Ripple Labs has officially begun the process to secure a US banking license, signaling its ambitions to cement legitimacy and deepen integration with the traditional financial system.

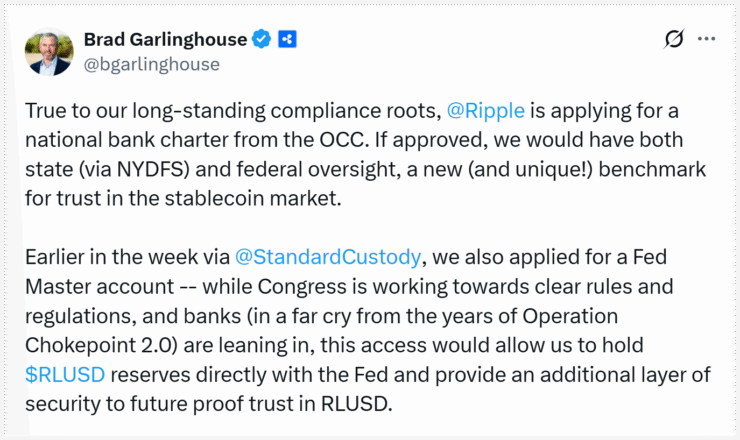

CEO Brad Garlinghouse confirmed on Wednesday that Ripple has applied for a national bank charter from the US Office of the Comptroller of the Currency (OCC). The move follows a report by The Wall Street Journal and comes as Congress advances legislation to place stablecoin issuers under tighter oversight.

“True to our long-standing compliance roots, Ripple is applying for a national bank charter,” Garlinghouse wrote on X.

If approved, Ripple would join a small group of federally regulated crypto institutions and place its Ripple USD (RLUSD) stablecoin under dual scrutiny from both the OCC and the New York Department of Financial Services. Garlinghouse called the effort a “unique benchmark for trust in the stablecoin market.”

Following Circle’s Lead as Washington Tightens Rules

Ripple’s bid for a banking license comes just two days after Circle, the company behind USDC, submitted its own application to create a national trust bank to safeguard stablecoin reserves.

The timing is no coincidence. The US Senate recently passed the GENIUS Act, a landmark bill setting out a regulatory framework for stablecoins that makes the OCC the chief watchdog for major issuers.

Circle CEO Jeremy Allaire described his company’s move as “proactive steps to align with emerging US regulation.”

So far, Anchorage Digital remains the only crypto firm to have received a full-fledged national bank charter from the OCC. But Ripple and Circle’s applications reflect a growing race among large digital asset companies to position themselves as regulated financial institutions before the new rules take effect.

A Bid for Fed Master Account Access

In parallel with its OCC application, Ripple has also applied for a Master Account at the Federal Reserve.

Garlinghouse explained that direct access to the Fed’s central banking system would allow Ripple to hold RLUSD reserves directly with the central bank, “providing an additional layer of security to future proof trust in RLUSD.”

The Master Account request was submitted via Standard Custody, the crypto custody firm Ripple acquired in early 2024.

If granted, this account would elevate Ripple’s standing among US stablecoin issuers and potentially streamline its ability to issue and redeem dollar-backed tokens at scale.

With Congress and regulators converging on a new stablecoin regime, Ripple’s strategic pivot underscores how the crypto industry is rapidly evolving from disruptors to federally regulated players.

Quick Facts

- Ripple has applied for a national bank charter with the OCC, aiming to become a federally regulated crypto bank.

- The company also applied for a Federal Reserve Master Account to custody stablecoin reserves directly with the Fed.

- Ripple’s move follows Circle’s similar application as stablecoin legislation like the GENIUS Act advances in Congress.

- If approved, Ripple would join Anchorage Digital as one of the few crypto firms with a US bank charter.