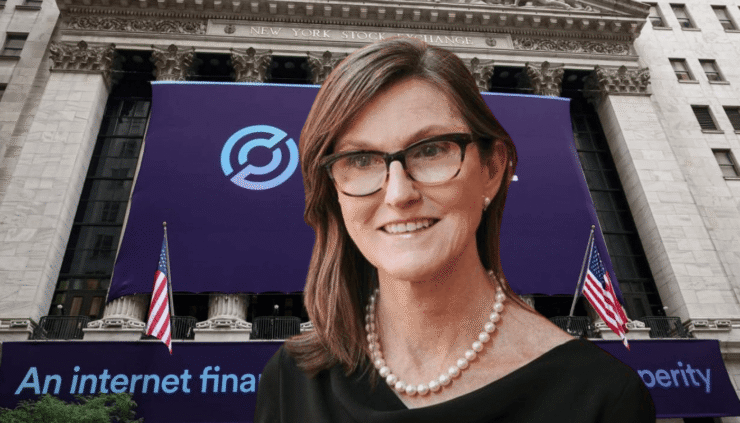

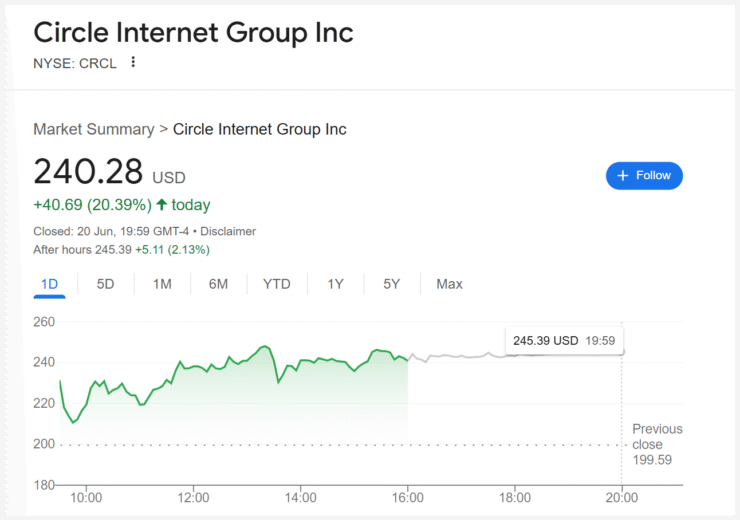

Cathie Wood’s ARK Invest has accelerated its sell-off of Circle shares, unloading more than $146 million worth of stock on Friday—just as CRCL surged 20% in a single day to $240.30. The move comes amid a staggering 248% price increase since Circle’s June 5 NYSE debut at $69.

The latest transaction saw ARK offload 609,175 CRCL shares across three ETFs, pushing total sales to 1.25 million shares over the past week. Estimated proceeds from these divestments now sit at approximately $243 million, based on closing prices during the week.

Despite the aggressive liquidation, ARK remains a top institutional holder of Circle, signaling strategic profit-taking rather than a full exit from the stablecoin giant’s long-term narrative.

Daily Circle Sales Top 300K Across ARK Funds

ARK’s recent divestment campaign has been spread across its major ETFs: ARK Innovation (ARKK), ARK Next Generation Internet (ARKW), and ARK Fintech Innovation (ARKF). Friday’s sale alone accounted for 490,549 CRCL shares in ARKK, 75,018 in ARKW, and 43,608 in ARKF.

This marks the third major liquidation of Circle stock in five trading days, following $52 million in sales on Monday and $45 million on Tuesday. On average, ARK has sold nearly 300,000 Circle shares daily throughout the week.

The firm has not commented publicly on its exit strategy, but the pattern suggests it is leveraging high liquidity amid growing interest in Circle’s fintech and stablecoin positioning.

ARK Still Holds $750M in Circle Stock

Despite selling roughly 29% of its original 4.49 million-share position, ARK remains the eighth-largest institutional holder of Circle stock, according to Bloomberg Terminal data as of June 20. The firm still holds $750.4 million worth of CRCL across its ETFs.

Notably, CRCL has now become the largest position in the ARKW fund, accounting for 7.8% of its portfolio—a testament to ARK’s continued conviction in Circle’s long-term potential even as it locks in profits from recent gains.

Other top CRCL holders include IDG-Accel China Capital Fund II with 23.3 million shares, General Catalyst with 20.1 million, and tech investor James Breyer holding 16.7 million.

Quick Facts

- ARK sold 1.25M Circle shares worth $243M this week.

- Friday’s sell-off alone totaled $146M across three ARK ETFs.

- Circle shares are up 248% since debuting on June 5.

- ARK still holds $750M in CRCL, ranking eighth among investors.