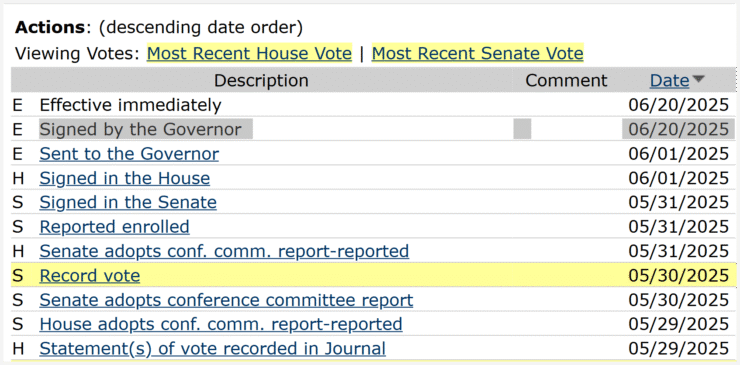

Texas has officially become the first U.S. state to approve the use of public funds to purchase and hold Bitcoin, marking a significant milestone in the institutional adoption of digital assets. Governor Greg Abbott signed Senate Bill 21 (SB 21) into law, setting the foundation for the Texas Strategic Bitcoin Reserve—a state-run fund that treats Bitcoin as a long-term financial instrument.

Unlike traditional reserves, this Bitcoin fund will operate independently of Texas’ primary treasury system. According to the bill, the initiative aims to enhance the state’s financial durability and provide a modern hedge against inflationary pressures.

Strict eligibility rules ensure only digital assets with a market capitalization above $500 billion qualify—effectively limiting the reserve to Bitcoin. Oversight will be handled by the Texas Comptroller of Public Accounts, guided by a three-member advisory panel of experienced crypto investment professionals.

Bitcoin Reserve to Grow via Airdrops, Forks, and Donations

Beyond direct Bitcoin purchases, the law allows Texas to grow its reserve through a variety of crypto-native mechanisms. The Strategic Bitcoin Reserve is authorized to accept assets via forks, airdrops, market gains, and even public donations.

To ensure accountability, the Comptroller’s office will publish a detailed performance report every two years, providing transparency on the size, structure, and performance of the reserve.

The passage of SB 21 follows the earlier signing of House Bill 4488, which adds a key legal safeguard: it prohibits the reserve from being absorbed into the broader state budget. This ensures the Bitcoin holdings are insulated from fiscal or political reallocation.

While states like Arizona and New Hampshire have floated similar initiatives, Texas stands apart as the first to deploy taxpayer dollars toward Bitcoin and to establish an entirely separate system to manage the asset.

Public Companies Expand Bitcoin Treasuries as Trend Accelerates

Texas may be leading on the public policy front, but it joins a fast-growing trend of institutional Bitcoin adoption. Increasingly, corporations are diversifying their balance sheets with BTC as part of a long-term treasury strategy.

Last week, Nakamoto Holdings—a Bitcoin investment firm founded by Trump crypto advisor David Bailey—announced a $51.5 million private funding round to expand its BTC reserves.

Meanwhile, French tech firm The Blockchain Group added 182 BTC to its holdings, investing roughly $19.6 million and bringing its total stash to 1,653 BTC—cementing its role as one of Europe’s top corporate Bitcoin holders.

According to BitcoinTreasuries.net, corporate Bitcoin adoption has surged in recent months, reflecting growing interest in BTC as a resilient, modern financial instrument.

Quick Facts

- Texas is the first U.S. state to fund a Bitcoin reserve using taxpayer money.

- SB 21, signed by Governor Abbott, establishes an independently managed crypto reserve.

- The law limits eligible assets to those with a $500B+ market cap—currently only Bitcoin.

- Texas joins a global shift toward treating Bitcoin as a long-term financial asset.