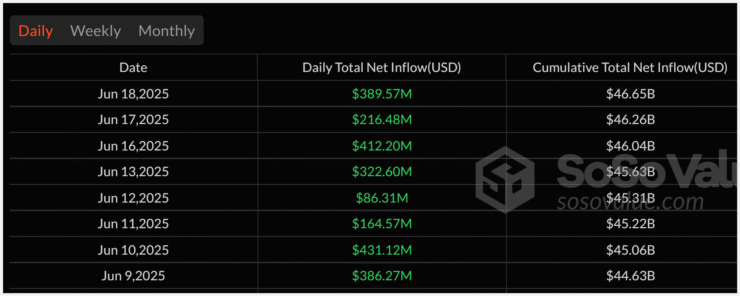

Momentum behind U.S. spot Bitcoin ETFs is accelerating, with funds recording $389.5 million in net inflows on Wednesday. This marks the eighth consecutive day of positive flows, pushing the total haul to $2.4 billion since the streak began according to data from SosoValue.

BlackRock’s iShares Bitcoin Trust (IBIT) led the charge once again, securing $278.9 million in a single day. IBIT now accounts for over 96% of the cumulative eight-day inflow, with $2.3 billion added during the run. Fidelity’s FBTC came in second with $104.4 million, while Bitwise’s BITB, Grayscale’s BTC Mini, and Hashdex’s DEFI posted more modest gains.

Meanwhile, Grayscale’s legacy Bitcoin Trust (GBTC) saw $16.4 million in net outflows, continuing its decline amid investor aversion to its higher fee structure.

ETF industry analysts highlighted the broader significance of the trend.

“Eight straight days of inflows into spot Bitcoin ETFs,” said Nate Geraci, president of The ETF Store.

“The category has now taken in nearly $11.5 billion in 2025. Year two. Still ‘no demand’?”

While Ethereum spot ETFs have cooled after a hot start, Bitcoin continues to attract institutional capital, thanks to its maturity and regulatory clarity.

Bitcoin ETFs Near $47B in Total Inflows

Since launching in January 2024, U.S. spot Bitcoin ETFs have brought in $46.9 billion in net inflows, lifting total assets under management to nearly $125 billion. The surge tracks Bitcoin’s rising price and reflects strong institutional conviction in its long-term potential.

In contrast, Ethereum ETFs—while gaining early traction—are seeing reduced momentum. On Wednesday, ETH ETFs attracted just $19.1 million, with BlackRock’s ETHA leading the group with $15.1 million. The slowdown follows the end of a 19-day streak that saw $1.4 billion in inflows.

Launched in July 2024, ETH spot ETFs have since amassed $3.9 billion in net inflows—roughly 8% of Bitcoin ETF totals. Analysts attribute the disparity to differences in perceived regulatory certainty, institutional readiness, and network maturity between the two assets.

Fed Outlook, Global Risks Pressure Crypto Markets

Bitcoin and Ethereum prices have weakened amid mounting macroeconomic and geopolitical pressures. As of Thursday morning, Bitcoin is trading around $104,810—down 0.3% over 24 hours and 2.5% over the past week, according to CoinGecko. Ethereum has fallen more sharply, down 8.3% to $2,527 over the same seven-day period.

The pullback follows this week’s FOMC meeting, where the Federal Reserve kept interest rates unchanged for the fourth consecutive time. Although widely expected, the Fed’s updated projections struck a hawkish tone. Chair Jerome Powell emphasized that rate cuts would only come with sustained disinflation, prompting markets to scale back expectations for monetary easing in 2025.

Quick Facts

- Bitcoin ETFs saw $2.4B in net inflows over eight days.

- IBIT alone contributed $2.3B, over 96% of total inflows.

- Ethereum ETF inflows dropped to $19.1M on Wednesday.

- Bitcoin trades near $104.8K amid Fed-driven market caution.