Circle, the issuer of the USDC stablecoin, has significantly raised its IPO fundraising goal to $896 million, reflecting increased investor confidence and improving regulatory sentiment in the U.S.

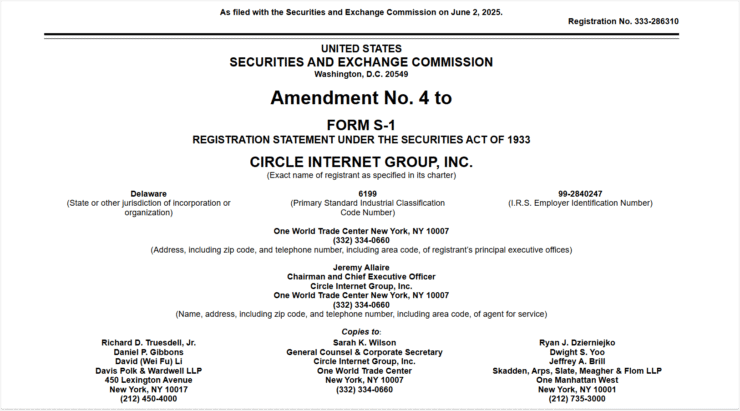

According to a June 2 filing with the U.S. Securities and Exchange Commission (SEC), Circle now plans to offer 32 million shares at a price range of $27 to $28. This is an upsized offering compared to its earlier proposal of 24 million shares priced between $24 and $26. The revised plan follows a late-May announcement to issue 9.6 million Class A shares and suggests a potential valuation of $7.2 billion on a fully diluted basis.

The expansion signals robust demand, fueled by accelerating stablecoin adoption and a more crypto-supportive political landscape. With the Trump administration pushing for clearer crypto policies, Circle appears poised to seize regulatory tailwinds to solidify its leadership in B2B and institutional payments.

This move not only anticipates stronger IPO performance but also positions Circle to scale its stablecoin services rapidly, reinforcing its central role in the digital payments ecosystem.

BlackRock Eyes Stake as Stablecoins Gain Ground

Circle’s IPO is attracting attention from major institutional players, with BlackRock reportedly preparing to acquire a 10% stake in the offering. The interest reflects the rising importance of stablecoins in global finance.

Recent data shows that over $94 billion in stablecoin transactions were settled between January 2023 and February 2025, underlining the critical role these assets now play in cross-border payments and business operations.

Stablecoins are no longer viewed as niche crypto tools; they are emerging as core components of next-generation financial infrastructure. Circle, through USDC issuance and expanding institutional partnerships, has established itself as a central figure in this evolution.

Investor momentum is also being driven by growing regulatory clarity. With the U.S. increasingly embracing stablecoins under structured oversight, Circle’s IPO is seen as a gateway to broader institutional engagement.

Washington Pushes Crypto Clarity With CLARITY Act

The U.S. regulatory stance on digital assets is undergoing a major shift. Recent developments—led by the bipartisan CLARITY Act introduced in late May—aim to untangle years of jurisdictional confusion between the SEC and the CFTC.

The proposed bill outlines a clearer division of oversight responsibilities and introduces a formal registration pathway for crypto firms—marking a potential turning point for companies like Circle operating under regulatory uncertainty.

Newly appointed SEC Chair Paul Atkins has also adopted a more constructive tone, signaling a shift away from enforcement-heavy tactics. His congressional testimony emphasized the need for structured compliance frameworks rather than litigation-driven policy.

At the same time, the SEC has rolled out updated staking rules to provide transparency around yield-generation practices. The CFTC is also expected to approve crypto perpetual futures contracts, according to outgoing Commissioner Summer Mersinger.

Together, these policy signals point to a more predictable regulatory environment, one that could attract deeper institutional capital and accelerate the growth of U.S.-based crypto firms like Circle.

Quick Facts

- Circle raised its IPO target to $896 million, offering 32 million shares at $27–$28 each.

- Projected valuation stands at approximately $7.2 billion on a fully diluted basis.

- BlackRock is expected to acquire a 10% stake in Circle’s IPO.

- U.S. crypto regulation is becoming more structured and investor-friendly under new leadership.