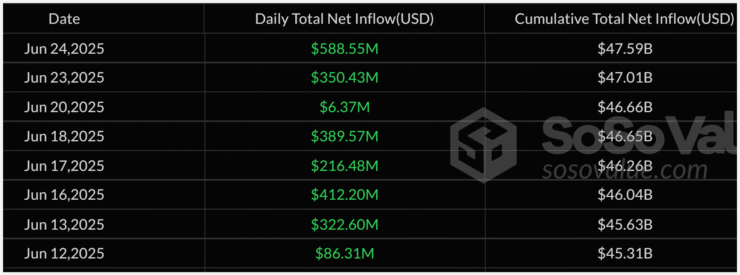

Bitcoin exchange-traded funds (ETFs) in the U.S. extended their winning streak on Tuesday, pulling in $588.6 million in net inflows — the largest single-day total so far in June. This marks 11 consecutive trading days of positive inflows, the longest such stretch since December 2024.

BlackRock’s iShares Bitcoin Trust (IBIT) led the surge with $436.3 million in new capital. Fidelity’s FBTC followed with $217.6 million, while Bitwise and VanEck posted smaller contributions. Grayscale’s GBTC, however, continued to bleed capital, losing another $85.2 million according to data from SosoValue.

Since June 10, spot Bitcoin ETFs have collectively drawn over $2.2 billion, underscoring a strong revival of institutional demand despite ongoing macroeconomic and geopolitical uncertainty.

Middle East Truce Fuels Risk Asset Recovery

The influx of ETF capital coincided with a geopolitical development that helped ease investor nerves — a ceasefire between Israel and Iran, brokered by U.S. President Donald Trump. The announcement spurred a relief rally across markets, with Bitcoin rebounding from a six-week low near $98,000 to over $106,800.

Vincent Liu, CIO at Kronos Research, commented that Bitcoin’s rising ETF flows reflect its strengthening narrative as a hedge asset.

“Investors are seeking stability through scarcity,” Liu said.

“Bit by bit, Bitcoin is bolstering its position as a resilient refuge in a rapidly shifting geopolitical landscape.”

Meanwhile, Ethereum ETFs posted mixed results. VanEck’s EFUT gained $98 million in inflows, while Grayscale’s ETHE lost $26.7 million — highlighting Bitcoin’s stronger appeal in uncertain environments.

Analysts Warn of Fragile Price Momentum

Despite the bullish inflows, market experts remain cautious. Ray Youssef, CEO of NoOnes, described Bitcoin’s recent price action as a “relief rally” rather than a sustained breakout. In a note shared Tuesday, he suggested the move felt like the market “exhaling after a period of sustained tension.”

Analysts warn that upcoming macroeconomic data could either reinforce the trend or trigger a pullback. Investors are closely watching Fed Chair Jerome Powell’s congressional testimony, as well as the Personal Consumption Expenditures (PCE) inflation report due later this week.

Until those events unfold, Bitcoin is expected to trade within a $100,000–$106,000 range. A decisive move above $106,200 could open the door to fresh highs, while a break below $100,000 risks retesting support near $93,000.

Quick Facts

- U.S. Bitcoin ETFs recorded $588.6 million in inflows Tuesday, the largest for June.

- BlackRock’s IBIT and Fidelity’s FBTC led the gains; Grayscale’s GBTC saw continued outflows.

- The ETF surge followed a Trump-brokered ceasefire between Iran and Israel.

- Investors now await Powell’s testimony and inflation data to guide market direction.