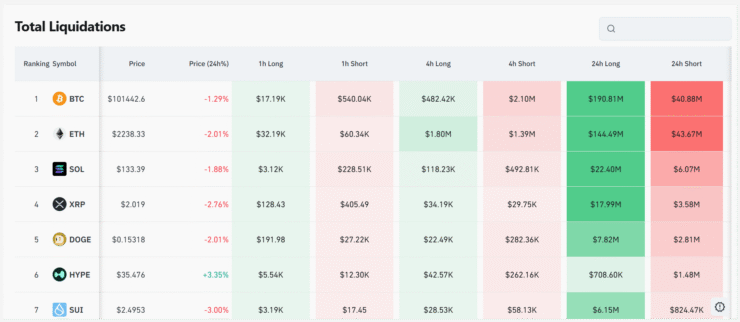

Global crypto markets plunged over the weekend after U.S. military airstrikes targeted three suspected Iranian nuclear development sites. The geopolitical shockwave sent Bitcoin crashing below the $100,000 mark for the first time in over six weeks, before recovering slightly to above $101,000. Altcoins bore the brunt of the selloff, with cascading liquidations wiping out more than $1 billion in crypto derivatives positions within a 24-hour window.

Data from Coinglass shows the vast majority of these losses came from long positions, as traders caught off guard by the sudden escalation scrambled to cover bets on rising prices. While the exact extent of losses remains uncertain—especially as Coinglass data only covers public exchanges—the scale of the liquidation highlights the vulnerability of over-leveraged markets amid rising global tensions. Altcoins and highly speculative tokens registered the sharpest declines, but even market leaders like Ethereum and Solana suffered double-digit losses.

Bitcoin Falls Below $100K as Small Caps and AI Tokens Slide

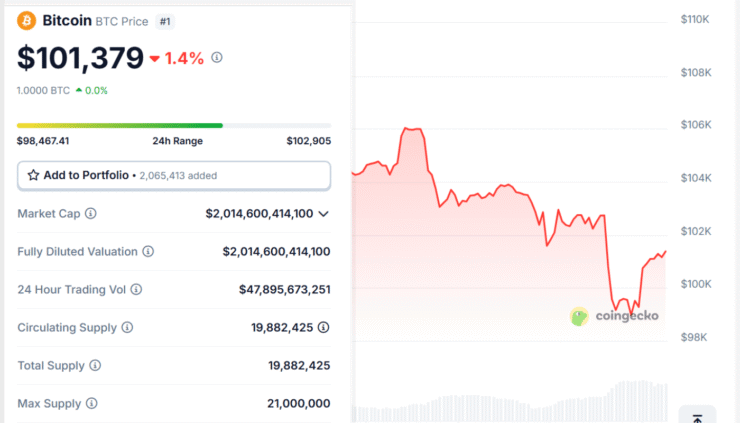

Bitcoin’s brief drop below $100K on Sunday marked its lowest point in 45 days and sent ripples through broader markets. The slump coincided with a reduction in pace, in the nine-day streak of net inflows into U.S. spot Bitcoin ETFs, which had bolstered BTC’s rally through much of June. Friday’s inflow numbers were already slowing, and the weekend volatility may challenge institutional buying momentum heading into the new week.

The total crypto market cap dropped by 3.2% in the past 24 hours, reflecting a clear pivot to risk-off behavior among traders. While BTC and ETH saw more tempered declines, small-cap tokens sank by as much as 17%. AI-themed cryptocurrencies—previously market darlings—tumbled nearly 20%, suggesting a broader retreat from speculative assets.

Trump’s Strike on Iran Raises Oil Fears, Regime Shift Speculation

U.S. President Donald Trump described the coordinated strikes as a “very successful operation,” hinting on Truth Social that the move could signal the beginning of a larger campaign toward regime change. His comments have fueled fresh geopolitical jitters, with traditional and crypto markets bracing for heightened volatility as the news cycle develops.

Iran’s parliament swiftly responded by urging leadership to consider closing the Strait of Hormuz—a vital passage for nearly a fifth of the world’s oil supply. Though Tehran has made similar threats in the past without follow-through, markets remain on edge. The decision to shut the strait lies with Iran’s Supreme Leadership Council, and no formal move has been announced yet.

Quick Facts

- Bitcoin fell below $100K for the first time in 45 days.

- Over $1 billion in crypto liquidations occurred in 24 hours.

- Small-cap and AI tokens plunged 17–20% during the sell-off.

- Trump’s Iran strike raises fears of oil shocks and escalation.