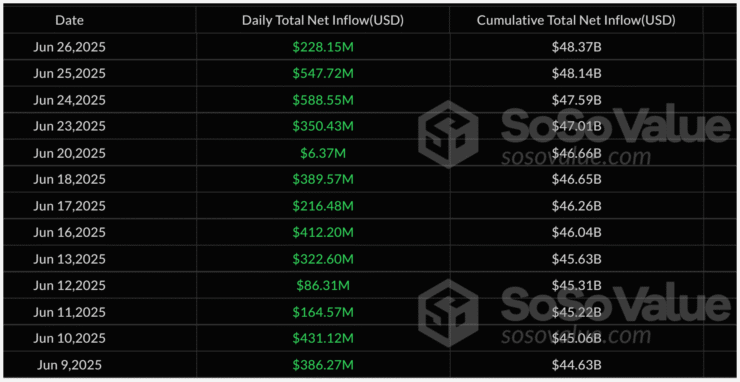

Spot Bitcoin exchange-traded funds in the U.S. have extended their winning streak to 13 consecutive trading sessions, marking the most sustained inflow run since late 2024. According to SosoValue data, these funds have absorbed more than $2.9 billion in fresh capital during this period, underscoring investors’ resilience despite Bitcoin’s choppy price action.

On Tuesday, the ETFs recorded their largest single-day haul for June, pulling in $588.6 million in new funds. As the week progressed, momentum remained strong: BlackRock’s iShares Bitcoin Trust (IBIT) led Thursday’s activity with $163.7 million in inflows, while Fidelity’s Wise Origin Bitcoin Fund (FBTC) collected another $32.9 million. Bitwise’s Bitcoin ETF (BITB) added $25.2 million.

Several smaller funds, including those managed by Ark Invest and Invesco, posted modest inflows, though Grayscale’s GBTC and other legacy vehicles reported flat activity.

The surge comes as regulatory winds shift in Washington, with lawmakers moving to advance the GENIUS Act for stablecoins and analysts predicting approvals for a broader set of crypto ETFs before year-end.

Institutional Appetite Grows Amid Price Stability

Market participants say this latest inflow wave highlights a growing appetite from large investors who prefer regulated products over direct crypto ownership.

“ETF flows are largely driven by two types of investors: long-only fundamental investors and basis arbitrage traders,” Peter Chung, head of research at trading firm Presto Labs, told reporters on Thursday.

Despite Bitcoin hovering near $107,374—down about 0.4% over 24 hours, per CoinGecko data—demand hasn’t slowed. Notably, many ETF managers have been executing their purchases over the counter to avoid disrupting the spot market.

“On-chain data shows Bitcoin held by short-term holders has fallen rapidly in the last two months,” Chung explained, suggesting that recent selling pressure has come mostly from speculators. At the same time, institutions are quietly accumulating exposure through ETFs without driving large price swings.

Since launch 18 months ago, Bitcoin ETFs have now attracted over $40 billion in assets, cementing their role as the primary gateway for traditional investors to gain Bitcoin exposure.

Next in Line: Solana, XRP, and Dogecoin ETFs

While Bitcoin remains the main magnet for capital, regulatory watchers see the landscape evolving quickly.

Bloomberg ETF analyst Eric Balchunas said revised filings for Dogecoin and Aptos ETFs—and a flurry of rule-change proposals from Bitwise—reflect what he called a “completely new attitude” at the Securities and Exchange Commission.

“Everything we’re hearing is even more optimistic than what we heard during the Bitcoin saga,” Balchunas told reporters this week.

According to his estimates, there is a better than 95% chance that Solana, XRP, and Litecoin ETFs will be approved before the end of the year, and roughly a 90% probability that a Dogecoin ETF will receive the green light.

Industry participants are watching closely for signals that the SEC will finalize a clear approval roadmap for alternative crypto ETFs—especially as trading volumes remain robust and asset managers push to diversify their offerings beyond Bitcoin.

Quick Facts

- U.S. spot Bitcoin ETFs have attracted nearly $3 billion over 13 straight days of inflows.

- BlackRock’s IBIT led this week with $163.7 million in new capital on Thursday alone.

- Analysts forecast a high likelihood of Solana, XRP, and Dogecoin ETF approvals in 2024.

- Total assets in U.S. Bitcoin ETFs have surpassed $40 billion since launch.