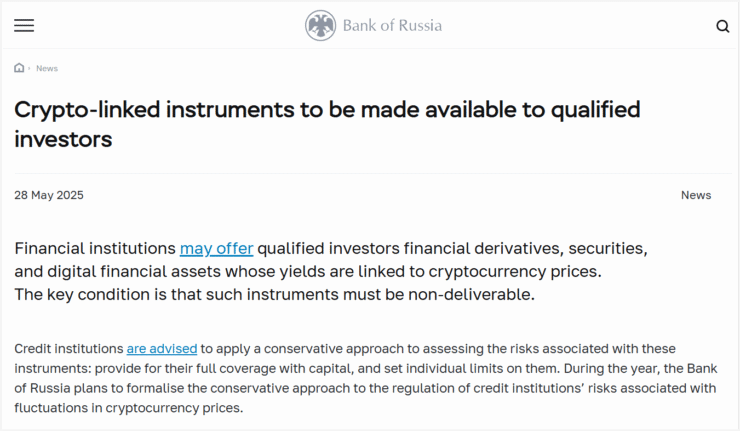

The Bank of Russia has approved the limited use of crypto-linked financial products—granting qualified investors access to cryptocurrency derivatives under strict conditions. The announcement signals one of the clearest indications yet that Russian regulators are cautiously warming to digital assets, provided risk containment remains central.

In a statement released on May 22, the central bank confirmed that financial institutions may now offer derivatives, securities, and digital financial instruments tied to the performance of crypto assets like Bitcoin and Ethereum. However, these products must be strictly non-deliverable—meaning investors cannot take direct ownership of the underlying digital assets. This framework resembles restrictions in other highly regulated markets, such as the U.S., where crypto ETFs limit asset redemption.

The Bank emphasized its conservative approach, instructing institutions to maintain full capital reserves and enforce strict individual exposure limits. These risk controls are designed to contain the volatility typically associated with crypto markets, while still allowing high-net-worth individuals and institutional players to gain exposure to the space.

This policy marks a significant pivot from the Bank’s earlier stance. In 2020, Russian authorities banned mutual funds and brokerages from offering any exposure to digital assets, citing concerns over fraud and market instability. While the current framework remains restrictive, it suggests a measured evolution—one that aims to enable controlled crypto participation without signaling a wholesale embrace.

From Sanctions to Strategy: Russia’s Evolving Crypto Policy

Russia’s historically combative stance on cryptocurrency is quietly giving way to pragmatism—driven less by ideology than necessity. Since its 2022 invasion of Ukraine and the subsequent wave of Western sanctions, Russian policymakers have been reassessing how digital assets might support financial resilience.

Once viewed as a threat to monetary sovereignty due to their decentralized and unregulated nature, cryptocurrencies were largely banned from formal markets. But as global banking access narrowed, the government began exploring how crypto could help facilitate cross-border payments, alternative settlement systems, and safeguard domestic liquidity.

The shift gained formal status last August when President Vladimir Putin signed legislation recognizing crypto mining as a legal industry. Previously operating in a regulatory grey area, miners had contributed significantly to the global Bitcoin hash rate without any legal certainty. The new law offered clarity, allowing registered entities to mine and sell crypto under defined conditions.

In March 2025, the Bank of Russia introduced a pilot program permitting “particularly qualified” investors—those with assets exceeding 100 million rubles ($1.1 million) or annual income above 50 million rubles ($550,000)—to engage in a three-year crypto trial. The initiative marked a shift from prohibition to supervised experimentation.

Further policy development is underway. The Finance Ministry is backing the creation of a state-sanctioned crypto exchange, designed to operate within a legal sandbox and restricted to “super-qualified” investors. According to reports by local outlet RBC, the final eligibility criteria are still being finalized. This dual-track approach—strict domestic regulation paired with a parallel state-run platform—suggests a nuanced attempt to manage crypto’s risks while leveraging its strategic benefits.

Quick Facts

- Bank of Russia now permits non-deliverable crypto derivatives for wealthy investors.

- Investors must not take direct ownership of crypto assets.

- Institutions must maintain full capital reserves and risk limits.

- Russia legalized crypto mining in August 2024.

- Plans are underway for a state-backed crypto exchange for elite investors.