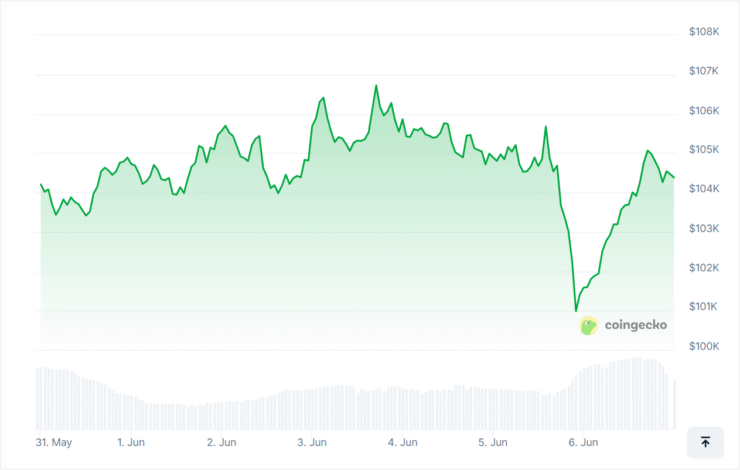

Bitcoin is mounting a recovery after a dramatic price correction triggered by a high-profile clash between two of the most influential figures in business and politics: Elon Musk and Donald Trump. The public dispute—broadcast across social and mainstream media—sent shockwaves through financial markets and pushed Bitcoin down to the key psychological threshold of $100,000.

The conflict, rooted in divergent views on economic policy and crypto innovation, came amid broader market unease. Tesla shares fell 15% in a single session, dragging down other risk assets, including cryptocurrencies. As a result, more than $980 million in crypto positions were liquidated within 24 hours across major exchanges.

Nic Puckrin, founder of Coin Bureau, warned that the market’s reaction went beyond media theatrics.

“The public spat we’re seeing between Musk and Trump was nothing if not predictable,” Puckrin said.

“But the markets don’t like this at all, and it’s only likely to get worse as emotions escalate. Combine that with uncertainty around Trump’s ‘big, beautiful bill,’ the debt ceiling, and eight-month-high jobless claims, and you’ve got a perfect storm.”

Market sentiment had already been shaky due to fears over Trump’s proposed trade tariffs, fiscal uncertainty, and unexpectedly high unemployment claims. The Musk-Trump fallout simply accelerated the retreat, compounding volatility and triggering a wave of margin call liquidations.

Trump vs. Musk Escalates, Markets Eye Bitcoin Resistance

The market turmoil stems from a deepening feud between President Trump and Elon Musk, sparked by Trump’s controversial tax and spending proposals. Musk, who recently stepped down from his role on the Department of Government Efficiency (DOGE) advisory board, slammed the bill as a “disgusting abomination.”

Trump responded by publicly rejecting any attempt at reconciliation, according to NBC News, leaving no room for diplomacy between the White House and one of the tech sector’s most powerful figures.

Investor nerves showed in market data. Bitcoin’s long/short ratio dipped to 47/53, indicating growing bearish sentiment. Although the asset recovered to $104,700 by press time, Puckrin cautioned that the rebound remains tentative.

“A strong close above $102,000 would show strength,” he said.

“But if bulls can’t push past $106,000, we’re likely to face more downside pressure.”

Adding to the narrative, the Official Trump token (TRUMP) fell another 3.6% following a 10% drop earlier in the week—highlighting how even fringe crypto assets are not immune to political theater.

With Bitcoin now trading in a narrow range and macro pressures mounting, market watchers are left wondering whether the path forward depends more on economic indicators or on a possible truce between two of the world’s most influential voices.

Emotional Markets, Real Fundamentals: The Liquidity Mismatch

Despite the week’s drama, some industry leaders argue that the crypto market’s root vulnerabilities lie elsewhere—specifically, in thin liquidity, reactive trading, and overdependence on social narratives.

Kevin Rusher, founder of RWA-focused DeFi protocol RAAC, criticized the market’s hypersensitivity to social media-driven headlines.

“When a Twitter feud tanks the market, that tells you how shallow the order books really are,” Rusher said.

“Crypto is still in its adolescence—driven more by sentiment than substance.”

Still, Rusher believes the industry is slowly maturing. He pointed to the rapid growth in tokenized real-world assets (RWAs), a space gaining traction among institutional giants like BlackRock, JPMorgan, and Citigroup.

“Tokenization is where lasting liquidity will emerge,” he added. “What we’re seeing now is volatility on the surface, but beneath it, a deep shift is taking place—one that could eventually stabilize the entire ecosystem.”

In short, while the Musk-Trump feud may have rattled short-term sentiment and triggered massive liquidations, the long-term trajectory of the crypto market remains tied to its institutional evolution—not political spats.

Quick Facts

- Bitcoin dropped to $100,000 amid Musk-Trump feud, then rebounded to $104,700

- Over $980M in crypto liquidations occurred within 24 hours

- Tesla shares fell 15%, contributing to the sell-off

- Trump slammed Musk following criticism of his tax plan

- Analysts say institutional RWA growth could provide long-term market stability