Crypto traders betting on a continued rally were blindsided over the past 24 hours, as a steep market downturn erased more than $827 million in open positions, the majority of them long bets. The selloff, which swept across top cryptocurrencies, highlights the unrelenting volatility that continues to define the digital asset landscape.

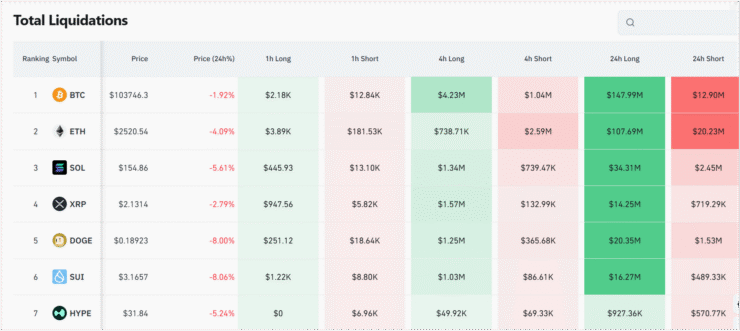

According to CoinGlass, roughly $747 million of the losses stemmed from traders who expected prices to rise. Instead, Bitcoin dropped toward $104,000, dragging the broader market down with it. Ethereum followed, triggering nearly $122 million in liquidations, while Dogecoin, Solana, and XRP also suffered significant losses.

Altogether, the global crypto market shed over 4% in value since Thursday, resulting in one of the most aggressive liquidation waves in recent weeks.

Dogecoin Leads Declines Among Top Cryptocurrencies

The latest selloff has impacted nearly all major digital assets, with Dogecoin registering the sharpest decline among the top ten coins by market cap. The meme token dropped nearly 9% in 24 hours, dipping just below $0.20—a level it last touched in early May.

Solana fell by nearly 5%, trading around $160, while XRP declined 3.3%, settling near $2.20. Ethereum also slipped, down 3%, to approximately $2,573.

Despite a comparatively smaller 1.3% dip, Bitcoin briefly tested the $104,000 level before rebounding slightly above $104,700. The world’s largest digital asset continues to pull back from its recent all-time high of $111,814, showing signs of weakening momentum amid broader macroeconomic uncertainty.

Analysts Warn of Possible $100K Retest for Bitcoin

Friday’s crypto retreat mirrored a broader selloff in equity markets, fueled by disappointing U.S. GDP data and renewed legal tensions surrounding former President Trump’s tariff policies. The combination sent investors fleeing from risk assets, intensifying pressure on already fragile crypto markets.

Valentin Fournier, lead analyst at BRN, suggested the short-term pullback may not be over. In a market note, he predicted that Bitcoin could revisit the $100,000 level before staging a rebound toward a new range of $130,000 to $150,000.

He added that a stabilizing BTC price could lay the groundwork for a new altcoin rally, as capital rotates back into riskier assets once sentiment recovers.

Quick Facts

- $827M in crypto positions liquidated in 24 hours

- $747M of losses were from long positions

- Dogecoin led losses, dropping nearly 9%

- Bitcoin dipped near $104K, then rebounded above $104,700

- Ethereum, Solana, and XRP also posted declines