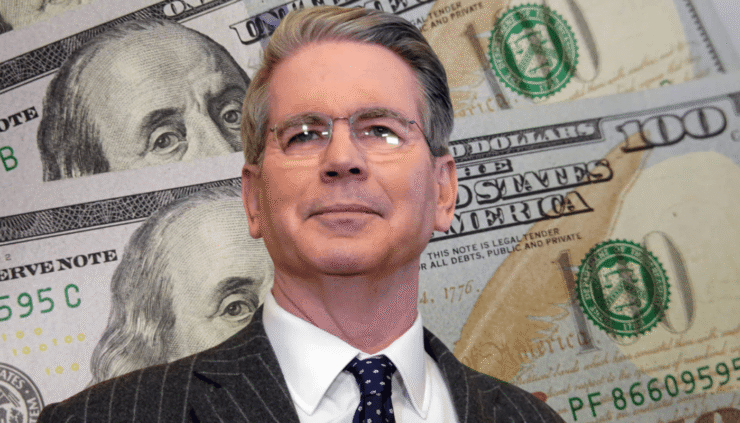

U.S. Treasury Secretary Scott Bessent has thrown his support behind stablecoins as a strategic asset for American monetary leadership, crediting President Donald Trump’s crypto-friendly stance as pivotal to maintaining the U.S. dollar’s global dominance.

Speaking in a public interview shared on X, Bessent argued that stablecoins—particularly those backed by U.S. Treasuries—could become some of the largest institutional buyers of American government debt. That demand, he suggested, would deepen global reliance on the dollar and secure its supremacy in a rapidly digitizing financial world.

“Stablecoins could reinforce dollar supremacy because with stablecoins, stablecoins could end up being one of the largest buyers of U.S. Treasurys,” said Bessent.

“There’s a very good chance crypto is actually one of the things that locks in dollar supremacy.”

His comments came just a day after the U.S. Senate passed the GENIUS Act, a landmark stablecoin bill that lays the groundwork for federal oversight of dollar-backed digital tokens. The House of Representatives is now considering whether to advance its own version or adopt the Senate’s draft. Either way, the Trump administration has made clear it wants comprehensive legislation on the President’s desk before the end of summer.

Stablecoin Market Could Hit $2 Trillion in Three Years

As momentum builds around stablecoin regulation in the U.S., Treasury Secretary Bessent is doubling down on his bullish outlook—predicting the market could exceed $2 trillion within the next three years.

Speaking last week, Bessent emphasized that traditional financial institutions like JPMorgan Chase and Bank of America are preparing to enter the space, which could turbocharge adoption. Their involvement, he suggested, will legitimize the sector further and drive an explosion in demand for U.S. dollar-backed digital assets.

Currently, the total circulating supply of dollar-pegged stablecoins stands at around $240 billion, according to The Block’s Data Dashboard. Tether’s USDT, issued from El Salvador, remains the dominant player in both market capitalization and daily trading volume.

Still, with federal legislation taking shape and institutional players watching closely, Bessent believes the stablecoin sector is only beginning to reveal its full scale. If realized, the multi-trillion-dollar projection would represent one of the fastest digital asset expansions in financial history.

Bessent Slams Biden for Anti-Crypto Regulatory Approach

In a pointed critique, Bessent accused former President Joe Biden of taking an aggressively hostile stance toward the crypto industry. When asked whether the prior administration merely tried to “constrain” digital assets, Bessent replied, “I think ‘constrain’ is too mild a word—I think make it extinct.”

Bessent argued that the Biden administration failed to grasp the global significance of crypto, calling it “one of the most important phenomenons in the world.” He claimed the U.S. effectively turned a blind eye to the industry under Biden’s leadership, leading to stagnation and lost opportunities.

His remarks echo long-standing industry frustrations over regulatory ambiguity, high-profile enforcement actions, and legislative inaction during the prior administration.

Now, with a Trump-aligned Treasury, Bessent is part of a pro-crypto cohort working to position the U.S. as a leader in blockchain innovation, financial competitiveness, and digital dollar infrastructure.

Quick Facts

- Bessent says stablecoins could become top buyers of U.S. debt.

- Stablecoin regulation advances as Senate passes the GENIUS Act.

- Treasury chief predicts stablecoin market may exceed $2 trillion.

- Bessent blames Biden for trying to “extinguish” crypto innovation.