The U.S. Securities and Exchange Commission (SEC) has raised new concerns over two proposed crypto exchange-traded funds (ETFs) linked to Ethereum and Solana, questioning whether they meet the legal definition of an investment company under U.S. law.

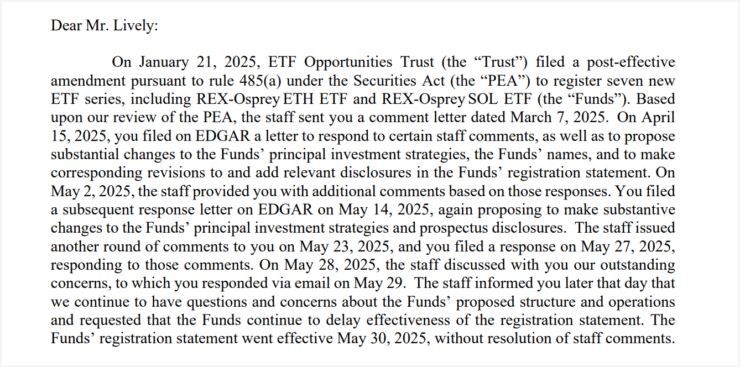

In a letter addressed to ETF Opportunities Trust—a Delaware-registered entity behind various ETF products—the SEC flagged unresolved compliance issues regarding the structure of the REX-Osprey ETH and SOL ETFs. Central to the agency’s inquiry is whether these staking-integrated ETFs qualify under the Investment Company Act of 1940.

While staking has become a staple across proof-of-stake networks, the SEC’s scrutiny suggests that including staking rewards in ETF products may create unforeseen regulatory roadblocks. This move also comes just a day after the SEC issued new guidance suggesting most crypto staking activities may fall outside current securities regulations—underscoring the increasingly complex and contradictory landscape facing digital asset products.

REX-Osprey ETF Plans Stall Despite Initial SEC Approval

Earlier this year, REX Shares and Osprey Funds submitted a registration statement outlining plans to launch a suite of crypto-themed ETFs. These included funds tied to Ethereum, Solana, Bitcoin, XRP, and meme coins like TRUMP, BONK, and Dogecoin. The filing, submitted on January 21, aimed to offer retail investors diversified access to digital assets through regulated investment vehicles.

Though the SEC approved the registration for the Ethereum and Solana ETFs on May 30, the funds remain unlaunched and unlisted. The delay now hinges on the Commission’s ongoing concerns over the ETFs’ compliance with the Investment Company Act—particularly surrounding their integration of staking mechanisms.

In its formal letter, the SEC reaffirmed that key legal questions remain unresolved and could obstruct the funds’ ability to launch under the proposed framework.

Definition of “Investment Company” at the Core of Dispute

The SEC’s primary concern revolves around whether the REX-Osprey funds legally qualify as investment companies. Under the Investment Company Act of 1940, a fund must either be primarily engaged in trading securities or hold at least 40% of its total assets in securities.

The Commission questioned whether the ETH and SOL ETFs meet this threshold, particularly given their staking-based revenue model. Additionally, regulators raised doubts about the use of Form N-1A—a filing format designated for investment companies—and whether the funds comply with Rule 6c-11, which permits streamlined ETF launches without special exemptions.

“If these concerns remain unresolved, the staff will evaluate appropriate next steps to ensure full compliance with securities laws,” the SEC stated.

Notably, the letter arrived just one day after SEC staff released updated guidance suggesting that certain forms of staking—both self-custodied and custodial—may not constitute securities offerings. However, the guidance sparked internal debate, with Commissioner Caroline Crenshaw warning that it could further blur rather than clarify regulatory boundaries.

Quick Facts

- The SEC has flagged legal issues with the REX-Osprey Ethereum and Solana ETFs.

- Concerns focus on whether staking-integrated funds qualify as investment companies.

- The ETFs remain unlisted despite initial SEC registration approval on May 30.

- New SEC guidance on staking was met with internal disagreement over regulatory clarity.