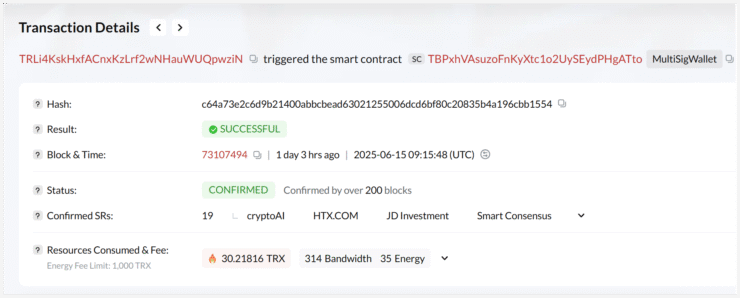

Tether has frozen over $12.3 million worth of USDT on the Tron blockchain, targeting wallet addresses suspected of violating anti-money laundering laws or international sanctions. The freeze, detected on Tronscan at 9:15 AM UTC on Sunday, adds to Tether’s growing record of centralized interventions under mounting regulatory scrutiny.

While the company has yet to release an official statement, the action aligns with Tether’s ongoing policy of blacklisting wallets flagged for potential ties to illicit activity—including money laundering, terror financing, or sanctioned individuals. The firm’s enforcement approach closely mirrors the guidelines of the U.S. Treasury’s Office of Foreign Assets Control (OFAC) and its Specially Designated Nationals (SDN) list.

This latest freeze underscores the dual nature of USDT: a decentralized-adjacent asset that still operates within the boundaries of global financial regulations. It also reflects a broader trend in which stablecoin issuers play increasingly active roles in compliance and financial enforcement on-chain.

Russia Sanctions Push Tether Into Regulatory Spotlight

Tether’s enforcement actions have again placed the company at the center of geopolitically sensitive regulatory efforts. On March 6, Tether froze $27 million in USDT tied to Garantex, a Russian crypto exchange blacklisted by OFAC in 2022 for failing to meet anti-money laundering standards.

The freeze came just as Garantex abruptly shut down operations and accused Tether of “waging war against the Russian crypto market.” The blocked wallets reportedly held more than 2.5 billion rubles in value, sparking backlash in Russian crypto circles.

Despite being sanctioned over two years ago, Garantex-linked wallets remain partially active. On-chain analysis from Global Ledger, published June 5, revealed more than $15 million in traceable USDT reserves still circulating under Garantex control—highlighting both the scale of enforcement and its current limits.

Tether’s Lazarus Crackdown Expands With FCU Support

Tether’s growing interventionism is gaining traction amid concerns over the role of state-backed cybercrime. The company has ramped up enforcement against wallets linked to North Korea’s Lazarus Group, a notorious hacking syndicate tied to billions in crypto theft.

Tether’s asset freezes—sometimes criticized as overreach in decentralized finance—are often credited with helping law enforcement stifle digital money laundering. Through its T3 Financial Crimes Unit (FCU), a joint initiative with Tron and TRM Labs launched in 2024, Tether has frozen over $126 million in suspicious USDT activity in just six months.

The FCU focuses on supporting global enforcement agencies by tracking and blocking funds associated with scams, hacks, and sanctioned actors. That includes the Lazarus Group, which reportedly stole more than $3 billion in crypto from 2017 to 2023.

According to on-chain analyst ZachXBT, Tether blacklisted $374,000 in Lazarus-tied funds in November 2023. Industry-wide, stablecoin issuers have frozen at least $3.4 million across wallets connected to the group—illustrating a broader push for real-time compliance and chain-based monitoring.

Quick Facts

- $12.3M in USDT frozen on Tron-linked wallets

- Action follows Tether’s AML and OFAC compliance policy

- Garantex wallets linked to $27M freeze in March

- $15M in traceable USDT still tied to Garantex

- Tether’s FCU has blocked $126M in suspicious funds