Bitcoin is holding steady above the $105,000 mark, even as geopolitical tensions in the Middle East stoke global market unease. The flagship cryptocurrency is forming a Doji candlestick on the weekly chart—a classic sign of indecision—but analysts remain confident in the long-term trend, with some projections for this cycle placing BTC between $135,000 and $230,000.

Despite escalating conflict between Israel and Iran, crypto markets have shown remarkable resilience. Investor appetite continues to build: spot Bitcoin ETFs recorded $86.3 million in inflows on Thursday, followed by a surge of $301.7 million on Friday, according to Farside Investors. That brings total weekly ETF inflows to $1.37 billion—underscoring Bitcoin’s role as a macro hedge during periods of volatility.

None of the 30 key “bull market peak” signals tracked by CoinGlass have triggered so far, reinforcing the belief that this cycle still has room to run. Well-followed trader Cas Abbe echoed the optimism, noting on X that his technical models continue to show higher price targets for Bitcoin.

With BTC holding ground, the rally may soon spread to key altcoins showing strength—namely HYPE, Bitcoin Cash (BCH), Aave (AAVE), and OKB. All four are hovering near breakout levels, and a push beyond $110,000 for BTC could trigger steeper upside in the altcoin space.

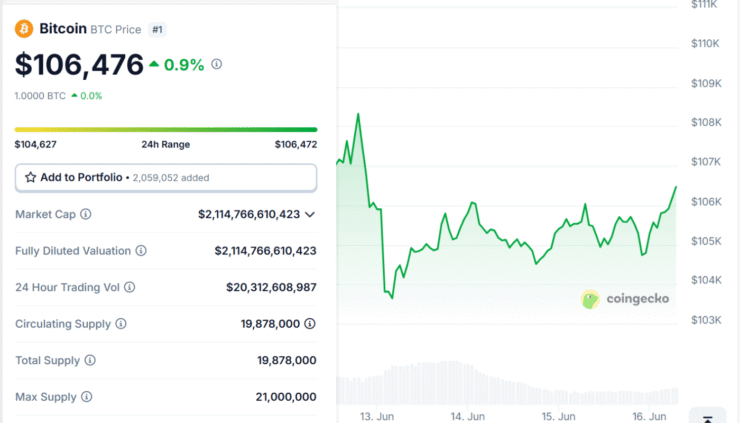

Bitcoin Tests Resistance at $106K Amid Neutral Signals

Bitcoin’s price action is now caught in a critical technical range. After bouncing from the 50-day simple moving average (SMA) around $103,600 last week, it’s struggling to convincingly break above the 20-day exponential moving average (EMA) near $106,000.

Momentum indicators remain neutral. The 20-day EMA is flattening, while the Relative Strength Index (RSI) sits near the midpoint—showing no clear control from either bulls or bears. If buyers can reclaim the 20-day EMA, the next target is the $110,500 to $112,000 resistance zone. A breakout beyond this could open the path toward the $130,000 level, which many see as the next major milestone.

However, if Bitcoin fails to hold the 50-day SMA on the downside, a correction toward the psychological support at $100,000 becomes more likely. A clean break below that could drag BTC further to $93,000—where long-term buyers may step back in with conviction.

Altcoins Flash Strength as BTC Consolidates

As Bitcoin consolidates near all-time highs, select altcoins are positioning themselves for breakout moves. HYPE, BCH, AAVE, and OKB are all nearing key resistance levels, showing signs of increased trading volume and investor attention. If Bitcoin moves past the $110,000 mark, a rotation into these altcoins could fuel significant gains across the board.

Technical setups suggest the altcoin market is poised for upside—but confirmation depends on Bitcoin leading the way.

What to Watch Next

The crypto market is entering a holding pattern—balancing breakout potential with ongoing macro uncertainty. Bitcoin’s current consolidation, especially in the face of global conflict, signals underlying strength. However, altcoins need strong follow-through to validate their setups.

The next key test? Whether Bitcoin can decisively close above $106,000 and build momentum toward the $110,000 zone. If it does, expect broader market excitement to return—with altcoins riding the wave.

Quick Facts

- Bitcoin remains above $105,000 amid Middle East tensions

- Spot Bitcoin ETFs saw $1.37B in inflows this week

- BTC faces resistance at $106,000, with $130K as next key target

- HYPE, BCH, AAVE, and OKB are showing bullish setups

- A drop below $100K could bring a retest of $93,000 support