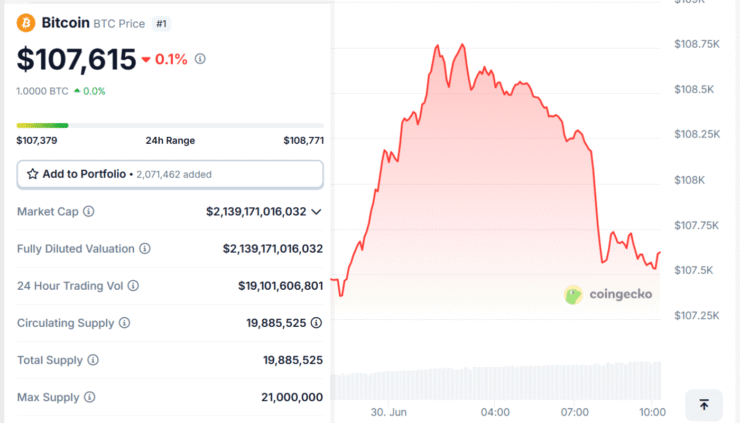

Bitcoin hovered steadily above $107,000 on Monday, showing resilience as traders positioned for a week packed with influential economic events.

According to CoinGecko data, Bitcoin rose 1% in the past 24 hours to trade near $107,600, while Ether gained 2.8%, briefly topping $2,500 before pulling back slightly. The market has recovered most of its recent declines, which were triggered by escalating tensions in the Middle East that briefly sent Bitcoin below the $100,000 mark.

Analysts said attention is now squarely on macroeconomic data and fresh signals from central banks, which could set the tone for risk appetite across financial markets in July.

This week has all the ingredients for significant volatility, researchers think. The data and the tone from policymakers will determine whether crypto’s momentum carries through the summer.

Powell to Headline ECB Forum as Rates Remain in Focus

One of the most closely watched events is Tuesday’s European Central Bank policy forum, where Federal Reserve Chair Jerome Powell is scheduled to speak alongside central bank chiefs from the UK, Japan, and South Korea.

Powell told U.S. lawmakers last week that the Fed is not rushing to cut interest rates despite slowing inflation. However, President Donald Trump on Sunday criticized Powell, accusing him of keeping rates “artificially high.”

Traders expect Powell’s remarks to help clarify whether the Fed could shift toward easing policy later this year or remain cautious.

In addition to Powell’s appearance, markets will be digesting a wave of labor market data. On deck are the May Job Openings and Labor Turnover Survey (JOLTS) figures and Friday’s June nonfarm payrolls report, which will include updates on wage growth and the unemployment rate.

“These numbers will be critical for risk assets,” said Vincent Liu, CIO at Kronos Research.

“If the labor market shows signs of cooling, that could support the case for rate cuts and bolster crypto further.”

Dollar Weakness, Tariff Talks Add to Market Crosscurrents

Beyond monetary policy, investors are also tracking progress in tariff negotiations ahead of deadlines on July 8 and 9, which could impact broader market sentiment and the dollar.

“The combination of tariff uncertainty and ongoing dollar weakness will keep traders on alert,” Liu said.

The U.S. dollar index has softened in recent weeks as investors weigh the possibility of rate cuts later this year and potential changes to trade policy. Meanwhile, sentiment gauges are trending high: the Bitcoin Fear and Greed Index sits at 66, reflecting growing optimism across crypto markets.

“Crypto is climbing, but conviction may be tested,” Liu added.

“Momentum is building as macro winds ease and risk appetite returns, but one major macro surprise could reset the board.”

Market watchers say Bitcoin’s ability to maintain support above the psychologically important $100,000 level is helping fuel speculative interest. But with so many macro variables in play, traders are bracing for potentially sharp moves in either direction.

Quick Facts

- Bitcoin climbed 1% in 24 hours to trade above $107,000; Ether briefly topped $2,500.

- Investors await remarks from Fed Chair Jerome Powell at Tuesday’s ECB forum.

- U.S. labor market data and tariff talks are expected to drive volatility this week.

- Bitcoin’s Fear and Greed Index sits at 66, indicating elevated market optimism.