The Bank of Russia has approved the limited use of crypto-linked financial products—granting qualified investors access to cryptocurrency derivatives under strict conditions. The announcement signals one of the clearest indications yet that Russian regulators are cautiously warming to digital assets, provided risk containment remains central. In a statement released on May 22, the central bank

Jesse B.

Jesse is an engineering graduate and former business owner with hands-on experience in the crypto space. After running her own business, she transitioned into researching and writing about blockchain technology, decentralization, and the future of digital economies. Having worked with various crypto projects, she offers valuable insights into the expanding Web3 ecosystem.

The Reserve Bank of India (RBI) is significantly expanding its central bank digital currency (CBDC) initiatives by introducing advanced features and broadening stakeholder access. According to the RBI’s annual report for 2024–25, the digital rupee will soon support offline payment functionality and programmable features, aimed at boosting financial inclusion and enabling tailored use cases. Programmability

India Pushes Digital Rupee Frontier with Offline Payments

Pakistan is making a high-stakes leap into the sovereign crypto space. Speaking at the Bitcoin 2025 conference in Las Vegas, Bilal Bin Saqib—recently appointed as Special Assistant to the Prime Minister on Blockchain and Cryptocurrency—announced that Pakistan will establish its own strategic Bitcoin reserve, becoming one of the first countries in South Asia to pursue

Pakistan Follows U.S. Footsteps with Strategic Bitcoin Reserve Plans

Stablecoin issuer Circle has frozen approximately $58 million worth of USDC held in two wallets linked to the controversial LIBRA memecoin project. The freeze, executed on the Solana blockchain, targets wallet addresses associated with the token’s deployer and early project insiders. The two wallets—now marked as frozen on Solana block explorer Solscan—hold roughly $44.6 million

Circle Freezes $58M in USDC Tied to LIBRA Memecoin Founders

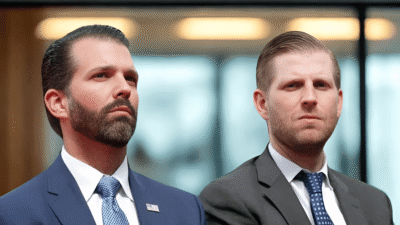

At the Bitcoin 2025 conference in Las Vegas, Donald Trump Jr. and Eric Trump made headlines with bold predictions about Bitcoin’s price trajectory. Echoing the event’s upbeat tone, the brothers forecasted that the world’s largest cryptocurrency could surge as high as $175,000 by the end of 2026. Eric Trump, playing to the crowd, declared that

Trump Sons Make Bullish Bitcoin Forecast at Bitcoin Conference

Australian regulators are stepping up legal action against Liang “Allan” Guo, former director of the failed crypto exchange ACX.io, over alleged misconduct in one of the country’s most damaging digital asset collapses. The Australian Securities and Investments Commission (ASIC) announced civil proceedings against Guo on Wednesday, accusing him of misusing client funds, keeping inadequate financial

ASIC Sues Former ACX Director Over Missing $20M in Customer Funds

French law enforcement has arrested at least a dozen individuals in an ongoing investigation into a wave of violent kidnapping attempts targeting cryptocurrency figures. The crackdown follows two recent high-profile incidents in Paris involving ransom demands and attempted abductions tied to the victims’ connections to the crypto industry. The operation was led by the Brigade

French Authorities Dismantle Alleged Crypto Kidnapping Ring

Circle, the issuer of the U.S. dollar-pegged stablecoin USDC, is moving forward with its long-anticipated IPO, eyeing a listing on the New York Stock Exchange under the ticker “CRCL.” In a recent filing with the U.S. Securities and Exchange Commission, the crypto firm revealed plans to offer 24 million shares at a price range of

Circle Targets $6.7B Valuation in NYSE IPO Bid

Standard Chartered Bank has released its long-term outlook for Solana (SOL), projecting that the token could reach $500 by 2029. However, the bank expects Solana to underperform Ethereum in the near term, citing ecosystem imbalances and a heavy reliance on memecoin activity. In a report published Tuesday, Geoffrey Kendrick, the bank’s global head of digital

Standard Chartered Sets $500 Solana Target by 2029

Luxembourg’s latest National Risk Assessment (NRA) has formally classified virtual asset service providers (VASPs) as high-risk entities for money laundering—reflecting growing regulatory concerns about crypto’s vulnerability to misuse. Published as part of the country’s 2025 financial crime risk framework, the report assigns a “High” inherent risk level to crypto firms, citing multiple red flags. These

Luxembourg Flags Crypto Firms as High-Risk for Laundering

The United Kingdom is emerging as the fastest-growing crypto market among leading economies, according to a newly released State of Crypto report by U.S.-based exchange Gemini. Published on May 27, the study highlights a sharp rise in UK crypto ownership, outpacing nations such as the United States, France, and Australia in year-over-year growth. Based on

UK Leads Global Growth in Crypto Ownership, Gemini Finds

Dubai has officially launched the first licensed tokenized real estate investment platform in the Middle East and North Africa (MENA), marking a major milestone in the region’s push to merge blockchain technology with traditional property markets. The initiative is a joint effort between the Dubai Land Department (DLD), the Central Bank of the UAE, the