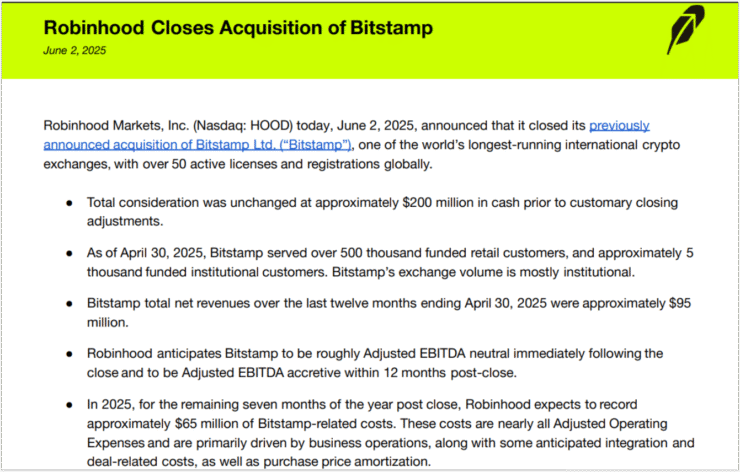

Robinhood has officially finalized its $200 million acquisition of Bitstamp, marking a significant step in its global expansion into institutional crypto markets. Initially announced in June 2024, the all-cash deal grants Robinhood access to more than 50 regulatory licenses and operational rights across Europe, the UK, and Asia—regions where Bitstamp has built a strong presence since its founding in 2011.

The acquisition represents a pivotal moment for Robinhood’s crypto division, which has historically focused on U.S.-based retail services. Bitstamp’s seasoned infrastructure and established reputation among institutional clients—over 5,000 globally—now position Robinhood to serve a far more diverse audience. Bitstamp also boasts approximately 50,000 active retail customers and reported $95 million in revenue over the 12 months ending April 2025.

By contrast, Robinhood’s crypto business has seen faster growth, generating $252 million in revenue in Q1 2025 alone. Still, Bitstamp’s operational maturity and compliance strength offer critical strategic value as Robinhood expands its international footprint.

Integration is already underway. Bitstamp’s trading infrastructure is now connected to Robinhood’s proprietary platforms, including Legend and its Smart Exchange Routing system. This rapid technical onboarding suggests Robinhood is moving quickly to monetize its expanded global user base.

Robinhood Eyes More Crypto Deals After Bitstamp, WonderFi Acquisitions

Robinhood’s aggressive crypto expansion shows no signs of slowing. Following the Bitstamp deal, the firm expects to absorb about $65 million in related integration costs through the remainder of 2025. Yet rather than retreating, the company appears poised for further acquisitions.

Just weeks before finalizing Bitstamp, Robinhood revealed plans to acquire WonderFi, a Canadian digital asset firm, in a $179 million deal aimed at solidifying its presence in Canada’s regulated crypto sector.

These back-to-back moves reflect Robinhood’s broader shift toward global market leadership, with a focus on regulatory clarity and scalable infrastructure.

In a June 2 interview with CNBC, Robinhood Crypto GM Johann Kerbrat hinted that more acquisitions may be coming:

“If we can find a way to accelerate by at least 18 months or two years—and we have a lot of great reason to believe this is a great acquisition—it’s something that we’ll definitely look at.”

The market appears supportive. Robinhood shares (HOOD) closed up 2.77% at $67.98 on June 2, with modest gains continuing after hours. The positive reaction underscores investor confidence in Robinhood’s blended approach of organic growth and strategic acquisitions, solidifying its role as a rising player in the global crypto ecosystem.

Robinhood Sets Sights on Real-World Asset Tokenization

With its exchange acquisitions nearly complete, Robinhood is turning its attention to real-world asset (RWA) tokenization—a trend many believe could reshape global finance. CEO Vladimir Tenev has described tokenization as a “game-changing unlock” for both institutional and retail investors.

Speaking during the firm’s Q1 earnings call, Tenev said tokenization could revolutionize private equity markets by enabling on-chain access to previously illiquid assets. This would reduce reliance on slow, paper-based secondary market processes.

He cited OpenAI and SpaceX as examples of firms whose equity could become fractionally tradeable through tokenized platforms—unlocking new investor classes and liquidity channels.

Robinhood’s newly acquired licenses and infrastructure may serve as the foundation for this next chapter. As regulatory attitudes toward RWAs evolve, Robinhood is positioning itself at the intersection of accessibility, speed, and innovation.

Quick Facts

- Robinhood has completed its $200 million acquisition of Bitstamp, gaining global regulatory coverage.

- The deal includes over 50 licenses and access to 5,000+ institutional clients across Europe, Asia, and the UK.

- Robinhood’s integration of Bitstamp’s platform is already in motion, connecting it with internal tools like Legend.

- Future growth includes planned tokenization of real-world assets such as private equity shares.

- A second deal to acquire WonderFi in Canada for $179 million is also underway, signaling continued expansion.