U.S. President Donald Trump has disclosed more than $57 million in income from World Liberty Financial’s (WLFI) token sales, marking one of the largest crypto-linked earnings by a political figure on record. The figure was revealed in his latest financial disclosure filed with the U.S. Office of Government Ethics, covering income earned during the 2024 calendar year.

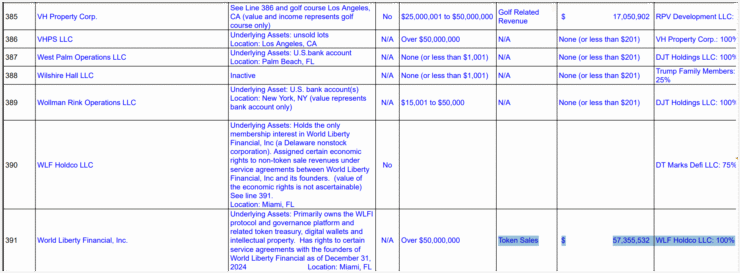

According to the Form 278e filing, Trump raked in $57,355,532 from WLFI token sales alone. The project—branded as a pro-liberty financial network—has evolved into a high-profile crypto initiative under the influence of the Trump family brand.

Trump’s involvement goes beyond earnings. The disclosure also reveals that he holds 15.75 billion governance tokens, a stake that theoretically gives him voting power within the protocol. While the token holding itself is valued at just $1,001 to $15,000 on paper, the enormous income figure suggests that his real benefit may stem from performance-linked token distributions or a share of revenues from token sales.

This crypto-linked windfall appeared alongside Trump’s broader portfolio, which includes traditional investments in companies like Visa, Blackstone, Invesco, and Microsoft, signaling a diversified financial profile now actively including digital assets.

Trump’s Crypto Role Raises Eyebrows as World Liberty Grows

Though often described as the “chief crypto advocate” for World Liberty Financial, Trump and his sons do not officially hold executive or ownership positions within the company, according to the project’s whitepaper. Nonetheless, the Trump name has proven central to the project’s branding success and fundraising efforts.

World Liberty concluded its most recent token sale round in March, raising $550 million through the sale of just 25% of its 100 billion token supply. The roadmap, outlined by co-founder Zak Folkman, aims to eventually release 63% of the token supply into circulation.

Alongside its governance token, the project has been actively developing a U.S. dollar-pegged stablecoin called USD1, which was recently airdropped to WLFI token holders. The rollout aligns closely with Trump’s public support for U.S.-led stablecoin innovation, a hot-button issue gaining steam in congressional circles as policymakers debate how to regulate digital dollars.

However, the expanding footprint of the Trump family in the crypto space has prompted ethical scrutiny. Democratic lawmakers have begun voicing concerns about potential conflicts of interest, particularly as the U.S. inches closer to passing comprehensive laws around stablecoins and digital asset markets.

Quick Facts

- Trump earned over $57M from WLFI token sales in 2024

- Holds 15.75B WLFI tokens with governance power

- WLFI’s latest sale raised $550M, selling 25% of token supply

- Project has launched a stablecoin called USD1

- Democratic lawmakers are probing possible ethical conflicts