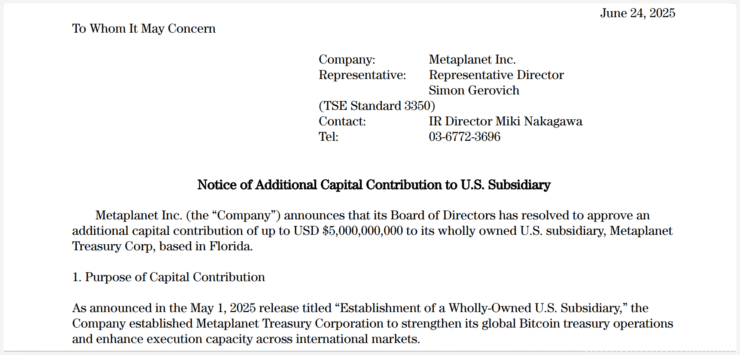

Metaplanet, the Japanese investment firm making waves for its bold Bitcoin treasury strategy, has approved a $5 billion capital injection into its U.S.-based subsidiary in Miami. The move signals a major transition from setup to full-scale deployment as the company ramps up its ambition to create a globally integrated Bitcoin reserve system.

In a statement issued Tuesday, Metaplanet said the new capital infusion follows the successful establishment of its American entity, Metaplanet Treasury Corp, launched in May as the firm’s international growth hub.

“While Metaplanet continues to pioneer corporate Bitcoin adoption in Japan, this U.S. expansion underscores our determination to establish a globally integrated treasury model,” the company stated.

The $5 billion will be raised through the exercise of stock acquisition rights—effectively converting shareholder options into equity to fuel operations at the U.S. arm. The funds are earmarked for ongoing BTC accumulation as Metaplanet doubles down on its long-term thesis: that Bitcoin can enhance shareholder value and serve as a durable store of corporate wealth.

Metaplanet Adds 1,111 BTC, Nears Tesla’s Holdings

The capital boost comes just days after Metaplanet announced the purchase of an additional 1,111 BTC, raising its total Bitcoin reserves to 11,111 BTC. That puts the firm within striking distance of Tesla’s holdings, which stand at 11,509 BTC, according to BitcoinTreasuries.net.

Despite the magnitude of the purchase, Metaplanet noted that the immediate impact on its financial performance will be limited, with further disclosures to come in future regulatory filings.

Market reaction has been mixed. Shares of Metaplanet’s U.S.-listed stock (MTPLF) dropped 5.9% to $11.64 by Monday’s close, while its Tokyo-listed shares fell 6.36% on Tuesday. Nevertheless, the firm’s confidence in its Bitcoin-first treasury strategy remains intact.

The move aligns with a broader trend of public companies increasingly treating BTC as a hedge against monetary debasement and a strategic corporate asset in uncertain macroeconomic times.

U.S. Subsidiary Leads Global Growth Push

Metaplanet Treasury Corp, based in Miami, is now positioned as the main driver of the company’s international Bitcoin acquisition strategy. The subsidiary had already executed Metaplanet’s first BTC purchase earlier this year and is now entering what executives describe as an “aggressive expansion” phase.

According to internal projections, Metaplanet aims to acquire as much as 210,000 BTC by 2027—a scale that would dwarf even MicroStrategy’s current holdings and signal a seismic shift in corporate Bitcoin adoption.

Miami, with its growing reputation as a crypto-friendly jurisdiction and deep liquidity pools, offers the infrastructure and market access necessary for the company’s ambitious roadmap.

Quick Facts

- Metaplanet approved a $5B capital injection into its Miami-based U.S. subsidiary.

- The new funds will fuel long-term BTC acquisitions under a global treasury model.

- The firm now holds 11,111 BTC—just 398 BTC behind Tesla.

- Metaplanet aims to accumulate 210,000 BTC by 2027 via its U.S. entity.