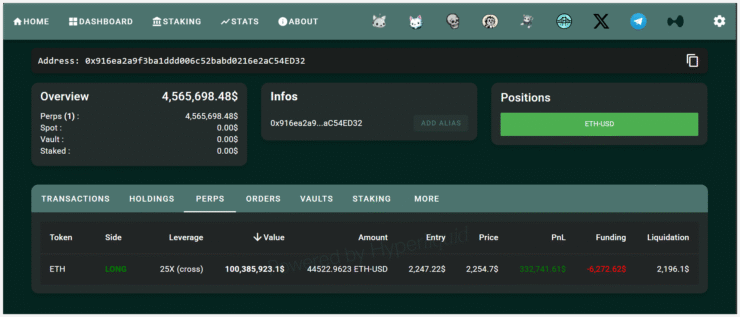

Ethereum whales are taking aggressive positions despite geopolitical tensions, with one investor opening a massive $101 million leveraged long on Ether just hours after the U.S. launched airstrikes on Iranian nuclear facilities. The high-stakes trade—executed with 25x leverage at an entry price of $2,247—was flagged by on-chain monitoring tool Hypurrscan.

While the position has already generated over $900,000 in unrealized gains, it carries steep costs—more than $2.5 million in funding fees. If Ether drops below $2,196, the position risks liquidation.

In a separate but possibly coordinated move, another whale withdrew over $40 million in ETH from Binance shortly afterward, increasing their total holdings to $112 million, according to Onchain Lens. The synchronized activity points to renewed confidence among Ether whales, even as market sentiment remains fragile.

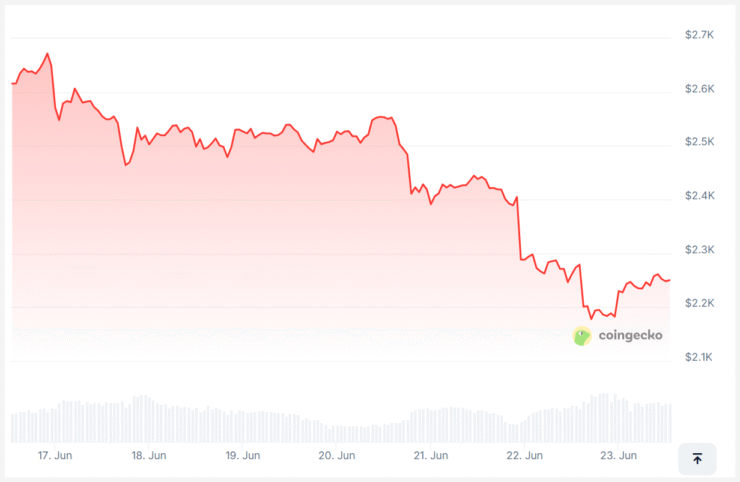

Ether Falls to One-Month Low as Geopolitical Risks Intensify

Ether plunged to a one-month low of $2,113 on Sunday, as investors reacted to escalating military tensions. The decline followed U.S. airstrikes targeting Iranian nuclear development sites—a move President Donald Trump called a “spectacular military success.”

The recent spike in hostilities traces back to Israel’s June 13 attack on Iran—its most aggressive military action since the 1980s Iran-Iraq War. The deepening crisis has amplified uncertainty across global markets, with crypto assets among the hardest hit.

Market sentiment has shifted toward the downside. According to HyperDash, 64% of top traders on Hyperliquid are now shorting both Bitcoin and Ether, while just 36% remain in long positions—signaling a defensive stance across the board despite continued institutional inflows into ETH-focused funds.

Ethereum Investors Tread Lightly Amid War and Monetary Jitters

Ethereum investors appear to be taking a cautious approach as both geopolitical and macroeconomic risks cloud the near-term outlook. Nicolai Sondergaard, a research analyst at Nansen, said ETH holders are largely adopting a wait-and-see mindset.

“Uncertainty remains high—whether it’s driven by war or macro signals,” Sondergaard told Cointelegraph.

Options market data also reflects a neutral posture, with traders avoiding heavy bets in either direction. A recent note from Binance Research attributed Ether’s latest pullback to “macro-driven sell-offs,” yet emphasized that many investors continue to view these dips as temporary.

“Whether the familiar ‘panic-then-recover’ pattern re-emerges will hinge on how quickly the geopolitical narrative cools,” Binance analysts wrote.

Despite short-term caution, long-term sentiment among Ethereum holders appears resilient. On June 17, the total amount of staked Ether reached a new all-time high of over 35 million ETH—an indication that more investors are choosing to lock up their assets rather than liquidate amid turbulence.

The continued rise in staked ETH suggests that, even in a volatile environment, a growing share of participants see Ethereum as a reliable yield-generating asset with enduring value.

Quick Facts

- A whale opened a $101M ETH long with 25x leverage

- ETH briefly dipped to $2,113 following U.S. airstrikes on Iran

- 64% of top traders on Hyperliquid are shorting ETH and BTC

- Staked Ether hit a record 35 million ETH on June 17