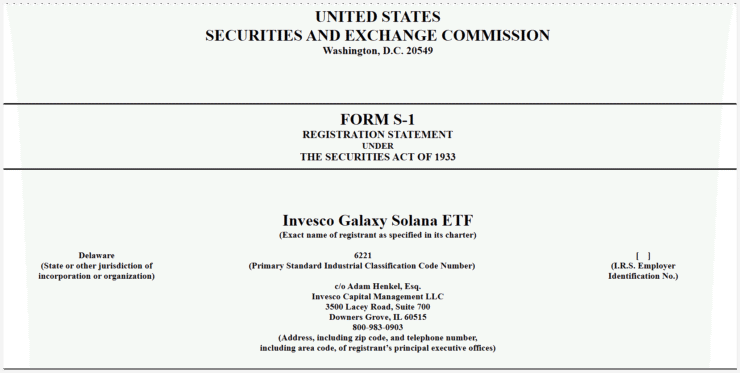

In a fresh push toward altcoin-focused investment products, Invesco and Galaxy Digital have filed with the U.S. Securities and Exchange Commission (SEC) to launch a spot Solana ETF. The proposed fund, dubbed the Invesco Galaxy Solana ETF, is designed to track the price of SOL, the native token of the Solana blockchain. If approved, the ETF will be listed on the Cboe BZX Exchange under the ticker symbol QSOL.

Under the proposed structure, Invesco Capital Management would act as the sponsor, with the Bank of New York Mellon serving as administrator. Galaxy Digital would be responsible for acquiring SOL, while Coinbase Custody Trust will manage secure custody of the assets.

This move positions Invesco and Galaxy among a growing cohort of asset managers chasing approval for Solana ETFs, including VanEck, 21Shares, and Bitwise. The race accelerated after a pivotal shift in SEC policy, following last year’s court-ordered approval of spot Bitcoin ETFs and the subsequent green light for Ethereum-based funds. Many now anticipate similar regulatory openness under the Trump administration, especially as crypto policy becomes a campaign focal point.

SEC Filings Suggest Accelerated Timeline for ETF Launches

Hints of progress from the SEC indicate that altcoin ETFs may be closer to approval than expected. According to prior reports from The Block, the SEC recently requested updated S-1 forms from Solana ETF applicants—an indication that regulatory feedback is advancing and formal decisions could arrive in the near term.

On the same day Invesco and Galaxy submitted their filing, Cboe BZX also filed a Form 19b-4 on behalf of Canary Capital, which seeks to launch a unique ETF tied to the PENGU token—issued by the NFT project Pudgy Penguins. This proposal includes holding the token along with other cryptocurrencies and reflects a broader diversification trend across ETF filings that extend beyond just Bitcoin and Ethereum.

As more issuers experiment with products linked to meme coins, NFTs, and now altcoins like SOL, the SEC is being forced to reconsider older regulatory frameworks in light of new asset classes and investor demand.

SEC Signals Openness to In-Kind Redemption for Crypto ETFs

A potential breakthrough in ETF design is also underway. SEC Commissioner Hester Peirce said this week that in-kind redemptions—a structure favored by many ETF issuers—may soon be permitted for crypto-based ETFs. This method allows ETF shares to be exchanged directly for crypto assets, rather than relying solely on cash transactions.

Firms such as BlackRock have lobbied for in-kind creation and redemption systems for their Bitcoin ETFs, filing relevant forms as early as January. Speaking at a panel hosted by the Bitcoin Policy Institute, Peirce noted that those proposals are “going through the process now,” and although she couldn’t make promises, she acknowledged the growing interest in this mechanism across the board.

If in-kind transactions are approved, it would mark a major efficiency upgrade for crypto ETFs—potentially reducing friction, fees, and tax burdens for large investors. This shift could enhance the viability of altcoin funds like QSOL by making them more attractive to institutional players.

Quick Facts

- Invesco and Galaxy have filed with the SEC for a Solana ETF, set to trade under QSOL on Cboe BZX.

- The fund would hold SOL directly, with Coinbase Custody serving as the crypto custodian.

- The SEC has requested updates on S-1 forms from multiple Solana ETF issuers, signaling possible upcoming approvals.

- SEC Commissioner Hester Peirce indicated that in-kind redemptions for crypto ETFs are “on the horizon.”