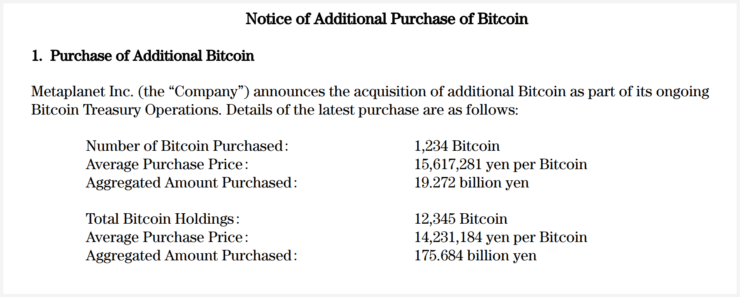

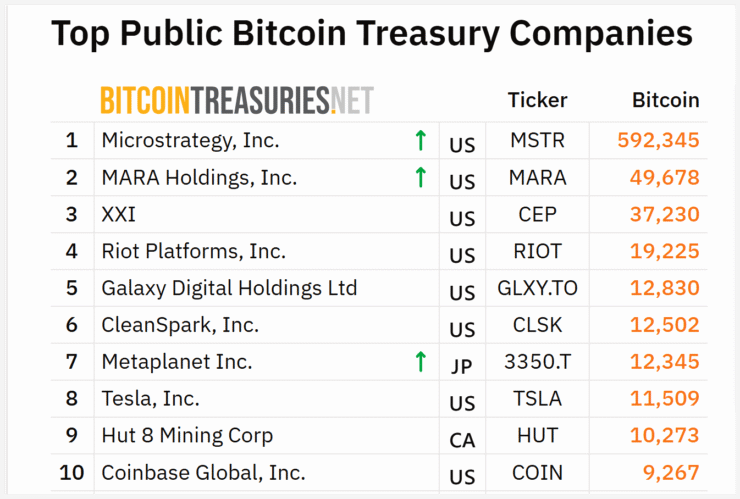

Japanese investment company Metaplanet has added another 1,234 Bitcoin to its balance sheet, surpassing Tesla’s holdings and reinforcing its aggressive digital asset strategy. With this purchase, disclosed in a recent regulatory filing, Metaplanet now controls 12,345 BTC—just ahead of Tesla’s 11,509 BTC—making it one of the largest corporate holders of Bitcoin globally.

The acquisition was executed at an average cost of 15.6 million yen per coin (around $108,000), placing Metaplanet among the top 10 public firms with the largest Bitcoin reserves, according to BitcoinTreasuries.net. At its current pace, the firm is now within reach of CleanSpark, the next-largest holder, which currently sits on 12,502 BTC.

Bitcoin prices hovered around $108,150 at the time of the announcement, reflecting a modest 1.4% daily increase. Metaplanet’s aggressive buying comes as part of a broader strategy to reposition its treasury around Bitcoin as a hedge against Japan’s mounting macroeconomic challenges, including a weakening yen and growing national debt.

Inside the $21 Billion Plan to Accumulate Bitcoin

The recent BTC acquisition is just one chapter in Metaplanet’s ambitious expansion plan. Earlier in the week, the firm’s board approved a massive capital contribution of up to 5 billion yen to accelerate its ongoing “555 Million Plan”—a strategic roadmap targeting the acquisition of over 200,000 BTC by 2027.

Metaplanet has previously stated it aims to hold at least 100,000 BTC by the end of 2026. At current prices, that would value its BTC reserves at over $10 billion—transforming the company from a regional player into a global heavyweight in Bitcoin treasury management.

The scale of the strategy is bold and heavily reliant on continuous capital inflows, a point acknowledged by the firm’s executive team. While the full fundraising progress remains undisclosed, Metaplanet says it expects the recent injection of funds to “significantly accelerate” its buying cycle.

A New Wave of Corporate BTC Treasuries Is Emerging

Metaplanet’s aggressive positioning reflects a broader trend among global firms embracing Bitcoin as a strategic reserve asset. Across Europe and Asia, several companies are following suit. Norwegian firm K33 recently announced an equity raise to buy up to 1,000 BTC, while South Korean-based Parataxis Holdings launched a new BTC treasury platform aimed at institutional investors.

French technology firm The Blockchain Group has also added 182 BTC to its balance sheet, bringing its total holdings to 1,728 BTC. Meanwhile, Block Exchange, a Norwegian crypto platform, saw its stock soar over 130% in a single day after revealing plans to establish a Bitcoin treasury.

Commenting on the strategy of using BTC as a long-term reserve, Matthew Howells-Barby, VP of Growth at Kraken, told CoinrockMedia,

“This can be a solid playbook if there’s no unnecessary risk in the structure of the debt… but once the financing gets too exotic, you risk being forced to sell—and then things can spiral out of control.”

This caution reflects a lesson from previous cycles: while BTC can offer a hedge against fiat weakness, leveraging too aggressively without sound financial backing can turn a strong treasury strategy into a liquidity nightmare.

Quick Facts

- Metaplanet now holds 12,345 BTC, surpassing Tesla’s 11,509 BTC.

- The firm executed a new $76 million Bitcoin purchase, paying an average of ¥15.6 million per BTC.

- Its long-term target: 201,112 BTC by 2027, valued at over $21 billion.

- Firms in Norway, France, and South Korea are also ramping up their BTC treasuries, signaling a broader institutional wave.