American Bitcoin, a crypto mining firm co-founded by Donald Trump’s sons and majority-owned by Hut 8, has raised $220 million in fresh capital to expand operations and strengthen its Bitcoin reserves.

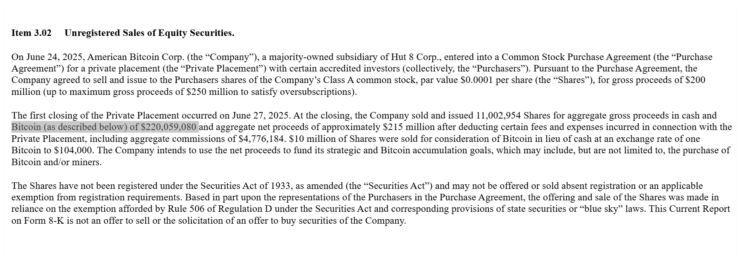

A regulatory filing released Friday confirmed that the company issued 11 million shares in a private placement deal. Unusually, $10 million of the funding was contributed in Bitcoin rather than cash, with the average acquisition price calculated at $104,000 per BTC.

The strategic capital injection will be used to purchase additional mining equipment and bolster the company’s treasury. As of June 10, American Bitcoin held 215 BTC on its balance sheet.

The company has attracted attention not only for its rapid growth but also because of its ties to the Trump family—both Donald Trump Jr. and Eric Trump were early founders. Hut 8 completed a majority acquisition of American Bitcoin on March 31, consolidating its position in North America’s mining sector.

Hut 8 Sets Up Crypto Trading Hub in Dubai

While American Bitcoin focuses on North America, Hut 8 is expanding into the Middle East. On June 23, Hut 8 officially registered Hut 8 Investment Ltd. in Dubai, with plans to open an office dedicated to crypto trading and treasury management, according to Bloomberg.

Hut 8 CEO Asher Genoot said the move is part of a strategy to improve how the company manages capital and builds digital asset positions.

“The Dubai expansion will enhance the precision and efficiency of Hut 8’s capital strategy,” Genoot stated.

The United Arab Emirates has become a magnet for crypto companies thanks to favorable tax policies and regulatory clarity, but it still requires firms to implement comprehensive legal frameworks to remain compliant.

A Hut 8 spokesperson clarified that the Dubai trading office is entirely separate from American Bitcoin’s operations.

Public Listing Plans Through Gryphon Merger

In parallel with the fundraising, American Bitcoin has announced plans to go public through a merger with Gryphon Digital Mining, a Nasdaq-listed mining firm.

The transaction will be structured as a stock swap, with the combined company adopting the American Bitcoin brand. Notably, Eric Trump is slated to join the board after the deal closes.

Post-merger, American Bitcoin’s existing shareholders will own 98% of the newly formed entity, positioning the firm as one of the most prominent publicly traded Bitcoin miners. Hut 8 will maintain operational oversight as the business expands into new markets and ramps up treasury accumulation.

Quick Facts

- American Bitcoin raised $220 million, including $10 million contributed in Bitcoin.

- Hut 8 opened a Dubai office to focus on crypto trading and asset accumulation.

- A Nasdaq-listed merger will take American Bitcoin public, with Eric Trump joining the board.

- The company’s Bitcoin holdings and capital strategy aim to rival larger mining competitors.