Digital Investment Group (NYDIG). The deal includes 270 megawatts of power generation capacity

Crusoe Shifts Focus to AI as NYDIG Acquires Bitcoin Mining Business

A major governance controversy has hit Polymarket after a powerful UMA token holder cast millions of votes to tilt a market outcome and walk away with a profit. The prediction platform confirmed it will not issue refunds, despite widespread user backlash. The dispute centers on a market asking whether Ukraine would agree to a rare

Whale Power Overrules Facts in Polymarket Dispute on Ukraine Deal

The Securities and Exchange Commission will host four new public roundtables on crypto regulation between April and June, marking a noticeable shift in the agency’s approach under Acting Chair Mark T. Uyeda. Each session will focus on a distinct area of the crypto industry, ranging from trading platforms to decentralized finance. The agency announced the

SEC Announces Four New Crypto Roundtables as Regulatory Approach Softens

Bitcoin’s shift from the fringes of finance to center stage was on full display in the latest episode of The CoinRock Show, where host Matthias Mazur opened with an urgent tone. “This is the ideal time to build,” he said, addressing long-time followers and new listeners alike. With bullish momentum in the market, major updates

Matthias Mazur and Mati Greenspan on Crypto, Tokenization, Regulation, and the Next Big Rally

BlackRock Inc. is launching a Bitcoin exchange-traded product in Europe after its $48 billion U.S. fund became the most successful ETF debut in history. The new product, the iShares Bitcoin ETP, will be listed on Tuesday under the ticker IB1T on Xetra and Euronext Paris and under BTCN on Euronext Amsterdam. The fund opens with

BlackRock Expands Bitcoin Fund Reach with European ETF Rollout

In a first for the U.S. banking sector, Custodia Bank and Vantage Bank have completed the tokenization of dollar demand deposits on a public blockchain, using Ethereum and the Avit stablecoin. The series of transactions, executed under full regulatory compliance, marks the activation of a new U.S. dollar payment rail at a time of rising

Custodia Bank and Vantage Bank Tokenize Dollar Deposits on Ethereum

Polymarket, a blockchain-powered prediction platform, has added Solana as a payment option, marking a strategic move to reduce transaction costs and increase speed for its users. The integration, announced Monday on X, enables deposits using the high-speed cryptocurrency SOL. The launch comes as the platform continues to attract significant attention from traders and regulators alike.

Polymarket Adds Solana as Scrutiny Builds and User Base Grows

The crypto market turned sharply upward this week, and according to Matthias on the latest episode of The CoinRock Show, that momentum may be more than just temporary. Bitcoin surged past $88,000, Ethereum approached $2,100, and meme tokens like Fart Coin led daily gains. But beyond price action, Matthias emphasized that structural developments—including renewed engagement

Matthias Breaks Down Market Shifts Venture Moves and Crypto Momentum

Peter Schiff, a vocal critic of Bitcoin and prominent gold advocate, claimed this week that the Chinese government likely sold its Bitcoin holdings in January when prices were above $100,000. The remark came in response to renewed speculation on social media about a potential geopolitical “arms race” over Bitcoin between the United States and China.

China May Have Cashed Out Its Bitcoin Holdings Above $100K, Schiff Suggests

Short-term Bitcoin holders are locking in losses at a scale not seen since the early stages of this market cycle, signaling a crucial test of sentiment in an otherwise bullish trend. Over the past 30 days, realized losses for this group have reached $7 billion, according to data from Glassnode—marking the largest loss-taking event since