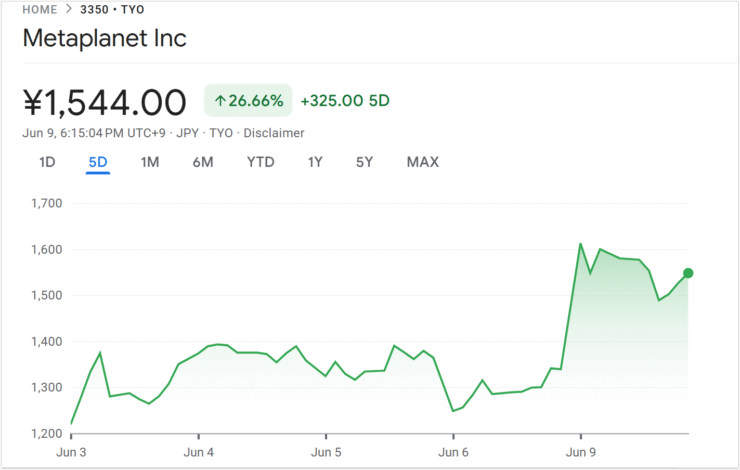

Shares of Japanese investment firm Metaplanet soared following its ambitious announcement to pursue a staggering $5.4 billion Bitcoin acquisition strategy. The company’s stock (3350T) jumped over 12% in early trading on June 9, reaching an intraday high of ¥1,641 (approximately $11.36), a 22% spike from its opening level, according to Google Finance.

The rally was fueled by the firm’s June 6 update, in which it unveiled a dramatic expansion of its Bitcoin acquisition roadmap. Metaplanet now aims to accumulate 210,000 BTC by the end of 2027—a tenfold increase from its previously stated target of 21,000 BTC. If fully executed, the plan would place the company just behind Strategy Inc. as the second-largest public holder of Bitcoin globally, based on current rankings by Bitbo.

The announcement has energized markets and analysts alike, with many viewing the move as a bold declaration from an emerging Bitcoin treasury powerhouse in Asia. As traditional institutions increasingly view Bitcoin not just as an investment but as a strategic reserve asset, Metaplanet’s aggressive posture could reshape regional dynamics in corporate crypto adoption.

Metaplanet Launches $21B Bitcoin Accumulation Plan

Metaplanet has officially launched its “555 Million Plan,” a long-term strategy that would see the company acquire an additional 201,112 BTC by 2027—requiring over $21 billion in capital at current prices. The updated roadmap dramatically expands on the firm’s previous “21 Million Plan,” which had targeted just 21,000 BTC by 2026. Now, Metaplanet aims to hit 100,000 BTC by the end of 2026 and reach 210,000 BTC the following year.

The announcement follows Metaplanet’s June 2 purchase of 1,088 BTC, bringing its current holdings to 8,888 BTC. Since initiating its Bitcoin strategy on July 22, 2024, the firm’s stock price has surged over 1,740%, reflecting growing investor confidence in its treasury approach.

This aggressive accumulation places Metaplanet in line with a growing wave of global corporations integrating Bitcoin into their balance sheets. On June 4, South Korean media conglomerate K Wave Media joined the list of BTC-holding firms. As of early June, data from Bitbo shows that 61 publicly traded companies collectively hold over 3.2% of Bitcoin’s total supply—more than 3 million BTC worth over $342 billion.

Market Reacts Unevenly to Corporate Bitcoin Moves

As more public companies embrace Bitcoin as a treasury asset, market responses have varied widely. While some firms have enjoyed significant stock rallies following BTC-related announcements, others have seen little benefit—or even faced declines.

Paris-based Blockchain Group saw its shares skyrocket by 225% to €0.48 ($0.52) after disclosing plans to accumulate Bitcoin beginning November 5. Similarly, Indonesian fintech firm DigiAsia Corp saw its stock price surge 91% following a $100 million fundraising announcement aimed at launching a Bitcoin treasury strategy.

However, the trend hasn’t been consistent. Norwegian brokerage K33, which declared its intent to begin holding Bitcoin on May 28, saw its share price drop nearly 2%, indicating muted investor enthusiasm. GameStop’s stock also tells a cautionary tale—jumping nearly 12% on March 26 after revealing Bitcoin ambitions, only to fall 11% on May 11 following disclosure of its initial acquisition of 4,710 BTC.

Quick Facts

- Metaplanet unveiled a $5.4B plan to buy 210,000 BTC by 2027.

- Its stock surged over 22% intraday after the announcement on June 9.

- The firm currently holds 8,888 BTC following a June 2 purchase.

- Market reactions to corporate Bitcoin buys remain inconsistent across regions.