Ethereum staking has crossed a major milestone this week, with over 35 million ETH now locked under the network’s proof-of-stake protocol—marking a new all-time high and reflecting surging investor confidence. This development also points to tightening liquid supply, a critical factor that could impact Ethereum’s long-term price dynamics.

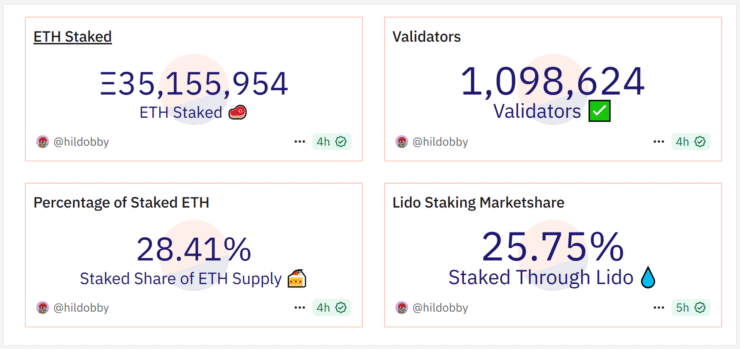

According to blockchain analytics data from Dune, more than 28.4% of all circulating ETH is now staked in smart contracts, effectively removing it from active trading or selling. This shift suggests a broader transformation in market sentiment—from short-term speculation to long-term value retention and yield generation.

Investor conviction appears especially strong this June, with over 500,000 ETH staked in the first half of the month alone. Analysts view this as a sign of growing trust in Ethereum’s fundamentals, despite broader market volatility. Additionally, the number of “accumulation addresses”—wallets with no history of selling—has hit a record 22.8 million ETH held, indicating a solid base of long-term holders quietly reinforcing Ethereum’s foundational strength.

The implications are twofold: as staking accelerates, the available ETH on exchanges shrinks, creating supply-side pressure that could influence price trends. Coupled with Ethereum’s expanding role in DeFi and layer-2 scaling, the asset’s position in the broader crypto market looks increasingly durable.

Staking Grows Despite Price Pressure, as Institutions Look Beyond Bitcoin

Even amid recent bearish price action, staking activity continues to surge, with investors increasingly embracing Ethereum’s proof-of-stake mechanism as a long-term yield strategy. This growing preference for passive income is steadily reshaping on-chain liquidity dynamics, as more ETH becomes locked and unavailable for short-term trading.

Institutional interest is a major force behind this trend. Beyond the traditional Bitcoin playbook, corporate treasuries are beginning to diversify into other digital assets. On Thursday, Nasdaq-listed Lion Group Holding announced plans to allocate a $600 million facility toward building a crypto reserve, with a primary focus on the Hyperliquid (HYPE) token. The firm has already deployed $10.6 million in its initial investment—reflecting the appetite for broader exposure to non-Bitcoin assets.

This move fits within a growing pattern of public companies treating crypto not merely as a speculative asset, but as a structured component of treasury and portfolio strategy. As ETH staking accelerates and treasury diversification intensifies, the crypto economy is beginning to take on a more mature, yield-driven structure.

On-Chain Asset Managers Quadruple Holdings in Institutional DeFi Shift

Crypto-native asset managers are rapidly scaling their presence across decentralized ecosystems, with total on-chain capital rising from $1 billion in January to over $4 billion by mid-year, according to a joint report by Artemis and DeFi platform Vaults.

The report highlights a significant shift in how institutions are leveraging blockchain—not as a side experiment, but as a core part of financial operations. Many firms are now deploying substantial capital into decentralized protocols, using DeFi infrastructure for active portfolio strategies.

A standout from the report is the nearly $2 billion allocated to Morpho Protocol, a decentralized lending platform that has emerged as a top choice for institutional DeFi exposure. Rather than publicizing their moves, these firms are quietly building sophisticated positions across lending, staking, liquid restaking, and synthetic asset primitives—marking a quiet revolution in institutional blockchain adoption.

Quick Facts

- Ethereum staking hit an all-time high with over 35 million ETH locked.

- 28.3% of ETH supply is now staked, reducing available liquidity.

- Lion Group plans a $600M crypto treasury with focus beyond Bitcoin.

- On-chain capital managed by crypto-native firms has surged to $4B in 6 months.