Crypto-related stocks in the U.S. surged Tuesday, fueled by investor optimism after President Donald Trump announced a ceasefire agreement between Iran and Israel. Though sporadic military activity continued on both sides, the president declared via social media that the truce would “go on forever,” temporarily easing geopolitical tensions and bolstering global markets.

Despite uncertainty over the truce’s durability—Trump himself acknowledged that violations may have already occurred—the announcement triggered a broad risk-on rally. For crypto stocks, long tied to political headlines and interest rate expectations, the geopolitical relief served as a welcome catalyst amid a tense macro backdrop.

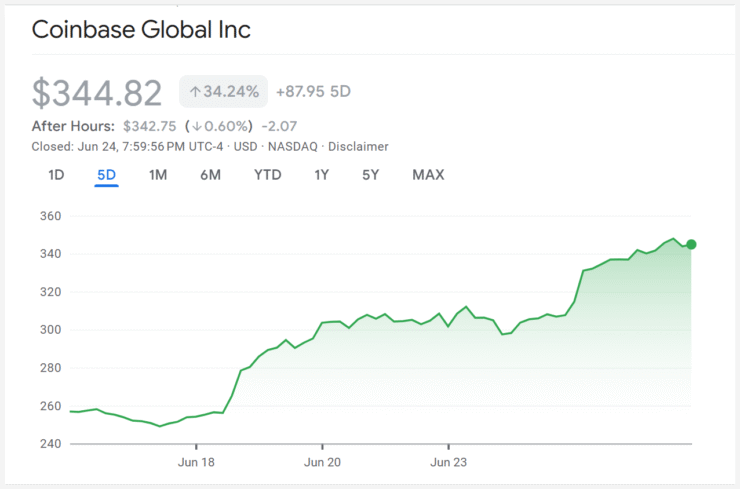

Coinbase Leads S&P 500 Gainers

Among the biggest beneficiaries was Coinbase (COIN), which soared 12.1% to become the top-performing stock in the S&P 500. The rally reflected renewed confidence in the crypto exchange sector, with Coinbase increasingly viewed as a bellwether for broader sentiment in digital assets.

Other major players also saw strong gains. Riot Platforms jumped over 8%, Marathon Digital rose nearly 5%, and MicroStrategy—heavily leveraged to Bitcoin—climbed close to 3%. Robinhood gained 7.4%, likely driven by its new crypto promotion offering a 1% match on digital asset deposits through early July.

The spike in crypto equities underscored a broader return of risk appetite, driven not only by geopolitical developments but also by growing investor conviction in the structural role of crypto stocks within traditional financial markets.

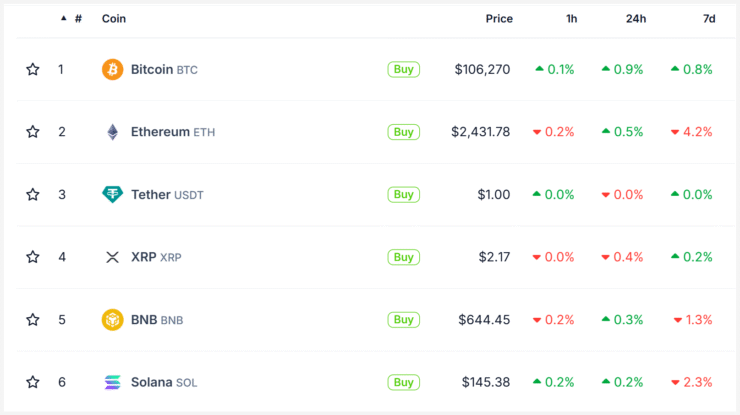

Bitcoin Holds Firm as Equities Outperform

While crypto stocks led the rally, the underlying assets showed more restrained movement. Bitcoin ticked up just over 1%, trading around the $106,000 mark. Ether gained close to 2%, and XRP advanced 1.9%. Although the price action was modest, it reinforced a broader uptrend that continues to build despite global instability and policy speculation.

Some outliers did emerge. Shares of stablecoin issuer Circle fell more than 15%, making it one of the few major crypto names to decline on the day. Still, the company remains significantly up since its June debut, and the mixed performance illustrates evolving investor expectations between newer market entrants and more established crypto firms.

Meanwhile, OKX—the global crypto exchange—reportedly plans a U.S. IPO as it re-establishes its American operations. The potential listing could expand the crypto-equity pipeline and reflect rising institutional interest in the sector’s long-term growth.

Quick Facts

- President Trump’s ceasefire announcement between Iran and Israel sparked optimism, lifting crypto stocks despite ongoing regional instability.

- Coinbase led the market with a 12.1% surge, while other major crypto stocks like Riot, Marathon Digital, MicroStrategy, and Robinhood also posted strong gains.

- Bitcoin and Ether logged modest increases, continuing their upward momentum amid broader market optimism.

- Crypto exchange OKX is exploring a U.S. IPO, signaling growing interest in public listings from major crypto firms.