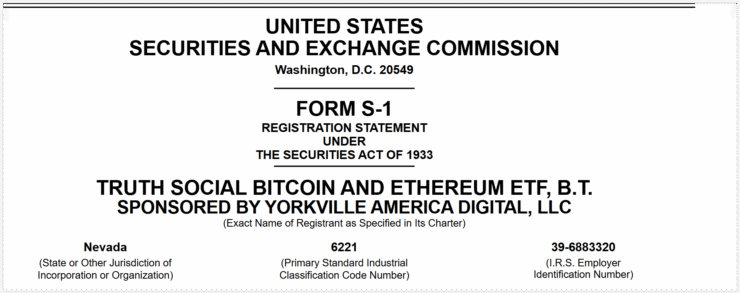

Trump Media & Technology Group, the parent company of Truth Social, has filed to launch a dual-asset spot ETF backed by Bitcoin and Ether. The S-1 registration, submitted Monday to the U.S. Securities and Exchange Commission (SEC), outlines plans for the “Truth Social Bitcoin and Ethereum ETF.” The fund is designed to provide investors exposure to both assets without direct ownership.

Yorkville America Digital, a digital asset fund manager, will serve as the ETF’s sponsor. The trust’s crypto holdings will be safeguarded by Foris DAX Trust Company, the institutional custody arm of Crypto.com. Shares in the ETF will be fully backed by on-chain BTC and ETH holdings.

The product targets investors looking for simplified access to crypto markets, combining Bitcoin’s status as a store of value with Ethereum’s utility-driven appeal. If approved, it would mark a high-profile, brand-powered entry into the increasingly crowded ETF landscape, potentially reshaping competition in digital asset investing.

Trump Media Deepens Crypto Ties with Balance Sheet Moves

While the ETF’s proposed listing on NYSE Arca has been confirmed, several key details remain undisclosed—most notably, the fund’s ticker symbol and its fiat custodian. However, Crypto.com, via its trust division Foris DAX, has been named as the digital asset custodian for the Bitcoin and Ether reserves.

The filing follows a string of recent crypto-related initiatives from Trump Media. Just days earlier, the SEC approved a $2.3 billion Bitcoin treasury registration for the company—although TMTG has stated it has no immediate plans to issue securities under that authorization.

In May, Trump Media also raised $2.5 billion in capital reportedly aimed at acquiring Bitcoin for its corporate balance sheet. Although the company initially denied the report, it later confirmed the move—suggesting a deliberate strategy to align the Trump brand with digital asset growth and innovation.

CoinShares Files for Solana Spot ETF in U.S.

On the same day as Trump Media’s ETF filing, digital asset manager CoinShares submitted its own S-1 registration with the SEC to launch a Solana spot ETF. CoinShares already offers a similar Solana-based ETP in Europe and is now looking to expand its presence in U.S. markets.

The CoinShares filing adds to a growing list of asset managers seeking to bring Solana ETFs to American investors. At least seven other firms, including Fidelity, Grayscale, VanEck, and Franklin Templeton, have filed for Solana ETFs, according to Bloomberg.

While approval is not expected immediately, the sheer volume of applications reflects Solana’s rise as a serious contender in institutional crypto portfolios. Known for its speed, low fees, and expanding DeFi and NFT activity, Solana continues to attract attention from asset managers looking to diversify beyond Bitcoin and Ethereum.

Quick Facts

- Trump Media filed with the SEC to launch a Bitcoin-Ether ETF, backed by Crypto.com’s custody division, Foris DAX Trust.

- The firm also secured a $2.3B Bitcoin treasury registration and raised $2.5B in May to acquire BTC for its balance sheet.

- CoinShares submitted a separate S-1 filing for a U.S.-listed Solana spot ETF, expanding on its existing European ETP.

- At least eight Solana ETF proposals are now pending with the SEC, signaling growing institutional demand for the Layer 1 network.