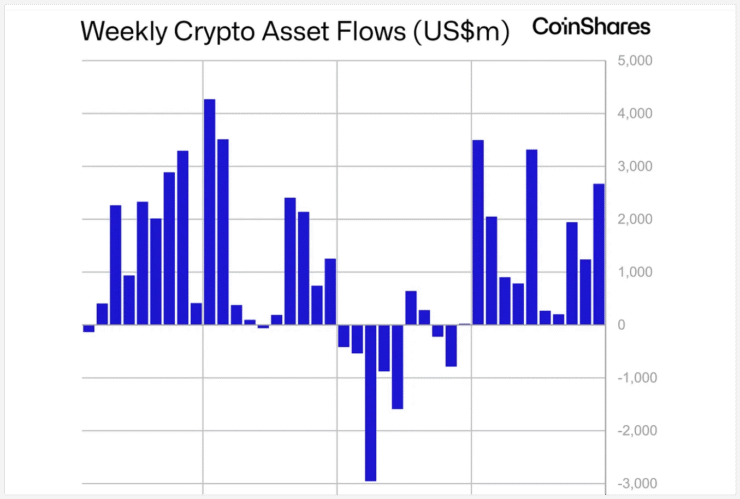

Global crypto investment products continued their blistering run, pulling in $2.7 billion in net inflows last week, according to new data from CoinShares.

The wave of buying extended the inflow streak to 11 consecutive weeks, pushing total year-to-date inflows to $17.8 billion — a figure approaching the record set during the launch of U.S. spot Bitcoin ETFs last year.

CoinShares Head of Research James Butterfill said investor demand remains “remarkably resilient,” driven largely by a potent mix of geopolitical tension and uncertainty over central bank policy.

“The inflows show a clear appetite for crypto as both a hedge and an opportunity in the current macro environment,” Butterfill wrote in the Monday report.

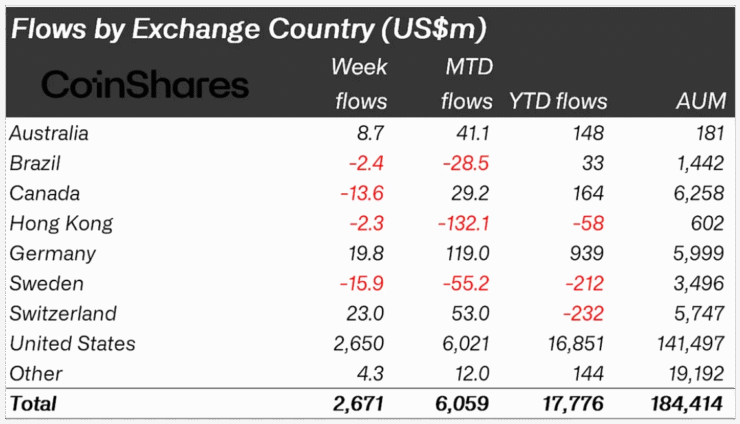

Collectively, global crypto funds now oversee $184.4 billion in assets under management, reflecting growing institutional conviction despite volatile markets.

Bitcoin ETFs Dominate While Ethereum Stays Hot

Bitcoin investment products once again led the charge, adding $2.2 billion last week — representing 83% of total inflows.

This marked the third week in a row of gains for Bitcoin-based funds, while short-Bitcoin products shed another $2.9 million. So far this year, investors have pulled $12 million out of short positions, underscoring the tilt toward a bullish outlook.

U.S. spot Bitcoin ETFs remained the primary driver, hauling in nearly the entire amount of Bitcoin inflows.

Ethereum funds also maintained momentum, bringing in $429 million. That was the tenth straight week of net inflows for ETH products — the longest positive streak since mid-2021.

However, unlike Bitcoin ETFs, U.S. spot Ethereum ETFs played a smaller role, accounting for about $283 million of those flows.

Regionally, the U.S. dominated with $2.7 billion in inflows. Switzerland and Germany followed, adding $23 million and $19.8 million, respectively.

Canada, Brazil, and Hong Kong saw modest outflows, with Canadian products losing $13.6 million.

Broader Trends Fueling Institutional Crypto Demand

The sustained inflows illustrate a deeper shift in institutional attitudes toward digital assets. Analysts point to rising demand for regulated, transparent products that offer exposure to crypto without the operational risks of self-custody.

In recent weeks, expectations have also grown that the Federal Reserve could pivot toward rate cuts later this year, driving additional inflows into risk assets, including Bitcoin and Ethereum.

Meanwhile, the global race to approve more crypto ETFs continues. Last week, the SEC signaled no further objections to staking ETFs from REX Shares and Osprey Funds, suggesting Ethereum and Solana could soon see further inflows as new products come online.

As Butterfill noted,

“This combination of geopolitical hedging, monetary speculation, and product innovation has created fertile ground for inflows.”

Quick Facts

- Crypto investment funds recorded $2.7 billion in inflows last week, the 11th straight week of gains.

- Bitcoin products attracted 83% of the new capital, led by U.S. spot ETFs.

- Ethereum funds posted their longest inflow streak since 2021.

- Total assets managed by crypto funds hit $184.4 billion globally.